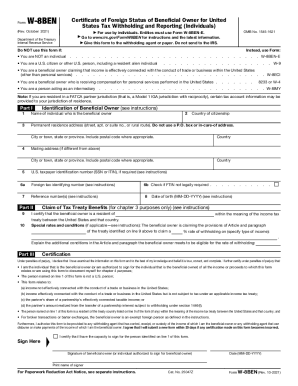

CA Transient Occupancy Tax 30-Day Exemption Form - City of San Jose 2000-2025 free printable template

Show details

Reset Form City of San Jose Transient Occupancy Tax 30-Day Exemption Form To qualify for exemption, this form must be completed in full and an original copy submitted to the City of San Jose, Treasury

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ca transient occupancy tax exemption form

Edit your form tax exemption san jose form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your thirty day tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form w 9 writable online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax exempt individual form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ca occupancy tax exemption

How to fill out CA Transient Occupancy Tax 30-Day Exemption Form

01

Download the CA Transient Occupancy Tax 30-Day Exemption Form from the official website.

02

Fill in your name and contact information at the top of the form.

03

Provide the address of the rental property for which you are claiming the exemption.

04

Indicate the check-in and check-out dates of your stay.

05

Specify the reason for your exemption claim, describing the nature of your stay.

06

Sign and date the bottom of the form to certify the information is accurate.

07

Submit the completed form to the relevant tax authority or the property owner.

Who needs CA Transient Occupancy Tax 30-Day Exemption Form?

01

Individuals who are renting a property in California for a duration of 30 consecutive days or more.

02

Visitors seeking to claim an exemption from the Transient Occupancy Tax due to a long-term stay.

03

Property owners or managers who are required to collect or report transient occupancy tax for short-term rentals.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from transient occupancy tax in California?

Any person who has a written agreement with the operator, entered into within the first thirty (30) days of the person's occupancy, which states the person will stay for more than thirty (30) consecutive calendar days is exempt from the TOT, for the first 30 days of the person's stay.

What is transient occupancy tax California?

*** EFFECTIVE JULY 1, 2021, THE TOT TAX IS 12.5% *** What is it? Transient occupancy tax (TOT), also known as "bed tax", is a voter approved tax collected from lodgers when they rent a motel room, campsite or RV space in the county for 30 days or less.

What is the tax exempt form for lodging in California?

How do I get a California tax exemption certificate? To apply for California tax exemption status, use form FTB 3500, Exemption Application. This is a long detailed form, much like the IRS form 1023. If you have already received your 501c3 status from the IRS, use form FTB 3500A, Submission of Exemption Request.

Who is exempt from hotel occupancy tax in California?

If a person plans to stay longer than thirty days, the first 30 days of their stay is exempt from the TOT if they complete and submit to the Operator the Transient Occupancy Tax Over Thirty Day Stay Exemption Application Form , within the first 30 days of the person's Occupancy.

What is the transient occupancy tax in San Jose?

Transient Occupancy Tax In San José, there are two separate TOT taxes under Chapters 4.72 and 4.74 of the Municipal Code. Chapter 4.72 provides for TOT at 6% of the room rent and Chapter 4.74 provides for a TOT at 4% of the room rent for a combined rate of 10%.

What is the transient occupancy tax in Santa Clara county?

For the privilege of occupancy, the County of Santa Clara's TOT rate is 8% of the total rent charged to a guest. The taxable rent includes: room rate, cleaning fees, and other charges directly associated to the room. Who collects TOT? TOT is collected by the operator at the same time rent is collected from the guest.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ca occupancy tax exemption online?

pdfFiller has made it simple to fill out and eSign ca occupancy tax exemption. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit ca occupancy tax exemption online?

With pdfFiller, the editing process is straightforward. Open your ca occupancy tax exemption in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I edit ca occupancy tax exemption on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing ca occupancy tax exemption right away.

What is CA Transient Occupancy Tax 30-Day Exemption Form?

The CA Transient Occupancy Tax 30-Day Exemption Form is a document used by accommodations in California to exempt certain long-term stays of 30 days or more from the transient occupancy tax.

Who is required to file CA Transient Occupancy Tax 30-Day Exemption Form?

Hosts or operators of accommodations, such as hotels, motels, or short-term rentals, are required to file this form when a guest stays for 30 days or longer and claims the exemption from the transient occupancy tax.

How to fill out CA Transient Occupancy Tax 30-Day Exemption Form?

To fill out the form, provide detailed information including the name and contact details of the guest, the dates of stay, the premises address, and any other required information as specified by the local jurisdiction.

What is the purpose of CA Transient Occupancy Tax 30-Day Exemption Form?

The purpose of the form is to exempt long-term guests from the transient occupancy tax that applies to shorter stays, ensuring compliance with local tax regulations.

What information must be reported on CA Transient Occupancy Tax 30-Day Exemption Form?

The form requires reporting the guest's name, address, contact information, check-in and check-out dates, the signature of the guest, and any other specific details required by the local tax authority.

Fill out your ca occupancy tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ca Occupancy Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.