Get the free EXCESS PROCEEDS FROM TAX SALES

Show details

EXCESS PROCEEDS FROM TAX SALES

REVISED 02/03/2017

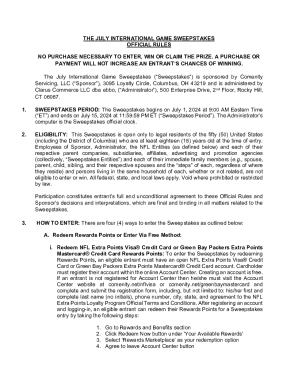

CAUSE NUMBER

STALEMATE

FUNDS

RECEIVE DOF

NOTICEAMOUNT OF

EXCESS

FUNDSDISBURSEMENT

PARTIAL

FINAL

PAYMENT

PAYMENTDATEBALANCEA123044TXC8/4/159/11/159/25/15×3,690.7208/04/17×3,690.72A113084TXA8/4/159/11/159/24/15×10,327.4508/04/17×10,327.45A113096TXA12/1/151/5/161/13/16×18,356.5012/01/17×18,356.50A123050TXC

REVISED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign excess proceeds from tax

Edit your excess proceeds from tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your excess proceeds from tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing excess proceeds from tax online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit excess proceeds from tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out excess proceeds from tax

How to fill out excess proceeds from tax

01

Determine the source of the excess proceeds from tax. This could be from overpayment of taxes or from a tax refund.

02

Gather the necessary documents related to the excess proceeds, such as tax statements, receipts, and any supporting documentation.

03

Calculate the exact amount of excess proceeds. This can be done by referring to the tax documents and verifying the overpayment or refund amount.

04

Fill out the necessary forms provided by the tax authority or government agency. These forms may vary depending on your jurisdiction.

05

Provide accurate and complete information on the forms, including your personal details, tax identification number, and the amount of excess proceeds.

06

Attach any supporting documents required by the tax authority, such as copies of tax statements, receipts, or bank statements.

07

Double-check all the information provided in the forms to ensure accuracy and completeness.

08

Submit the filled-out forms and supporting documents to the designated tax authority or government agency.

09

Keep copies of all documents submitted for your records.

10

Follow up with the tax authority or government agency to track the progress of your excess proceeds claim and to ensure it is processed timely.

11

Once approved, you may receive the excess proceeds through electronic funds transfer or as a physical check. Follow the instructions provided by the tax authority or government agency to receive the funds.

Who needs excess proceeds from tax?

01

Individual taxpayers who have overpaid their taxes or are entitled to a tax refund.

02

Businesses or corporations that have overpaid their taxes or are eligible for a tax refund.

03

Estate administrators or executors who have received excess proceeds from tax on behalf of an estate.

04

Non-profit organizations or charities that have overpaid their taxes or are eligible for a tax refund.

05

Anyone who has made excess tax payments and is eligible to claim the excess proceeds according to the tax laws and regulations of their jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete excess proceeds from tax online?

Easy online excess proceeds from tax completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I edit excess proceeds from tax on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing excess proceeds from tax right away.

How can I fill out excess proceeds from tax on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your excess proceeds from tax. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is excess proceeds from tax?

Excess proceeds from tax are funds remaining after a property has been sold at a tax sale for more than the amount of delinquent taxes owed.

Who is required to file excess proceeds from tax?

Anyone who is entitled to the excess proceeds from a tax sale must file a claim in order to receive the funds.

How to fill out excess proceeds from tax?

To fill out excess proceeds from tax, you will need to complete a claim form provided by the county where the tax sale took place.

What is the purpose of excess proceeds from tax?

The purpose of excess proceeds from tax is to distribute the extra funds from a tax sale to the rightful owner or claimant.

What information must be reported on excess proceeds from tax?

The claim form for excess proceeds from tax typically requires information such as the property address, the amount of the excess proceeds, and proof of ownership.

Fill out your excess proceeds from tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Excess Proceeds From Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.