Get the free LIFE INSURANCE NEEDS CALCULATOR

Show details

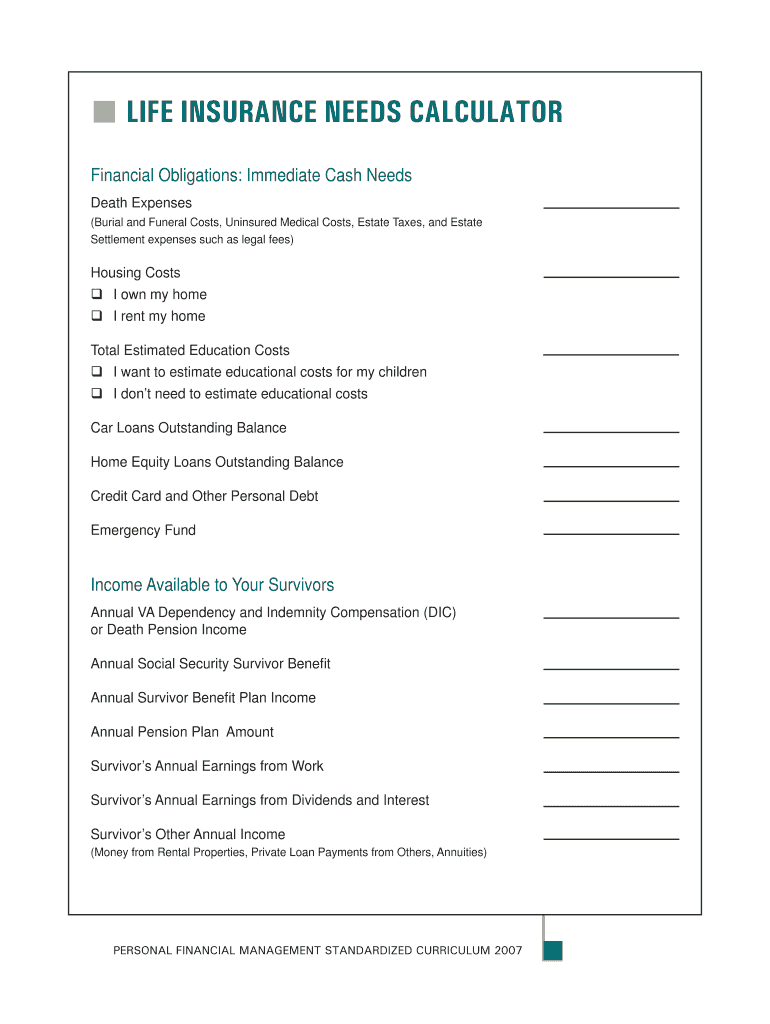

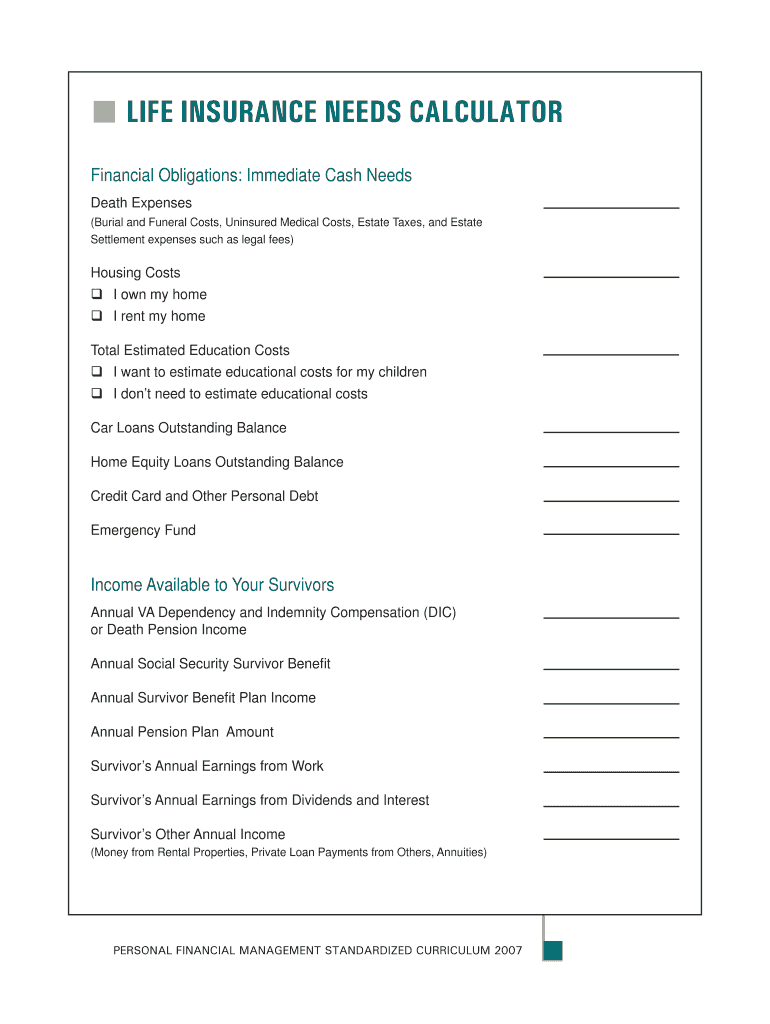

LIFE INSURANCE NEEDS CALCULATOR Financial Obligations: Immediate Cash Needs Death Expenses (Burial and Funeral Costs, Uninsured Medical Costs, Estate Taxes, and Estate Settlement expenses such as

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance needs calculator

Edit your life insurance needs calculator form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance needs calculator form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life insurance needs calculator online

To use the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit life insurance needs calculator. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance needs calculator

How to fill out life insurance needs calculator

01

Step 1: Gather all the necessary information such as your annual income, outstanding debts, expenses, and future financial goals.

02

Step 2: Determine how many years you would like your life insurance coverage to last. This can be based on factors such as the length of your mortgage or the number of years until your children become financially independent.

03

Step 3: Calculate your outstanding debts, including your mortgage, car loans, student loans, and credit card debt. Add these amounts together to get your total debt.

04

Step 4: Calculate your annual living expenses. This includes items such as groceries, utilities, childcare, and other monthly bills. Multiply this amount by the number of years you would like to have coverage for.

05

Step 5: Consider any additional financial goals you might have, such as funding your children's education or leaving an inheritance. Estimate the amount of money you would need to achieve these goals.

06

Step 6: Subtract your total debt, annual living expenses, and additional financial goals from your total available assets (savings, investments, etc.). The remaining amount is the estimated life insurance coverage you would need.

07

Step 7: Use a life insurance needs calculator to input all the gathered information. The calculator will provide an estimate of the recommended coverage amount based on your inputs.

08

Step 8: Review and adjust the coverage amount based on your personal preferences and circumstances. Keep in mind factors such as the cost of the insurance premiums and your budget.

09

Step 9: Consult with a licensed insurance agent or financial advisor to discuss your life insurance needs and options further. They can provide personalized guidance and help you choose the right policy.

Who needs life insurance needs calculator?

01

Anyone who wants to determine the appropriate amount of life insurance coverage they should have can benefit from using a life insurance needs calculator.

02

Individuals who have dependents and want to ensure their loved ones are financially protected in the event of their death.

03

People with significant debts, such as mortgages, student loans, or credit card debt, who want to ensure their debts are paid off if they pass away.

04

Parents who want to provide for their children's future financial needs, such as funding their education or leaving an inheritance.

05

Business owners who want to protect their business and ensure its continuity in the event of their death.

06

Individuals who want to have a clear understanding of their current financial situation and identify any gaps in their life insurance coverage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute life insurance needs calculator online?

pdfFiller makes it easy to finish and sign life insurance needs calculator online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit life insurance needs calculator online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your life insurance needs calculator and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I fill out life insurance needs calculator on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your life insurance needs calculator, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is life insurance needs calculator?

Life insurance needs calculator is a tool used to determine the amount of life insurance coverage a person may need based on their financial obligations and goals.

Who is required to file life insurance needs calculator?

Individuals who are considering purchasing life insurance or evaluating their current coverage may use a life insurance needs calculator.

How to fill out life insurance needs calculator?

To fill out a life insurance needs calculator, you would typically input information such as your income, debts, expenses, savings, and financial goals.

What is the purpose of life insurance needs calculator?

The purpose of a life insurance needs calculator is to help individuals assess how much life insurance coverage they may need to protect their loved ones financially.

What information must be reported on life insurance needs calculator?

Information such as income, debts, expenses, savings, and financial goals may need to be reported on a life insurance needs calculator.

Fill out your life insurance needs calculator online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Needs Calculator is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.