Get the free Succession of 529 Plans and UTMA Accounts

Show details

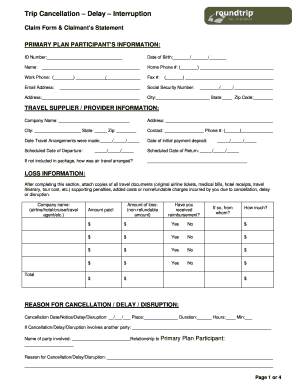

Succession of 529 Plans and TMA Accounts you are the owner of a 529 Plan or the custodian

of a TMA account, do you know who will take over

as owner or custodian at your death? It is important

to plan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign succession of 529 plans

Edit your succession of 529 plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your succession of 529 plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing succession of 529 plans online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit succession of 529 plans. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out succession of 529 plans

How to fill out succession of 529 plans

01

Step 1: Gather all necessary information, such as the beneficiary's name, Social Security number, and date of birth.

02

Step 2: Research and select a suitable 529 plan that aligns with your financial goals and investment preferences.

03

Step 3: Complete the application form provided by the selected 529 plan. Ensure that all required fields are accurately filled out.

04

Step 4: Decide on the contribution amount and choose how often you want to make contributions. Many 529 plans allow for automatic contributions from a bank account.

05

Step 5: Provide any additional documentation or forms required by the specific 529 plan, such as proof of residency or identification.

06

Step 6: Review the details of the completed application and make any necessary corrections before submitting it.

07

Step 7: Submit the filled out application along with any required fees or initial contributions. This can typically be done online or through mail.

08

Step 8: Keep track of your contributions and regularly monitor the account's performance. Consider adjusting your investment strategy as needed.

09

Step 9: Stay informed about any changes in tax laws or regulations related to 529 plans to ensure compliance.

10

Step 10: It is recommended to consult with a financial advisor or tax professional to fully understand the implications and benefits of succession planning for 529 plans.

Who needs succession of 529 plans?

01

Parents or legal guardians who want to save for their child's education expenses

02

Grandparents or other family members who wish to contribute towards a child or grandchild's educational savings

03

Individuals who anticipate future educational expenses and want to start saving early

04

Those who want to take advantage of potential tax benefits associated with 529 plans

05

Anyone interested in securing funds for higher education without being tied to specific institutions or geographical limitations

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my succession of 529 plans directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your succession of 529 plans and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I get succession of 529 plans?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the succession of 529 plans. Open it immediately and start altering it with sophisticated capabilities.

How do I edit succession of 529 plans on an iOS device?

Create, modify, and share succession of 529 plans using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your succession of 529 plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Succession Of 529 Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.