Get the free PLANNING FOR RETIREMENT, DEATH OR DISABILITY

Show details

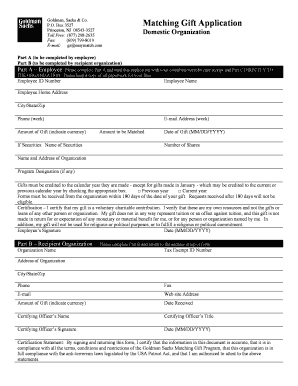

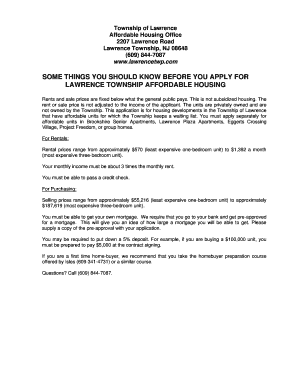

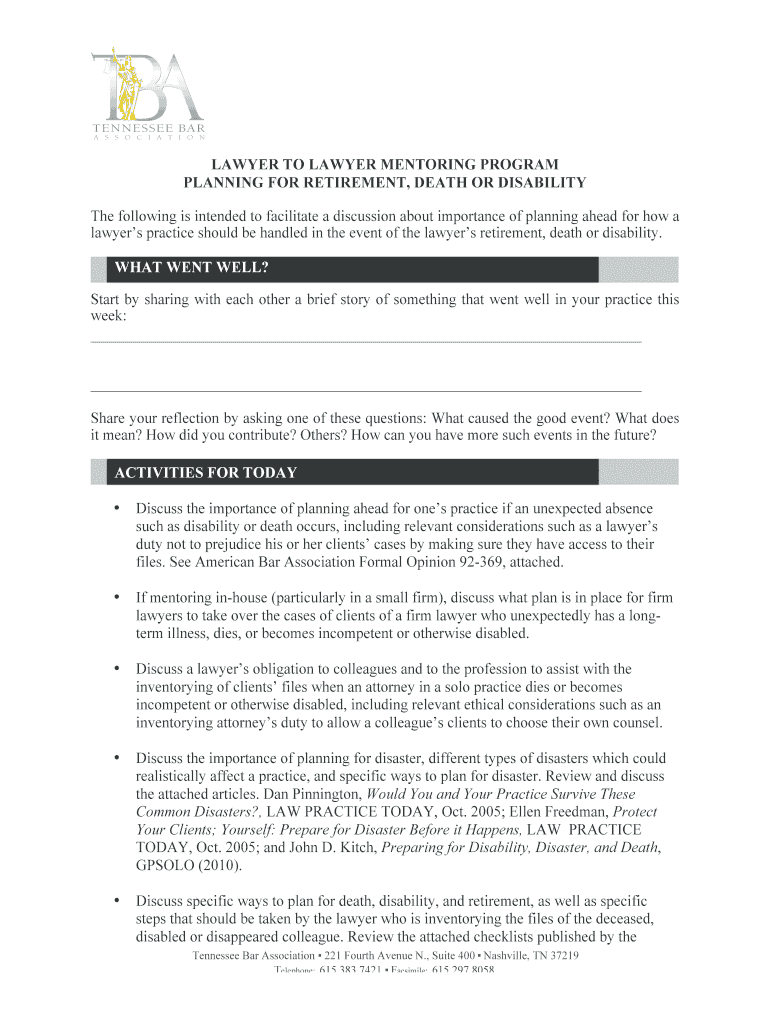

!LAWYER TO LAWYER MENTORING PROGRAM PLANNING FOR RETIREMENT, DEATH OR DISABILITY The following is intended to facilitate a discussion about importance of planning ahead for how a lawyers practice

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign planning for retirement death

Edit your planning for retirement death form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your planning for retirement death form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit planning for retirement death online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit planning for retirement death. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out planning for retirement death

How to fill out planning for retirement death

01

Start by assessing your current financial situation, including your income, expenses, and any existing retirement savings.

02

Evaluate your financial goals for retirement, such as the desired lifestyle, expenses, and potential healthcare costs.

03

Calculate the amount of money you will need for retirement by considering factors like inflation, life expectancy, and potential income sources.

04

Consider the various types of retirement accounts available, such as 401(k)s, IRAs, or pensions, and choose the ones that best align with your goals.

05

Determine how much to contribute to your retirement accounts on a regular basis, aiming to save a significant portion of your income.

06

Educate yourself about investment options and strategies to help grow your retirement savings over time.

07

Regularly review and adjust your retirement plan as needed, taking into account changes in your financial situation or retirement goals.

08

Consider consulting a financial advisor or retirement planner for professional guidance and assistance in creating a comprehensive retirement plan.

09

Ensure you have appropriate insurance coverage, such as life insurance or long-term care insurance, to protect yourself and your loved ones.

10

Communicate your retirement plans and wishes to your family members or beneficiaries, ensuring they are aware of important financial and legal documents.

11

Keep track of your retirement savings and stay informed about any changes in tax laws or regulations that may impact your retirement plan.

Who needs planning for retirement death?

01

Anyone who wants to ensure a financially secure and comfortable retirement needs to plan for retirement death.

02

Individuals who do not have access to a traditional pension plan or social security benefits may have a greater need for retirement planning.

03

Parents who want to leave a financial legacy for their children or provide for their dependents in case of their death should consider retirement planning.

04

Self-employed individuals or freelancers who do not have access to employer-sponsored retirement plans should take the responsibility of planning for retirement death themselves.

05

Those who want to maintain their current lifestyle or pursue their interests and hobbies during retirement should prioritize retirement planning.

06

Individuals who want to minimize the financial burden on their loved ones or prevent disputes over their estate should have a well-structured retirement plan.

07

People who want to have peace of mind and be prepared for unexpected events or emergencies during retirement should engage in retirement planning.

08

Young adults who start planning for retirement early can benefit from the power of compound interest and potentially accumulate a larger retirement nest egg.

09

Even individuals who have already retired can benefit from ongoing retirement planning to manage their savings, investments, and potential healthcare costs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get planning for retirement death?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific planning for retirement death and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute planning for retirement death online?

Easy online planning for retirement death completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for signing my planning for retirement death in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your planning for retirement death and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your planning for retirement death online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Planning For Retirement Death is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.