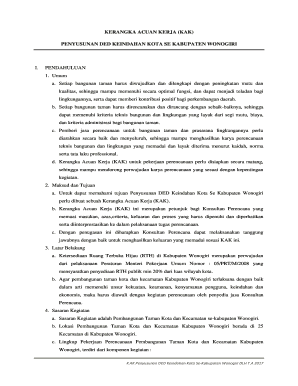

Get the free 720 E

Show details

Special Public Notice

US Army Corps

Of Engineers

Wall District

Regulatory Division

720 E. Park Blvd., Suite 245

Boise, ID 83712

20843344642017 Nationwide Permit Re issuance

and Request for Comments

Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 720 e

Edit your 720 e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 720 e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 720 e online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 720 e. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 720 e

How to fill out 720 e

01

To fill out Form 720 E, follow these steps:

02

Begin by downloading the Form 720 E from the official website of the Internal Revenue Service (IRS).

03

Provide your personal information at the top of the form, including your name, address, and Social Security Number or Employer Identification Number.

04

Indicate the quarter for which you are filing the form by checking the appropriate box.

05

Calculate the aggregate amount of the liabilities subject to the 720 E tax. This includes liabilities such as environmental taxes, communication taxes, fuel taxes, and air transportation taxes.

06

Report any adjustments or refunds owed from previous filings, if applicable.

07

Summarize your total liabilities, adjustments, and refunds to arrive at the net amount due.

08

Sign and date the form.

09

Make a copy of the completed form for your records and submit it to the appropriate IRS office according to the instructions provided on the form.

10

Keep track of your payment and ensure it is submitted by the due date to avoid penalties or interest.

11

Retain copies of all supporting documents and receipts related to your environmental and communication taxes for future reference.

12

Please note that this is a general overview and you should consult the official instructions provided by the IRS for detailed guidance specific to your situation.

Who needs 720 e?

01

Form 720 E is typically required to be filled out by businesses and individuals who have liabilities subject to the various environmental, communication, fuel, and air transportation taxes imposed by the IRS.

02

Specifically, the following entities often need to file Form 720 E:

03

- Manufacturers or importers of gasoline, diesel fuel, and other fuels

04

- Air transportation facilities

05

- Indoor tanning service providers

06

- Providers of communications services

07

- Manufacturers, producers, and importers of ozone-depleting chemicals

08

It is important to note that this is not an exhaustive list, and you should consult the official IRS guidelines or seek professional advice to determine if you are required to file Form 720 E.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 720 e in Gmail?

720 e and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get 720 e?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific 720 e and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for the 720 e in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your 720 e in seconds.

What is 720 e?

720 E is the form used to report and pay excise taxes on certain transactions, such as the sale of firearms, ammunition, and tobacco products.

Who is required to file 720 e?

Businesses engaged in the sales of certain products, such as firearms, ammunition, and tobacco products, are required to file Form 720 E.

How to fill out 720 e?

Form 720 E can be filled out either electronically or by mail. Businesses must provide information about their sales transactions and calculate the excise taxes owed.

What is the purpose of 720 e?

The purpose of Form 720 E is to report and pay excise taxes on certain sales transactions in order to fund various government programs and activities.

What information must be reported on 720 e?

Businesses must report details of their sales transactions, including the type and quantity of products sold, as well as the amount of excise taxes owed.

Fill out your 720 e online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

720 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.