Get the free Loan Application - first tuesday

Show details

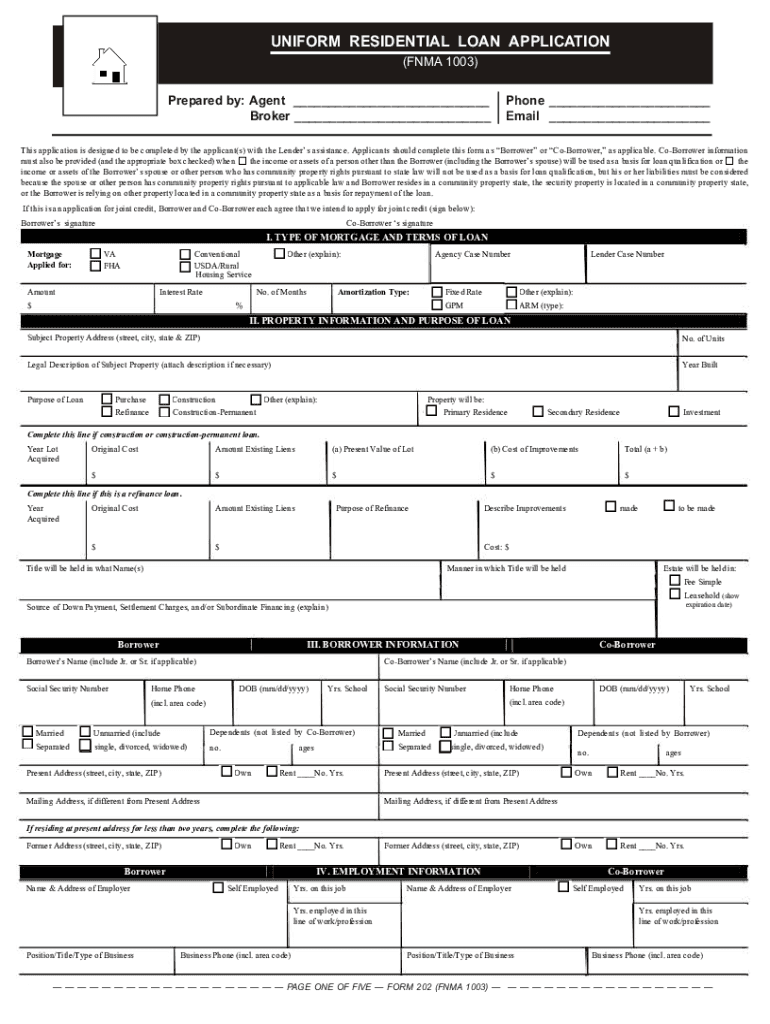

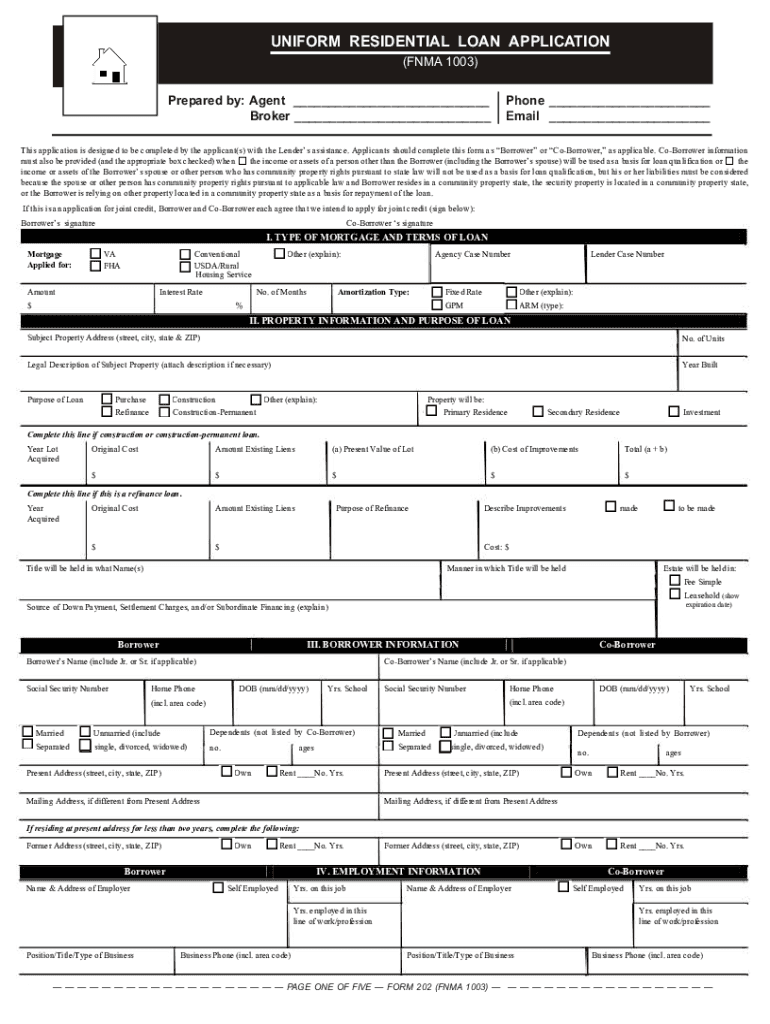

UNIFORM RESIDENTIAL LOAN APPLICATION Back to Welcome Page1003) (Nonuniform Residential Loan Application RESIDENTIAL LOAN APPLICATION Phone PreparedUNIFORM by: Agent (FNMA 1003) Email Broker This application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan application - first

Edit your loan application - first form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan application - first form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan application - first online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan application - first. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan application - first

How to fill out a loan application - first:

01

Gather all necessary documents: Before starting the loan application, make sure you have all the required documents ready. These may include identification proof, income proof, bank statements, tax returns, and any other documents requested by the lender.

02

Research different loan options: Before filling out the application, it's important to understand what types of loans are available and which one suits your needs best. Research different loan options, such as personal loans, car loans, or mortgages, and determine which one you would like to apply for.

03

Complete the personal information section: The loan application will typically require you to fill in your personal information, including your full name, contact details, social security number, and date of birth. Ensure that you provide accurate and up-to-date information.

04

Provide employment and income details: In this section, you will need to provide information about your current employment status, such as the name of your employer, your job title, and how long you have been employed. Additionally, you will need to disclose your income details, including your monthly salary or wages.

05

Disclose your financial information: Lenders will require information about your current financial situation. This may include details of your current debts, such as outstanding loans or credit card balances, as well as your assets, such as property or investments.

06

Fill in the loan details: Specify the loan amount you are applying for and the purpose of the loan. Provide accurate information regarding the loan term and any collateral you may be offering.

07

Review and submit the application: Once you have completed all the necessary sections, take the time to carefully review your application before submitting it. Double-check for any errors or missing information. Once you are satisfied, submit the application as instructed by the lender.

Who needs a loan application - first?

01

Individuals in need of financial assistance: A loan application is typically necessary for individuals who require financial assistance for various reasons. This could include funding for education, purchasing a car, starting a business, or covering unexpected expenses.

02

Homebuyers: For individuals looking to purchase a home, a loan application is an essential step in securing a mortgage. The application allows lenders to assess the borrower's eligibility and determine the terms of the loan.

03

Small business owners: Entrepreneurs looking to obtain financing for their small businesses often need to complete a loan application. This provides the lender with the necessary information to evaluate creditworthiness and assess the viability of the business.

04

Students seeking educational loans: Students who require financial aid to fund their education will need to fill out a loan application. This is especially crucial for accessing student loans, which can help cover tuition fees, books, and other educational expenses.

05

Individuals seeking personal loans: If someone needs funds for personal reasons, such as consolidating debt, paying off medical bills, or funding a major event, they will need to complete a loan application to access a personal loan.

In conclusion, anyone who requires financial assistance, whether for personal, education, home, or business purposes, may need to fill out a loan application as per their specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit loan application - first in Chrome?

Install the pdfFiller Google Chrome Extension to edit loan application - first and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the loan application - first in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your loan application - first.

How can I fill out loan application - first on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your loan application - first. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is loan application - first?

A loan application is a formal request for a loan from a financial institution.

Who is required to file loan application - first?

Anyone looking to borrow money from a financial institution is required to file a loan application.

How to fill out loan application - first?

You can fill out a loan application by providing your personal and financial information, as well as details about the loan you are requesting.

What is the purpose of loan application - first?

The purpose of a loan application is to provide a financial institution with the information they need to determine if you are eligible for a loan.

What information must be reported on loan application - first?

You must report your personal information, financial information, and details about the loan you are requesting on a loan application.

Fill out your loan application - first online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Application - First is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.