Get the free GOOD FAITH ESTIMATE OF SELLERS NET SALES PROCEEDS - firsttuesday

Show details

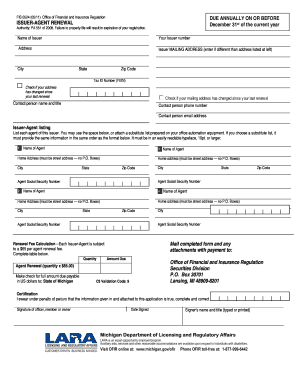

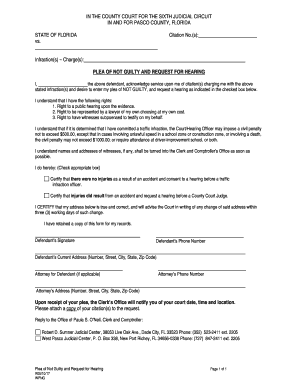

GOOD FAITH ESTIMATE OF SELLERS NET SALES PROCEEDS On Sale of Property Prepared by: Agent Broker Phone Email NOTE: This net sheet is prepared to assist the Seller by providing an estimate of the amount

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign good faith estimate of

Edit your good faith estimate of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your good faith estimate of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit good faith estimate of online

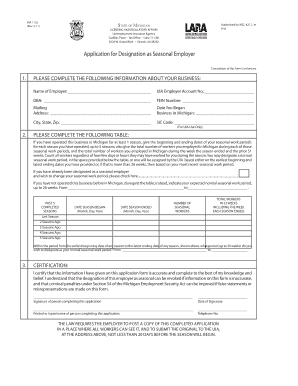

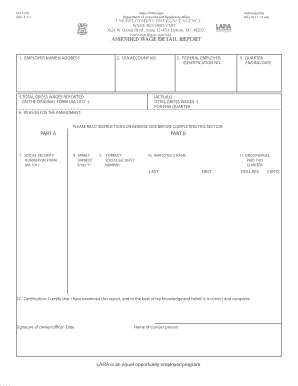

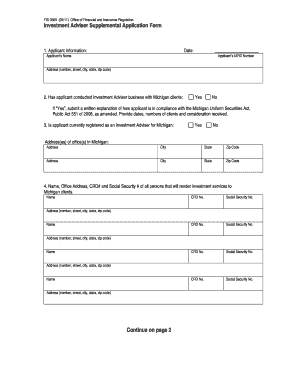

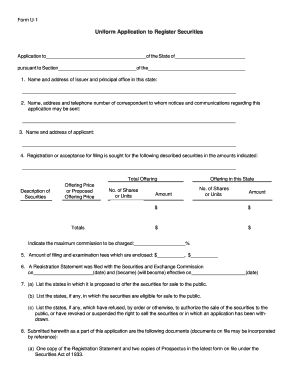

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit good faith estimate of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out good faith estimate of

How to fill out a Good Faith Estimate:

01

Start by gathering the necessary information. You will need details about the loan, the property, and the borrower(s). This includes the loan amount, interest rate, estimated closing costs, and the borrower's name and contact information.

02

Identify the purpose of the loan. Are you refinancing an existing mortgage or purchasing a new property? This will help determine the appropriate sections to complete on the Good Faith Estimate form.

03

In the Loan Terms section, provide details about the loan amount, interest rate, loan term, and whether it is a fixed or adjustable-rate mortgage. If applicable, indicate whether there are any prepayment penalties.

04

Move on to the Projected Payments section. Here, you'll need to estimate the principal and interest amount, mortgage insurance, property taxes, and homeowners insurance. These figures will provide an estimate of the monthly payment for the borrower.

05

Provide details about the estimated closing costs in the Charges section. This includes fees for the loan origination, appraisal, credit report, title insurance, and any other applicable charges. It is important to accurately include all charges to give the borrower a clear understanding of the costs associated with the loan.

06

The final section of the Good Faith Estimate is the Summary of Your Settlement Charges. This provides an overview of the estimated total amount due at closing, including the loan amount, estimated closing costs, and any prepaid items.

Who needs a Good Faith Estimate:

01

Homebuyers: Whether you are a first-time homebuyer or experienced in purchasing properties, you will need a Good Faith Estimate to understand the estimated costs associated with the loan and closing. This will help you make an informed decision about the affordability of the property and compare loan offers from different lenders.

02

Mortgage refinancers: If you are considering refinancing your existing mortgage, a Good Faith Estimate is crucial to understand the fees and costs associated with the new loan. This will help you evaluate whether refinancing is financially beneficial for you and compare offers from different lenders.

03

Real estate professionals: Agents, brokers, and other professionals involved in the real estate transaction process will need access to a borrower's Good Faith Estimate to accurately represent the transaction and explain the costs to their clients.

In summary, filling out a Good Faith Estimate involves collecting and providing accurate loan and borrower information, estimating projected payments and closing costs, and reviewing the document for completeness and accuracy. This document is crucial for homebuyers, mortgage refinancers, and real estate professionals to understand and compare the costs associated with a loan transaction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit good faith estimate of in Chrome?

Install the pdfFiller Google Chrome Extension to edit good faith estimate of and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out good faith estimate of using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign good faith estimate of. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete good faith estimate of on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your good faith estimate of. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is good faith estimate of?

The good faith estimate is an estimate of the total closing costs and loan terms provided to a borrower by a lender.

Who is required to file good faith estimate of?

Lenders are required to provide a good faith estimate to borrowers as part of the mortgage application process.

How to fill out good faith estimate of?

Lenders fill out the good faith estimate by providing an itemized list of closing costs, loan terms, and other relevant information to the borrower.

What is the purpose of good faith estimate of?

The purpose of the good faith estimate is to help borrowers understand the costs and terms associated with a mortgage loan before committing to the loan.

What information must be reported on good faith estimate of?

The good faith estimate must include information on closing costs, loan terms, interest rate, and any additional fees associated with the mortgage loan.

Fill out your good faith estimate of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Good Faith Estimate Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.