Get the free MONTH HOURS WORKED

Show details

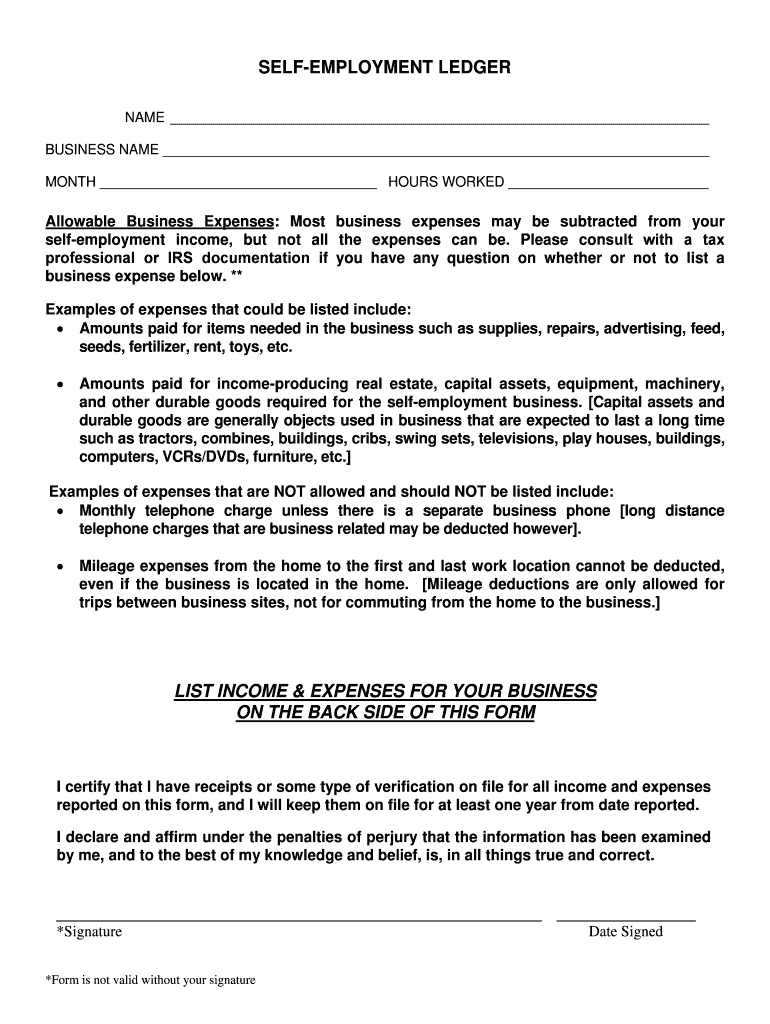

REEMPLOYMENT LEDGER RECIPIENT NAME BUSINESS NAME MONTH HOURS WORKED Allowable Business Expenses: Most business expenses may be subtracted from your self-employment income, but not all the expenses

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign month hours worked

Edit your month hours worked form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your month hours worked form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing month hours worked online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit month hours worked. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out month hours worked

How to fill out month hours worked

01

To fill out month hours worked, follow these steps:

02

Start by gathering all the necessary information such as your work schedule, timesheets, or any other records that document your hours worked.

03

Create a document or spreadsheet to record the month hours worked. You can use software like Microsoft Excel or Google Sheets, or simply use a pen and paper.

04

Begin by entering the date or day of the week for each day in the month you worked.

05

Next, input the start time and end time for each day you worked. Make sure to include any breaks or lunch periods if applicable.

06

Calculate the total hours worked for each day by subtracting the start time from the end time. You can use a time calculator or manually perform the calculation.

07

Sum up the total hours worked for each day to calculate the total month hours worked. You can use the sum formula in spreadsheet software or manually add up the hours.

08

Once you have filled out all the month hours worked, double-check your calculations and ensure the accuracy of the recorded data.

09

Save the document or spreadsheet for future reference or reporting purposes.

Who needs month hours worked?

01

Various individuals and entities may need month hours worked, including:

02

- Employees who need to track their own work hours for payroll or overtime purposes.

03

- Employers or human resources departments who need to calculate employee salaries, benefits, or performance metrics.

04

- Contractors or freelancers who need to invoice clients based on the hours worked.

05

- Project managers who need to monitor the progress and allocate resources based on the hours worked by the team members.

06

- Government agencies or auditors who need to verify compliance with labor laws or regulations.

07

- Researchers or analysts who need to study work patterns, productivity, or labor market trends.

08

- Consultants or advisors who provide advice or recommendations based on the hours worked by their clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit month hours worked from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including month hours worked, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete month hours worked online?

Easy online month hours worked completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I edit month hours worked on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing month hours worked.

What is month hours worked?

Month hours worked refers to the total number of hours worked by an employee during a specific month.

Who is required to file month hours worked?

Employers are typically required to file month hours worked for each employee.

How to fill out month hours worked?

Employers can fill out month hours worked by recording the number of hours worked by each employee for each day of the month.

What is the purpose of month hours worked?

The purpose of month hours worked is to track and monitor the amount of time employees spend working each month.

What information must be reported on month hours worked?

Information such as the employee's name, employee ID, and the total number of hours worked in a month must be reported on month hours worked.

Fill out your month hours worked online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Month Hours Worked is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.