Get the free Depreciation is always considered a product cost for external financial reporting pu...

Show details

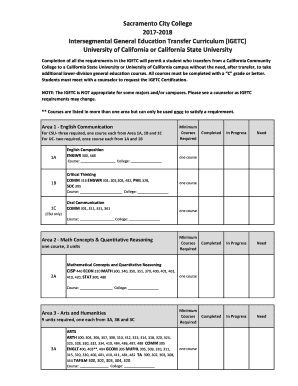

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question.

1)All costs incurred in a merchandising firm are considered to be period costs.

A) True

B) False

Answer:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign depreciation is always considered

Edit your depreciation is always considered form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your depreciation is always considered form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing depreciation is always considered online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit depreciation is always considered. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out depreciation is always considered

How to fill out depreciation is always considered

01

To fill out depreciation, follow these steps:

02

Identify the asset: Determine the item or asset for which depreciation is being calculated.

03

Determine the useful life: Determine the estimated useful life of the asset. This is the period over which the asset is expected to provide benefits.

04

Determine the salvage value: Determine the estimated residual or salvage value of the asset, which is the estimated value of the asset at the end of its useful life.

05

Choose a depreciation method: There are various depreciation methods like straight-line method, declining balance method, etc. Choose a method appropriate for the asset and the business.

06

Calculate annual depreciation: Using the chosen method, calculate the annual depreciation expense by dividing the asset's depreciable value (cost - salvage value) by its useful life.

07

Record depreciation expense: Record the annual depreciation expense in the appropriate expense account.

08

Repeat for subsequent periods: Repeat the above steps for each subsequent period until the asset's useful life is complete.

Who needs depreciation is always considered?

01

Depreciation is always considered by businesses and organizations that own tangible assets, such as buildings, vehicles, machinery, equipment, etc.

02

It is especially important for companies that report their financial statements according to generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS).

03

Owners, investors, and creditors also rely on depreciation information to assess the value, performance, and financial health of a company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my depreciation is always considered in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your depreciation is always considered along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get depreciation is always considered?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the depreciation is always considered. Open it immediately and start altering it with sophisticated capabilities.

How do I execute depreciation is always considered online?

pdfFiller has made it easy to fill out and sign depreciation is always considered. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is depreciation is always considered?

Depreciation is the allocation of the cost of an asset over its useful life.

Who is required to file depreciation is always considered?

Any business or individual who owns depreciable assets is required to file depreciation.

How to fill out depreciation is always considered?

Depreciation is typically filled out on tax forms or financial statements using the appropriate methods such as straight-line or accelerated depreciation.

What is the purpose of depreciation is always considered?

Depreciation allows for the matching of expenses with the revenues generated by the assets, providing a more accurate reflection of the asset's value.

What information must be reported on depreciation is always considered?

The information reported on depreciation includes the cost of the asset, its useful life, the depreciation method used, and the accumulated depreciation.

Fill out your depreciation is always considered online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Depreciation Is Always Considered is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.