Get the free A LIFE INSURANCE POLICY ILLUSTRATION

Show details

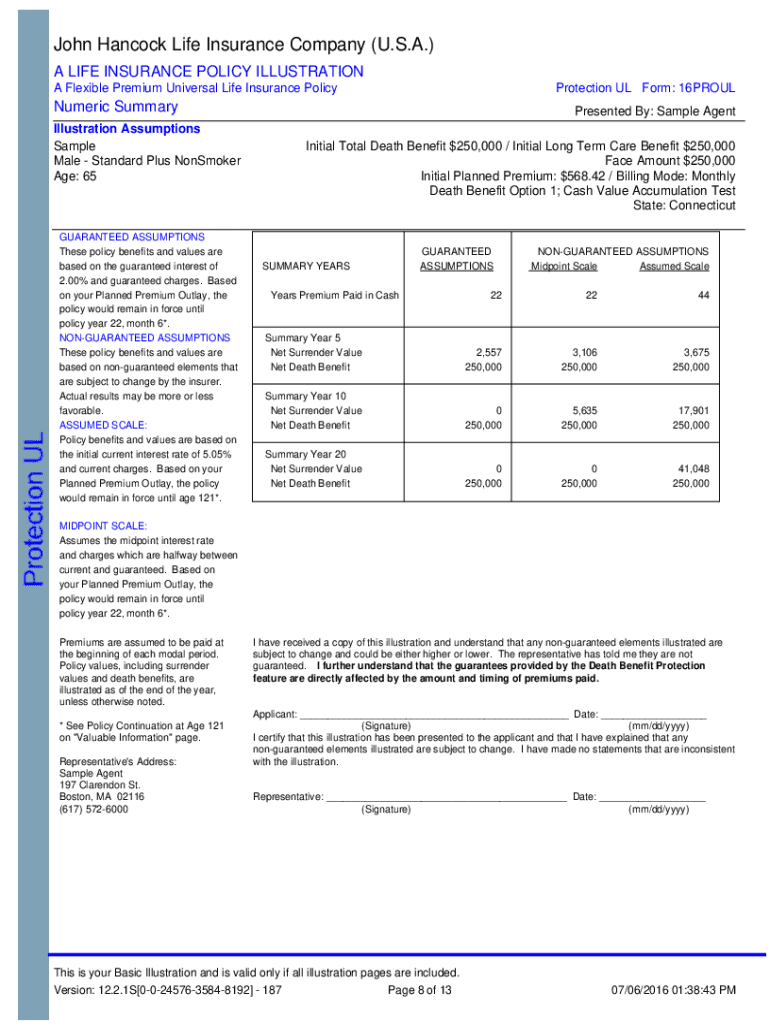

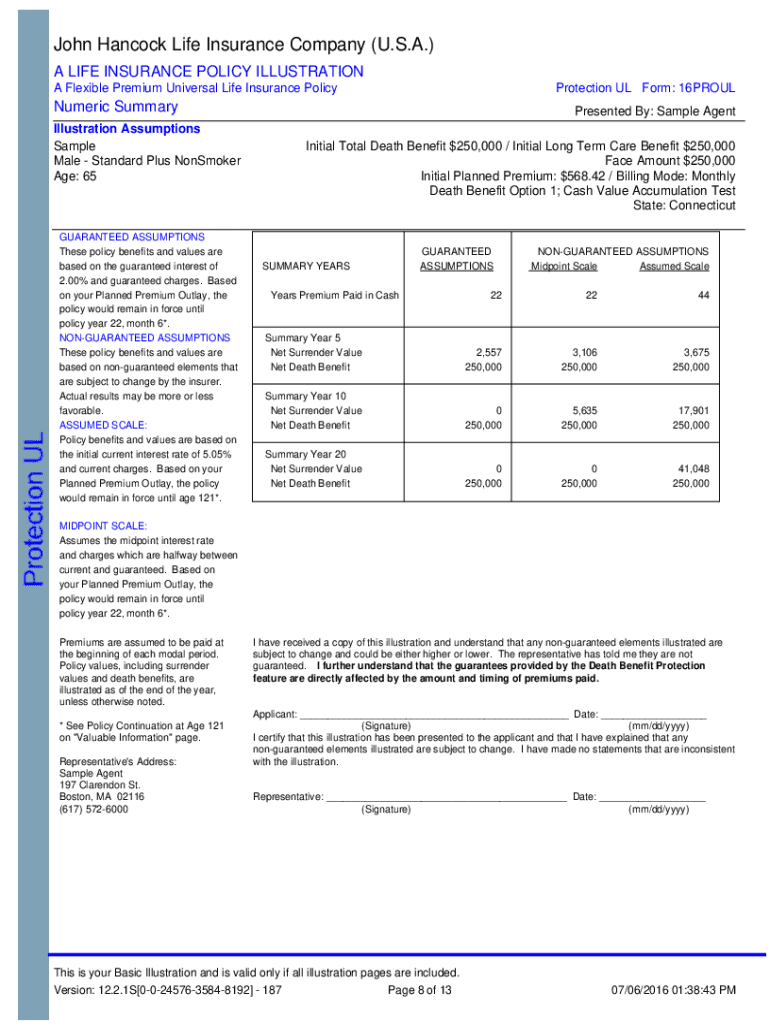

John Hancock Life Insurance Company (U.S.A.) A LIFE INSURANCE POLICY ILLUSTRATION A Flexible Premium Universal Life Insurance PolicyLongTerm Care Rider Cover Page Illustration Assumptions Sample Male

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a life insurance policy

Edit your a life insurance policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a life insurance policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing a life insurance policy online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit a life insurance policy. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a life insurance policy

How to fill out a life insurance policy

01

Gather all relevant personal information such as full name, date of birth, contact details, and social security number.

02

Determine the type of life insurance policy you want to purchase. Common types include term life insurance and whole life insurance.

03

Research and compare different insurance providers to find the best policy and rates for your needs.

04

Contact the chosen insurance provider or visit their website to start the application process.

05

Review the application form carefully and answer all the required questions accurately.

06

Provide any additional information or documents requested by the insurance company, such as medical records or financial statements.

07

Decide on the coverage amount and beneficiary designation for your life insurance policy.

08

Read and understand the terms and conditions of the policy before signing it.

09

Pay the initial premium amount or set up a payment plan as per the insurer's instructions.

10

Submit the completed application along with any required payments to the insurance company.

11

Wait for the insurance company to review and process your application. This may involve medical underwriting or further documentation.

12

Once approved, you will receive your life insurance policy documents. Keep them in a safe place and inform your beneficiaries about the policy.

13

Pay your premiums on time to keep the policy active and ensure the coverage remains in effect.

14

Review your life insurance policy periodically and make updates or changes as needed to reflect any significant life events or changes in financial circumstances.

Who needs a life insurance policy?

01

Anyone who wants to financially protect their loved ones in case of their death.

02

Individuals with dependents, such as spouses, children, or aging parents, who rely on their income or support.

03

Business owners who want to secure the continuity of their business or provide funds for buyout arrangements in case of their death.

04

People with significant debts, such as mortgages or loans, that they do not want to burden their family with upon their passing.

05

Individuals who want to leave a financial legacy or provide for charitable causes after their death.

06

Parents or guardians looking to secure their children's future education expenses or other financial needs.

07

Anyone who wants to cover funeral expenses and final medical bills without putting a financial strain on their family.

08

People in specific high-risk occupations or with health conditions who may have difficulties obtaining life insurance later in life.

09

Individuals who want to take advantage of the cash value component of certain types of permanent life insurance policies for investment or retirement purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my a life insurance policy directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your a life insurance policy and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make changes in a life insurance policy?

With pdfFiller, the editing process is straightforward. Open your a life insurance policy in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit a life insurance policy in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing a life insurance policy and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is a life insurance policy?

A life insurance policy is a contract between an individual and an insurance company where the insurer agrees to pay a designated beneficiary a sum of money upon the death of the insured person.

Who is required to file a life insurance policy?

The policyholder or the insured person is generally required to file a life insurance policy.

How to fill out a life insurance policy?

To fill out a life insurance policy, one must provide personal information, medical history, beneficiary details, and choose coverage options.

What is the purpose of a life insurance policy?

The purpose of a life insurance policy is to provide financial protection and support to the beneficiaries of the insured person in the event of their death.

What information must be reported on a life insurance policy?

Information such as personal details of the insured, beneficiary details, coverage options, medical history, and payment details must be reported on a life insurance policy.

Fill out your a life insurance policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Life Insurance Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.