Get the free TAX DEFERRAL/DELAY

Show details

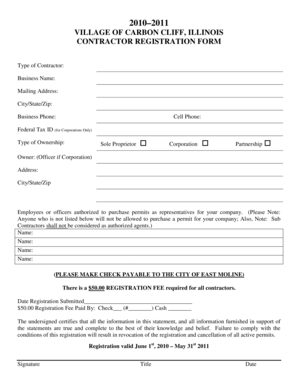

TAX RELIEF DEFERRAL/DELAY(Annual Filing Required)FOR ELDERLY or PERMANENTLY DISABLED A senior citizen or disabled person eligible for partial RE tax exemption may request deferral/delay of payment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax deferraldelay

Edit your tax deferraldelay form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax deferraldelay form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax deferraldelay online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax deferraldelay. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax deferraldelay

How to fill out tax deferraldelay

01

To fill out a tax deferral delay, follow these steps:

02

Gather all the necessary documents, such as your income statements, expense receipts, and any other relevant financial information.

03

Determine if you are eligible for a tax deferral. This usually depends on your income level and certain qualifying factors.

04

Once you have confirmed your eligibility, complete the appropriate tax deferral form. This form can usually be obtained from your local tax office or downloaded from their website.

05

Fill in all the required sections of the form accurately and completely. Pay attention to any specific instructions or additional information that may be requested.

06

Double-check all the provided information for accuracy and make sure all calculations are correct.

07

Attach any supporting documents that may be required, such as proof of income or receipts for deductible expenses.

08

Submit the completed form along with any supporting documents to the appropriate tax authority. This can usually be done by mail or electronically, depending on the available options.

09

Keep a copy of the filled-out form and any supporting documents for your records.

10

Wait for confirmation from the tax authority regarding your tax deferral request. They will notify you of any further steps or actions required.

11

Follow up with the tax authority if you have not received any response within a reasonable timeframe.

Who needs tax deferraldelay?

01

Tax deferral can be useful for various individuals and businesses in certain situations. Some examples of who may need tax deferral are:

02

- Small businesses or self-employed individuals who experience uneven or seasonal income streams and want to spread out tax payments over time.

03

- Individuals facing financial hardship or unexpected expenses who need temporary relief from immediate tax obligations.

04

- Investors or property owners who want to defer tax payments on capital gains or rental income until a later date.

05

- Individuals or businesses with significant upcoming expenses or investments and prefer to allocate funds towards those instead of immediate tax payments.

06

- People who want to take advantage of certain tax benefits or incentives that allow for deferred tax payments.

07

It is important to note that eligibility for tax deferral and the specific rules may vary depending on the jurisdiction and individual circumstances. It is advisable to consult with a tax professional or the appropriate tax authority for personalized guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax deferraldelay in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your tax deferraldelay as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I edit tax deferraldelay from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including tax deferraldelay. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send tax deferraldelay to be eSigned by others?

Once you are ready to share your tax deferraldelay, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

What is tax deferraldelay?

Tax deferraldelay is a method of delaying the payment of taxes until a later date.

Who is required to file tax deferraldelay?

Individuals or businesses with tax liabilities who wish to postpone payment.

How to fill out tax deferraldelay?

Tax deferraldelay forms can be filled out online or through a tax professional.

What is the purpose of tax deferraldelay?

The purpose of tax deferraldelay is to provide flexibility in when taxes are paid.

What information must be reported on tax deferraldelay?

Tax deferraldelay forms require details of income, deductions, and payment preferences.

Fill out your tax deferraldelay online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Deferraldelay is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.