Get the free for capital appreciation

Show details

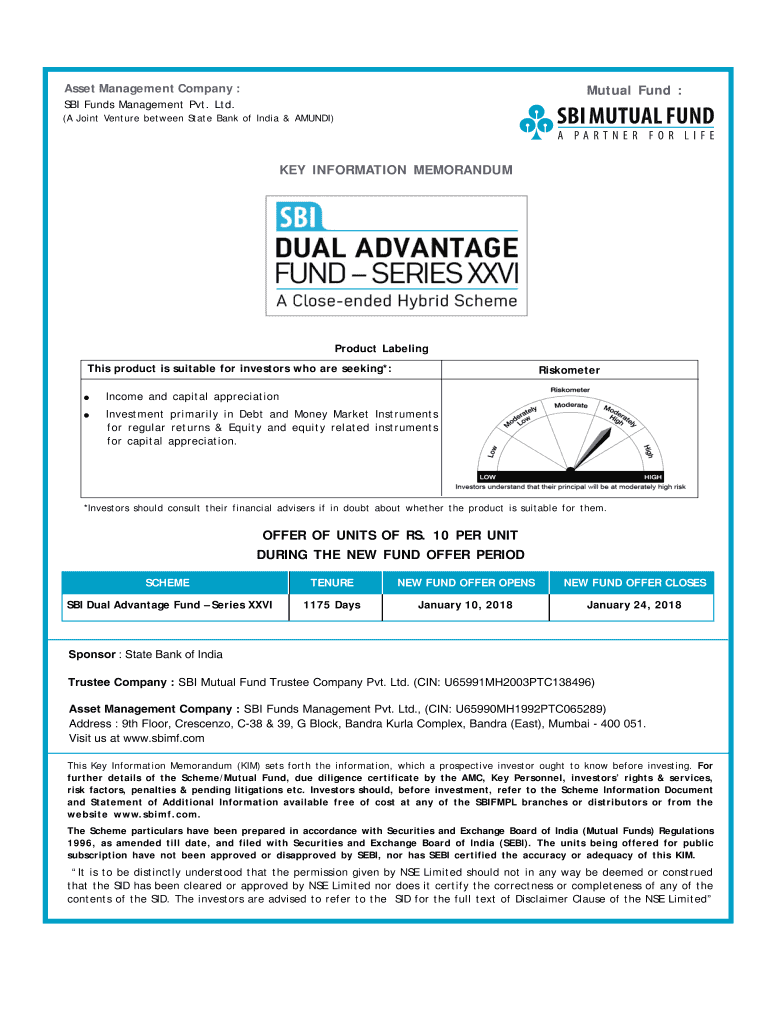

Asset Management Company :Mutual Fund :SBI Funds Management Pvt. Ltd. (A Joint Venture between State Bank of India & AMANDA)KEY INFORMATION MEMORANDUMProduct Labeling This product is suitable for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign for capital appreciation

Edit your for capital appreciation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for capital appreciation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit for capital appreciation online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit for capital appreciation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out for capital appreciation

How to fill out for capital appreciation

01

Start by assessing your financial goals and risk tolerance. Determine how much capital appreciation you aim to achieve and understand the level of risk you are willing to take on.

02

Research and identify investment opportunities that have the potential for capital appreciation. This may include stocks, real estate, mutual funds, or other assets that historically have shown growth in value over time.

03

Develop a well-diversified investment portfolio to minimize risk. This can involve allocating your capital to different asset classes and industries to spread out the potential for losses.

04

Consider seeking professional advice from a financial advisor or investment manager who can provide guidance and expertise in identifying potential investments for capital appreciation.

05

Monitor your investments regularly and make adjustments to your portfolio as needed. Economic conditions and market trends can change, so it's important to stay informed and adapt your investment strategy accordingly.

06

Keep a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. Capital appreciation is typically achieved over time, and it's important to stay focused on your financial goals.

Who needs for capital appreciation?

01

Individuals who have a long-term investment horizon and are looking to grow their wealth over time may be interested in capital appreciation.

02

Investors who are comfortable with taking on a certain level of risk in exchange for potentially higher returns may also be interested in capital appreciation strategies.

03

Those who have specific financial goals such as saving for retirement, funding their children's education, or achieving financial independence may find capital appreciation strategies helpful.

04

Additionally, individuals who have surplus capital and are willing to invest it in assets that have the potential for growth in value may also benefit from capital appreciation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute for capital appreciation online?

pdfFiller has made it simple to fill out and eSign for capital appreciation. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit for capital appreciation in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing for capital appreciation and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my for capital appreciation in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your for capital appreciation directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is for capital appreciation?

Capital appreciation is the increase in the value of an asset over time.

Who is required to file for capital appreciation?

Individuals who have realized capital gains as a result of selling assets such as stocks, bonds, or real estate are required to file for capital appreciation.

How to fill out for capital appreciation?

To fill out for capital appreciation, individuals must report the details of the capital gains earned during the tax year on their tax return forms.

What is the purpose of for capital appreciation?

The purpose of for capital appreciation is to accurately report and pay taxes on any capital gains earned by selling assets.

What information must be reported on for capital appreciation?

Individuals must report the details of the assets sold, the purchase price, the sale price, and the capital gains earned on their tax return forms for capital appreciation.

Fill out your for capital appreciation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For Capital Appreciation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.