Get the free An open-ended equity scheme

Show details

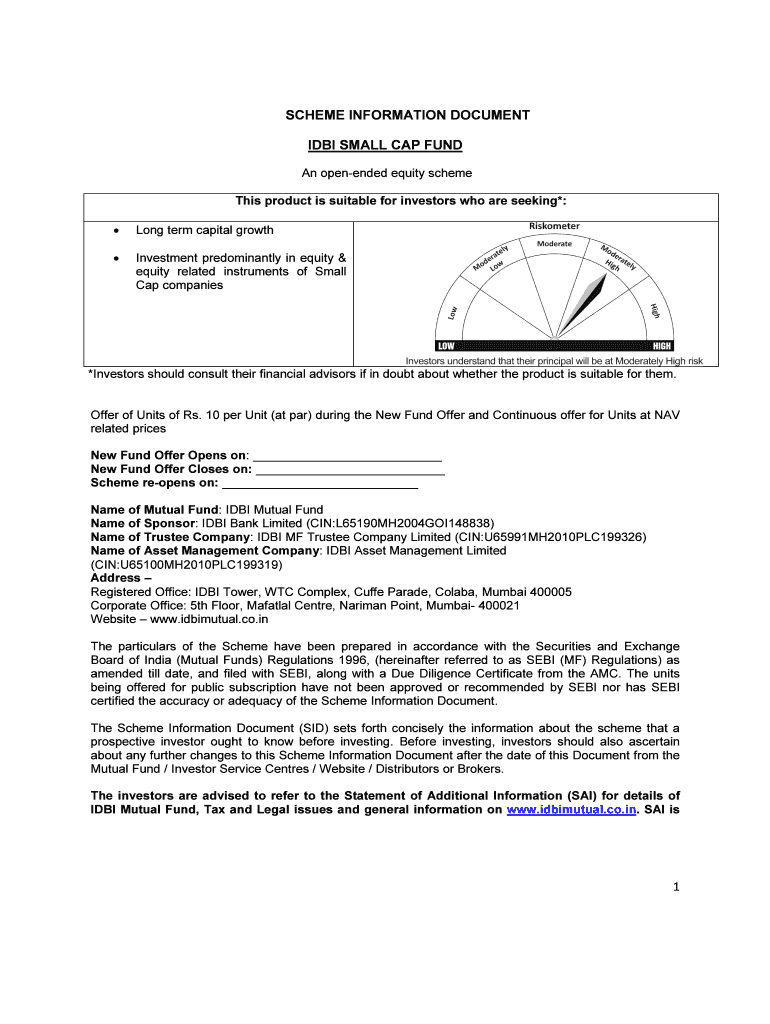

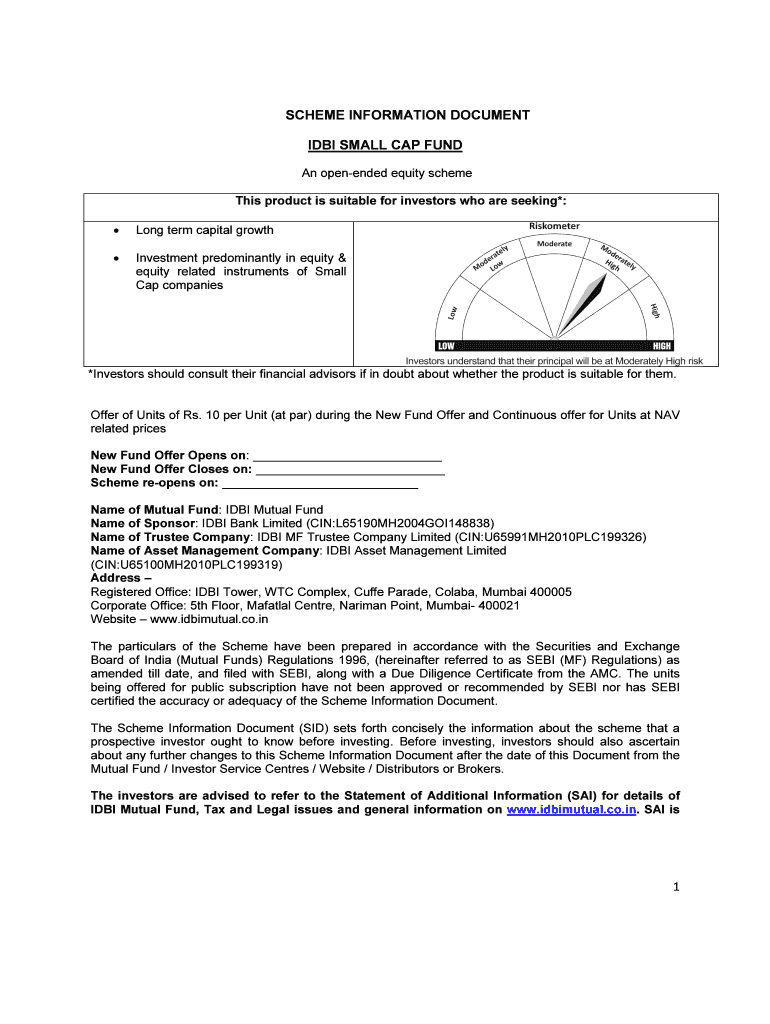

SCHEME INFORMATION DOCUMENT IDB SMALL CAP FUND An open-ended equity scheme This product is suitable for investors who are seeking*: Long term capital growthInvestment predominantly in equity & equity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign an open-ended equity scheme

Edit your an open-ended equity scheme form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your an open-ended equity scheme form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit an open-ended equity scheme online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit an open-ended equity scheme. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out an open-ended equity scheme

How to fill out an open-ended equity scheme

01

To fill out an open-ended equity scheme, follow these steps:

02

Begin by reading the scheme's prospectus carefully. It contains important information such as investment objectives, risk factors, charges, and expenses.

03

Determine your investment goals and risk tolerance. This will help you choose the right equity scheme.

04

Complete the application form provided by the scheme's issuer. Ensure that all the required information is accurately filled out and sign the form.

05

Provide the necessary identification documents as per the issuer's requirements. This may include KYC documents such as PAN card, Aadhaar card, address proof, etc.

06

Attach a duly signed cheque or initiate a bank transfer for the investment amount mentioned in the application form. Make sure the payment is made from your own bank account.

07

Double-check all the filled-out information, documents, and payment to avoid any errors or discrepancies.

08

Submit the filled-out application form along with all the required documents and payment to the designated office or distributor of the open-ended equity scheme.

09

Keep a copy of the filled-out application form, acknowledgment receipt, and all supporting documents for your records.

10

Wait for the confirmation of your investment in the open-ended equity scheme. It may take a few days for the scheme's issuer to process your application.

11

Monitor the performance of the scheme and review your investment periodically to ensure it aligns with your financial goals and risk appetite.

Who needs an open-ended equity scheme?

01

An open-ended equity scheme is suitable for individuals who:

02

- Have a long investment horizon and can stay invested for an extended period.

03

- Are willing to take higher risks in exchange for potentially higher returns.

04

- Seek exposure to equity markets and want professional management of their investments.

05

- Want the flexibility to enter or exit the scheme at any time.

06

- Wish to diversify their investment portfolio by including equity investments.

07

- Are comfortable with market fluctuations and can tolerate short-term volatility.

08

- Have a thorough understanding of the risks associated with equity investments.

09

- Want a regulated investment avenue with transparency and investor-friendly features.

10

However, it is advisable to consult a financial advisor or investment professional before investing in an open-ended equity scheme to evaluate its suitability based on individual financial circumstances and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit an open-ended equity scheme from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your an open-ended equity scheme into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete an open-ended equity scheme online?

With pdfFiller, you may easily complete and sign an open-ended equity scheme online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my an open-ended equity scheme in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your an open-ended equity scheme and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is an open-ended equity scheme?

An open-ended equity scheme is a type of mutual fund that does not have a fixed number of shares and can issue or redeem shares at any time.

Who is required to file an open-ended equity scheme?

Asset management companies or mutual fund companies are required to file an open-ended equity scheme.

How to fill out an open-ended equity scheme?

To fill out an open-ended equity scheme, you need to provide information about the fund's objectives, portfolio holdings, performance, expenses, and risks.

What is the purpose of an open-ended equity scheme?

The purpose of an open-ended equity scheme is to provide investors with a way to invest in a diversified portfolio of stocks and potentially earn returns.

What information must be reported on an open-ended equity scheme?

Information such as the fund's net asset value, performance data, investment objectives, risks, and fees must be reported on an open-ended equity scheme.

Fill out your an open-ended equity scheme online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

An Open-Ended Equity Scheme is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.