Get the free DUTY DRAWBACK FACILITY

Show details

DUTY DRAWBACK FACILITY

UNDER SECTION 99 CUSTOMS ACTS 1967ROYAL MALAYSIAN CUSTOMS DEPARTMENT

2017CONTENT

A.INTRODUCTION.DUTY DRAWBACK FACILITY

1. Legal Provision

2. Category of Applicant / Exporter

3.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign duty drawback facility

Edit your duty drawback facility form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your duty drawback facility form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit duty drawback facility online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit duty drawback facility. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

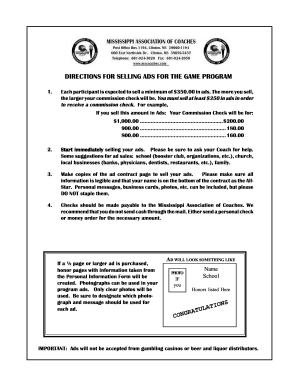

How to fill out duty drawback facility

How to fill out duty drawback facility

01

Gather all necessary information and documents, including invoices, bill of lading, import/export records, and any other relevant paperwork.

02

Determine the eligibility of your exports for duty drawback facility. This may require consulting with a customs expert or trade specialist.

03

Complete the duty drawback application form accurately and thoroughly. Pay attention to details and provide all required information.

04

Attach the supporting documents to the application form. Make sure they are properly organized and easy to reference.

05

Submit the completed application form and supporting documents to the appropriate customs authority or duty drawback program office.

06

Follow up with the customs authority to ensure that your application is being processed and to address any queries or requests for additional information.

07

Once approved, review the duty drawback calculation and ensure that you are receiving the correct amount of drawback.

08

Maintain proper record-keeping of your duty drawback activities, including all relevant documents and correspondence.

09

Periodically review and audit your duty drawback processes to identify any potential issues or improvements.

10

Stay updated with the latest customs regulations and changes that may affect your duty drawback facility.

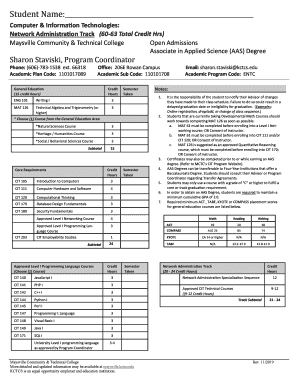

Who needs duty drawback facility?

01

Exporters who regularly engage in international trade and have significant import duties paid on their imported materials or products.

02

Manufacturers or producers who use imported components or raw materials in their production process and later export the finished goods.

03

Companies involved in industries with high duty rates, such as textiles, automotive, electronics, and machinery.

04

Businesses seeking to improve their competitive advantage by reducing the overall cost of importing and exporting.

05

Organizations aiming to streamline their customs compliance and maximize financial benefits through duty drawback facility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in duty drawback facility?

With pdfFiller, it's easy to make changes. Open your duty drawback facility in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit duty drawback facility in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing duty drawback facility and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit duty drawback facility on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as duty drawback facility. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

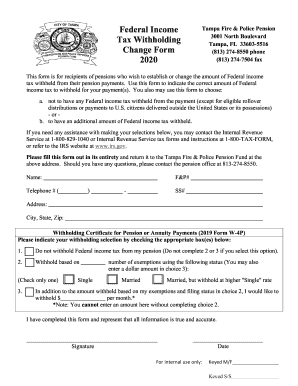

What is duty drawback facility?

Duty drawback facility is a refund of duties paid on imported merchandise that is subsequently exported or used in the production of exported goods.

Who is required to file duty drawback facility?

Importers or exporters who have paid duties on imported goods that are subsequently exported are required to file for duty drawback facility.

How to fill out duty drawback facility?

To fill out the duty drawback facility, importers or exporters must provide detailed information about the imported goods, export transactions, and supporting documentation.

What is the purpose of duty drawback facility?

The purpose of duty drawback facility is to provide financial relief to importers or exporters by refunding the duties paid on imported goods that are later exported.

What information must be reported on duty drawback facility?

Information such as the import entry number, export documentation, proof of payment of duties, and other relevant details must be reported on duty drawback facility.

Fill out your duty drawback facility online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Duty Drawback Facility is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.