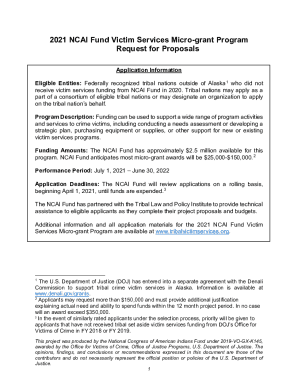

Get the free CAR LOAN NEW

Show details

CAR LOAN NEWLY FACT STATEMENTApplicant

Minimum Age

Maximum Age at maturity

Nationality / Residency

Work status

Min. years at current work

Min. years of experience

Min. monthly income

NSF Registration

Income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign car loan new

Edit your car loan new form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your car loan new form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit car loan new online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit car loan new. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out car loan new

How to fill out car loan new

01

Determine your budget for the car loan. Consider your monthly income, expenses, and other financial obligations to ensure that you can comfortably make the loan payments.

02

Research and compare different lenders and their loan offerings. Look for competitive interest rates, flexible repayment terms, and any additional fees or charges.

03

Gather all necessary documents such as proof of income, identification, and vehicle details. These might include your pay stubs, bank statements, driver's license, and the car's purchase agreement.

04

Apply for pre-approval from selected lenders. This allows you to know your loan eligibility and potential interest rates before finalizing the car purchase.

05

Once pre-approved, choose the lender that offers the most favorable terms and complete the formal loan application. Provide all required information accurately.

06

Review and understand the loan agreement before signing. Pay attention to the interest rate, monthly payment amount, repayment term, and any penalties or fees for early repayment.

07

Fill out the car loan application form with accurate details about the vehicle and your personal information. Double-check for any errors or missing information.

08

Submit the completed loan application along with the necessary documents to the lender for processing. Follow up with the lender to ensure timely processing of your application.

09

Once approved, carefully review the loan offer and make sure it matches your expectations. Consider negotiating the terms if needed before accepting the offer.

10

After accepting the loan offer, the lender will disburse the funds directly to the car dealer or seller, and you can proceed with purchasing the car.

11

Make regular, timely payments according to the agreed-upon terms. Keep track of the payment schedule and consider setting up automatic payments to avoid any missed payments or late fees.

12

Once the loan is fully repaid, ensure that you receive the necessary documentation to indicate the release of the lien on the car. This will establish your ownership of the vehicle.

Who needs car loan new?

01

Anyone who is looking to purchase a car but does not have the full amount available upfront may need a car loan. Car loans are commonly used by individuals who want to spread the cost of purchasing a car over a period of time. It is particularly useful for those who do not have enough savings to buy a car outright or prefer to maintain their savings for other purposes. Additionally, individuals who want to improve their credit score or establish a credit history may also opt for a car loan as it provides an opportunity to make timely payments and build a positive credit profile.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify car loan new without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like car loan new, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I sign the car loan new electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your car loan new and you'll be done in minutes.

How do I edit car loan new straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing car loan new right away.

What is car loan new?

Car loan new is a type of loan specifically used for purchasing a new car.

Who is required to file car loan new?

Individuals or entities looking to finance the purchase of a new car may be required to file for a car loan new.

How to fill out car loan new?

To fill out a car loan new, one must provide personal and financial information to the lender, along with details of the desired car.

What is the purpose of car loan new?

The purpose of car loan new is to provide financial assistance to individuals or entities looking to purchase a new car.

What information must be reported on car loan new?

Information such as personal details, financial information, desired car details, and loan terms must be reported on a car loan new.

Fill out your car loan new online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Car Loan New is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.