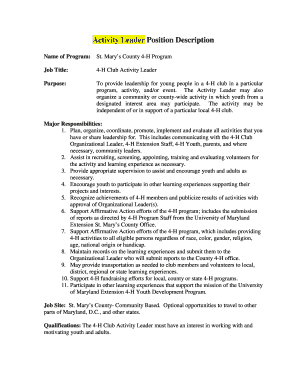

Get the free 2018 Savings and Spending Accounts Comparison Chart

Show details

2018 Savings and Spending Accounts Comparison Chart Flexible Spending Accounts (FSA)Health Savings Account (HSA)Healthcare Limited Purpose Independent Care Bayou deposit pretax money into the account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2018 savings and spending

Edit your 2018 savings and spending form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2018 savings and spending form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2018 savings and spending online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2018 savings and spending. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2018 savings and spending

How to fill out 2018 savings and spending

01

Start by gathering all your financial documents, including bank statements, investment statements, and receipts.

02

Create a spreadsheet or use personal finance software to track your income and expenses for the year.

03

Separate your income into different categories, such as salary, bonuses, dividends, or rental income.

04

Categorize your expenses into various categories, such as housing, transportation, groceries, entertainment, etc.

05

Enter the amounts for each income and expense category in your spreadsheet or personal finance software.

06

Calculate your total savings by subtracting your total expenses from your total income.

07

Analyze your spending patterns and identify areas where you can cut back or save more.

08

Set savings goals for the next year based on your analysis and make a plan to achieve them.

09

Keep track of your savings and spending throughout the year to ensure you stay on track with your goals.

10

Review and update your savings and spending regularly as your financial situation changes.

Who needs 2018 savings and spending?

01

Anyone who wants to gain a better understanding of their financial situation and make informed decisions about their savings and spending.

02

Individuals who are looking to track and improve their saving habits.

03

People who want to set financial goals and create a plan to achieve them.

04

Those who want to identify areas where they can cut back on expenses and save more money.

05

Businesses or organizations that want to analyze their spending and identify areas for cost-saving.

06

Individuals or households who want to create a budget and track their progress towards financial stability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2018 savings and spending online?

The editing procedure is simple with pdfFiller. Open your 2018 savings and spending in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the 2018 savings and spending electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your 2018 savings and spending in seconds.

How do I edit 2018 savings and spending on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 2018 savings and spending from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is savings and spending accounts?

Savings and spending accounts are financial accounts that individuals use to save money or make purchases.

Who is required to file savings and spending accounts?

Individuals who have savings and spending accounts are required to file them.

How to fill out savings and spending accounts?

You can fill out savings and spending accounts by entering information about your income, expenses, and savings goals.

What is the purpose of savings and spending accounts?

The purpose of savings and spending accounts is to track your financial transactions and help you better manage your money.

What information must be reported on savings and spending accounts?

Information such as account balances, transaction history, and interest earned must be reported on savings and spending accounts.

Fill out your 2018 savings and spending online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2018 Savings And Spending is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.