Get the free Personal / Family Budget

Show details

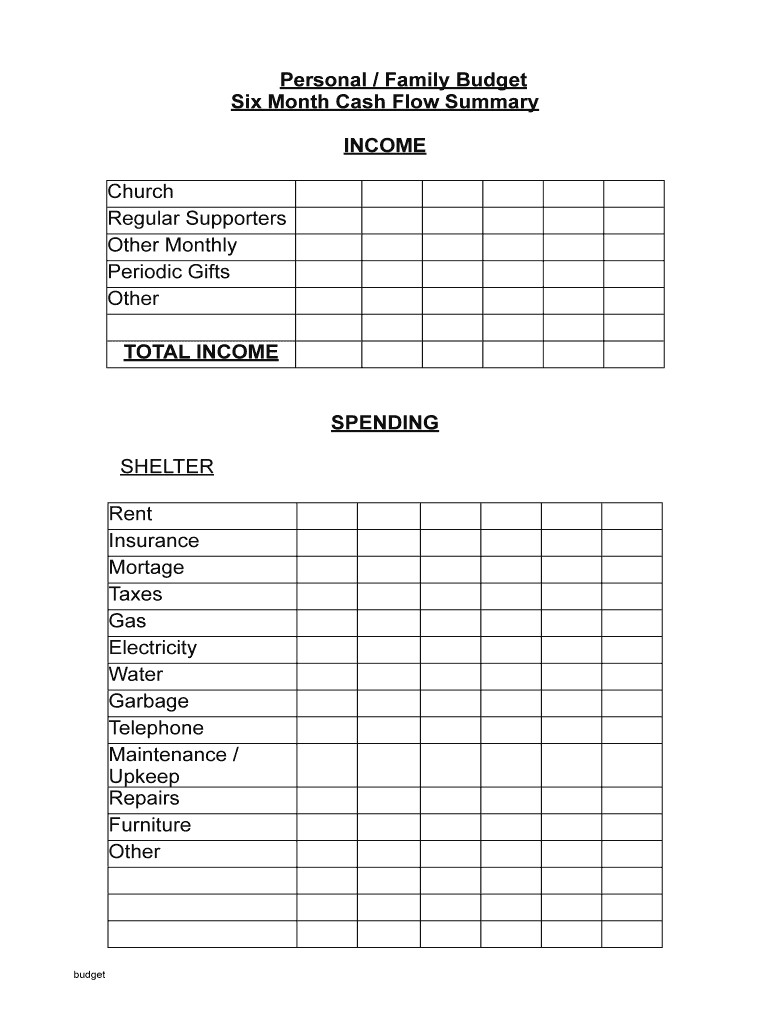

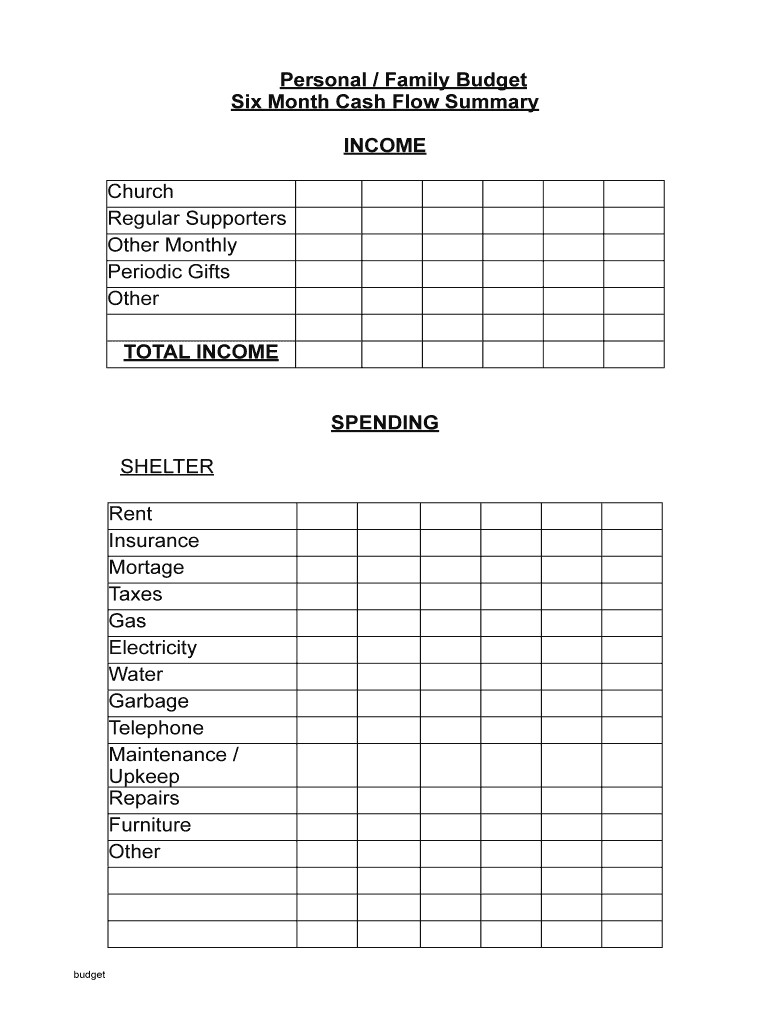

Personal / Family Budget

Six Month Cash Flow Summary

INCOME

Church

Regular Supporters

Other Monthly

Periodic Gifts

Other

TOTAL INCOMESPENDING

SHELTER

Rent

Insurance

Mortgage

Taxes

Gas

Electricity

Water

Garbage

Telephone

Maintenance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal family budget

Edit your personal family budget form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal family budget form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal family budget online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit personal family budget. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal family budget

How to fill out personal family budget

01

To fill out a personal family budget, follow these steps:

02

Gather all financial documents, such as pay stubs, bills, bank statements, and receipts.

03

Identify and list all sources of income.

04

Determine fixed expenses, such as rent/mortgage, utilities, insurance, and loan payments.

05

Track and categorize variable expenses, such as groceries, dining out, transportation, entertainment, and clothing.

06

Set financial goals and allocate a portion of the budget towards savings, investments, and debt repayment.

07

Calculate total income and subtract total expenses to determine whether the budget is balanced or there is a surplus/deficit.

08

Make adjustments as necessary, by reducing unnecessary expenses or finding ways to increase income.

09

Regularly review and update the budget to ensure it remains relevant and effective.

10

Consider using budgeting software or apps to simplify the process and track expenses more efficiently.

Who needs personal family budget?

01

Personal family budgets are beneficial for anyone who wants to manage their finances effectively and achieve financial goals.

02

Specifically, the following individuals or groups may find personal family budgets helpful:

03

- Individuals or families struggling with debt or financial instability.

04

- Couples planning for major life events, such as buying a home, starting a family, or retiring.

05

- Students or young adults who want to develop responsible financial habits from an early age.

06

- Individuals or families with irregular income who need to manage cash flow effectively.

07

- Those aiming to save for specific goals, such as a vacation, education, or emergency fund.

08

- Anyone who wants to gain a better understanding of their spending habits and make informed financial decisions.

09

By implementing a personal family budget, individuals and families can take control of their money, reduce stress related to finances, and work towards a more secure financial future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify personal family budget without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your personal family budget into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute personal family budget online?

pdfFiller makes it easy to finish and sign personal family budget online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out the personal family budget form on my smartphone?

Use the pdfFiller mobile app to complete and sign personal family budget on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is personal family budget?

A personal family budget is a financial plan that outlines a family's income and expenses in order to help manage finances effectively.

Who is required to file personal family budget?

Individuals or families who want to track and monitor their financial situation are encouraged to create and maintain a personal family budget.

How to fill out personal family budget?

To fill out a personal family budget, start by listing all sources of income, then list all expenses including fixed, variable, and discretionary expenses. Calculate the total income and subtract total expenses to determine if there is a surplus or deficit.

What is the purpose of personal family budget?

The purpose of a personal family budget is to help individuals and families manage their finances effectively, track spending habits, and save for future financial goals.

What information must be reported on personal family budget?

A personal family budget should include details about income sources, expenses, savings, debts, and financial goals.

Fill out your personal family budget online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Family Budget is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.