Get the free SCHEDULE NRH FORM 1040ME 2017 SCHEDULE for APPORTIONMENT and for CALCULATING the NON...

Show details

SCHEDULE

NRH

FORM 1040ME2017

Attachment Sequence No. 11SCHEDULE for APPORTIONMENT and

for CALCULATING the NONRESIDENT CREDIT

for MARRIED PERSON ELECTING TO FILE SINGLE

This schedule must be

We are not affiliated with any brand or entity on this form

Instructions and Help about schedule nrh form 1040me

How to edit schedule nrh form 1040me

How to fill out schedule nrh form 1040me

Instructions and Help about schedule nrh form 1040me

How to edit schedule nrh form 1040me

Edit the schedule nrh form 1040me using pdfFiller to easily make necessary changes. Start by uploading your completed form to the platform. Use the editing tools to modify text, signatures, or other elements as needed. After making your edits, save your changes and prepare for submission.

How to fill out schedule nrh form 1040me

Filling out the schedule nrh form 1040me requires due diligence. Follow these steps:

01

Gather all necessary financial documents and details related to your income and expenses.

02

Visit the official IRS website to download the latest version of the form.

03

Enter your information accurately in each section, ensuring all pertinent details are included.

04

Double-check calculations and confirm that all required signatures are completed.

Latest updates to schedule nrh form 1040me

Latest updates to schedule nrh form 1040me

The schedule nrh form 1040me undergoes revisions periodically. Be sure to check the IRS website for the most recent updates or changes in requirements. Updates may include changes in tax rates, eligibility criteria, or reporting requirements. Always use the latest form when filing to ensure compliance.

All You Need to Know About schedule nrh form 1040me

What is schedule nrh form 1040me?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About schedule nrh form 1040me

What is schedule nrh form 1040me?

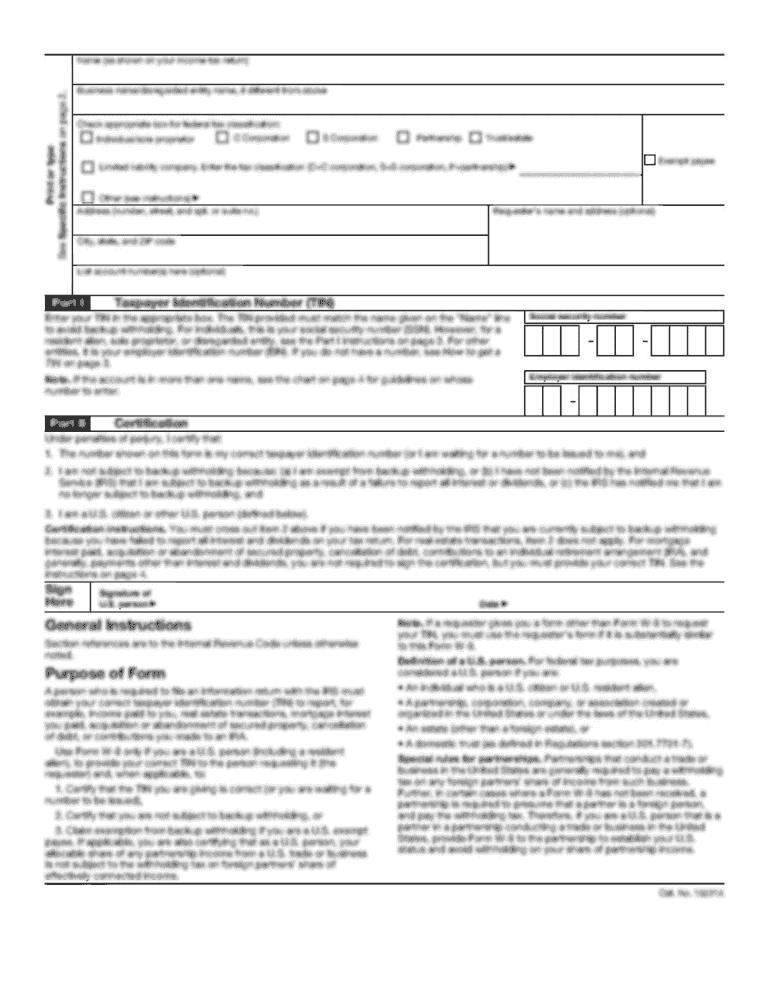

The schedule nrh form 1040me is a tax form used by certain U.S. taxpayers to report specific income and expenses. It is utilized in conjunction with the main IRS Form 1040 to provide detailed financial information regarding deductions and credits that may affect overall tax liability.

What is the purpose of this form?

The purpose of the schedule nrh form 1040me is to facilitate the accurate reporting of income and deductions that are not encompassed within the standard Form 1040. This form helps streamline tax calculations and ensures compliance with tax regulations, allowing taxpayers to claim eligible credits and deductions.

Who needs the form?

Taxpayers who have certain income types or deductions that require detailed reporting must file the schedule nrh form 1040me. This typically includes individuals with income from self-employment, rental properties, or other specific sources that necessitate further documentation beyond the main Form 1040.

When am I exempt from filling out this form?

You may be exempt from filling out the schedule nrh form 1040me if your income is below the filing threshold or if you do not have qualifying deductions or credits that require separate reporting. It is crucial to check IRS guidelines, as exceptions may vary based on individual circumstances.

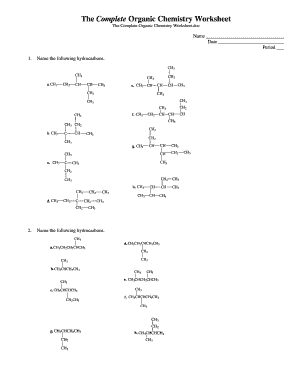

Components of the form

The schedule nrh form 1040me consists of several sections where taxpayers input detailed financial information. Key components include income sources, deductions, and credits that may influence the overall tax liability. Each section is designed to capture specific types of income and expense data necessary for accurate reporting.

What are the penalties for not issuing the form?

Failure to file the schedule nrh form 1040me when required can result in penalties imposed by the IRS. These penalties may include fines, interest on unpaid taxes, and potential audits. It is important to file accurately and on time to avoid these repercussions.

What information do you need when you file the form?

When filing the schedule nrh form 1040me, you need to have specific information ready, including:

01

Your Social Security number or taxpayer identification number.

02

Details of income from various sources.

03

Expense and deduction records.

Gathering this information in advance will streamline the process and help ensure accuracy throughout your filing.

Is the form accompanied by other forms?

The schedule nrh form 1040me may need to be accompanied by other forms, such as the standard Form 1040 or additional schedules for specific deductions and credits. Be mindful of any additional documentation that supports your entries on the schedule nrh form 1040me to ensure thorough reporting.

Where do I send the form?

Once completed, the schedule nrh form 1040me should be mailed to the designated IRS address associated with your state. Verify the mailing instructions on the IRS website to ensure your form is sent to the correct destination for processing. Keeping a copy of your submission can also aid in tracking and confirmation.

See what our users say