Get the free Section 1478: - uiltexas

Show details

Section 1478:

(a)(b)SEVENTH AND EIGHTH GRADE ATHLETIC PLANPURPOSES. The League is vitally interested in the welfare and development of every youngster. A properly administered

athletic program can

We are not affiliated with any brand or entity on this form

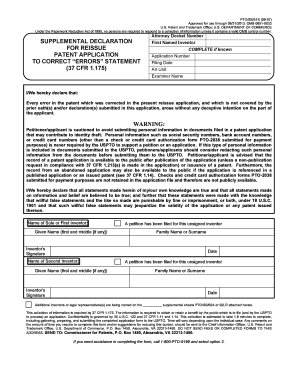

Get, Create, Make and Sign section 1478 - uiltexas

Edit your section 1478 - uiltexas form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section 1478 - uiltexas form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing section 1478 - uiltexas online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit section 1478 - uiltexas. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

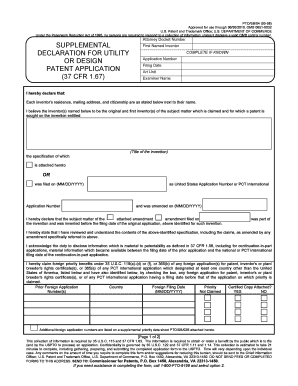

How to fill out section 1478 - uiltexas

Point by point, here is how you can fill out section 1478:

01

Start by carefully reading the instructions provided for section 1478. Make sure you understand what information is required and how it should be presented.

02

Begin by providing your personal details, such as your name, address, contact information, and any other relevant identifying information. This will help ensure that the section is properly attributed to you.

03

As you move forward, pay attention to any specific questions or prompts that guide you through section 1478. Answer each question thoroughly and accurately, providing any requested details or supporting documentation as necessary.

04

If you come across any terms or concepts that you're unfamiliar with, take the time to research and understand them. This will help you provide the most accurate and meaningful information in section 1478.

05

Double-check your responses for any errors or omissions before finalizing your submission of section 1478. It's essential to ensure that all information provided is correct and complete.

Who needs section 1478?

Section 1478 is typically required by individuals or organizations involved in specific processes or systems. It may be necessary for legal purposes, financial reporting, compliance with regulations, or other specific requirements.

01

Businesses: In some cases, businesses may be required to complete section 1478 as part of their financial reporting or compliance obligations. This section may involve disclosing various financial details, such as revenue, expenses, assets, or liabilities.

02

Government Agencies: Certain government agencies may request individuals or organizations to fill out section 1478 to provide specific information. This could include details related to taxes, subsidies, grants, or any other relevant data needed for regulatory or administrative purposes.

03

Individuals: Depending on the specific circumstances, individuals may need to fill out section 1478 for various reasons. For example, if they are applying for certain benefits or assistance programs, reporting income or financial information, or providing details about assets or liabilities.

It's important to note that the individuals or organizations requiring section 1478 will provide clear instructions on how to complete it and the exact purpose behind its requirement. Always follow the provided instructions and guidelines to ensure accurate and timely submission.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit section 1478 - uiltexas online?

With pdfFiller, the editing process is straightforward. Open your section 1478 - uiltexas in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the section 1478 - uiltexas in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your section 1478 - uiltexas and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit section 1478 - uiltexas straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing section 1478 - uiltexas right away.

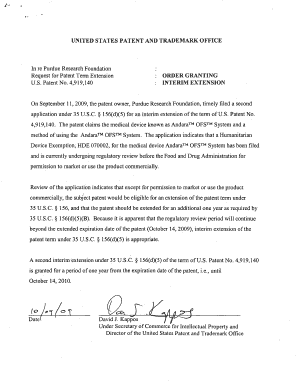

What is section 1478?

Section 1478 refers to a specific section of the tax code that requires certain taxpayers to report information related to foreign assets or financial accounts.

Who is required to file section 1478?

Taxpayers who meet the specified criteria for foreign assets or financial accounts are required to file section 1478.

How to fill out section 1478?

Taxpayers must provide detailed information about their foreign assets or financial accounts on the designated forms provided by the IRS.

What is the purpose of section 1478?

The purpose of section 1478 is to prevent tax evasion and ensure that all income from foreign sources is properly reported to the IRS.

What information must be reported on section 1478?

Taxpayers must report details such as the value of the foreign assets, the income generated from those assets, and any financial accounts held abroad.

Fill out your section 1478 - uiltexas online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section 1478 - Uiltexas is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.