Get the free Supervised Credit

Show details

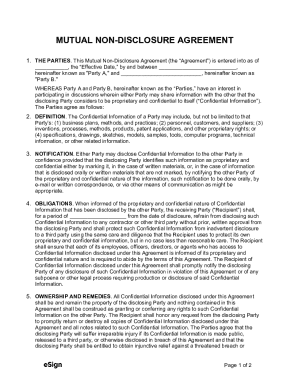

June 2017 2017 Acreage Reporting Dates Flooding? Supervised Credit Park County FSA Updates Park County FSA Office 1017 Hwy 14A Powell, WY 82435 Phone: 3077549411 Fax: 8554153438 County Executive Director:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supervised credit

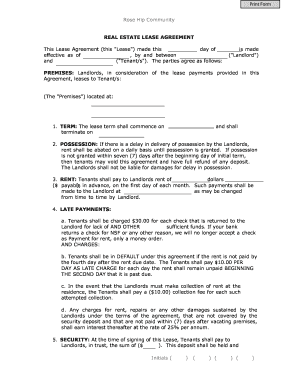

Edit your supervised credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supervised credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing supervised credit online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit supervised credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supervised credit

How to fill out supervised credit

01

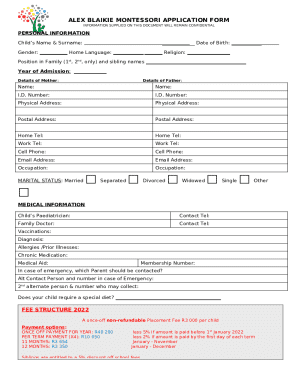

Step 1: Start by gathering all the necessary documents and information required to fill out the supervised credit application, such as personal identification, employment details, financial statements, and any relevant supporting documents.

02

Step 2: Carefully review the supervised credit application form and make sure you understand each section and the information requested.

03

Step 3: Begin by providing your personal information accurately, including your full name, date of birth, contact details, and residential address.

04

Step 4: Fill out the employment section with your current employment status, employer information, job title, and income details.

05

Step 5: Declare your financial information honestly and accurately, including any existing debts, loans, or financial obligations you may have.

06

Step 6: Attach any supporting documents required, such as proof of income, bank statements, identification documents, and any other relevant paperwork.

07

Step 7: Review the completed application thoroughly before submitting it, ensuring all information is accurate and complete.

08

Step 8: Submit the supervised credit application form as per the instructions provided, either electronically or by hand, depending on the submission method allowed.

09

Step 9: Wait for the credit institution to review and process your application. They may contact you for further information or clarification if needed.

10

Step 10: Once approved, carefully review any terms and conditions associated with the supervised credit agreement, and make sure you understand the repayment terms and obligations.

11

Step 11: Comply with the terms of the supervised credit agreement, making payments on time and fulfilling all obligations. Failure to comply may result in penalties or negative impact on your credit score.

Who needs supervised credit?

01

Individuals who have limited or no credit history and want to establish creditworthiness

02

Those who have a poor credit score and need to rebuild their credit

03

People who want to learn responsible borrowing habits and financial management skills under the guidance of a credit institution

04

Individuals who need financial assistance but may not qualify for unsecured credit options

05

Students or young adults who are new to the world of credit and want to start building a credit history

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send supervised credit to be eSigned by others?

When your supervised credit is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit supervised credit in Chrome?

supervised credit can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit supervised credit on an Android device?

You can make any changes to PDF files, such as supervised credit, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is supervised credit?

Supervised credit is a form of credit where a financial institution closely monitors and oversees the borrower's repayment behavior.

Who is required to file supervised credit?

Financial institutions are required to file supervised credit for borrowers who are under their monitoring and oversight.

How to fill out supervised credit?

Supervised credit can be filled out by providing detailed information about the borrower's repayment behavior and financial history.

What is the purpose of supervised credit?

The purpose of supervised credit is to ensure that borrowers are able to repay their debts on time and in full.

What information must be reported on supervised credit?

The information reported on supervised credit may include the borrower's repayment history, credit utilization, and any late payments.

Fill out your supervised credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supervised Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.