Get the free Freestyle Head Tax Accounting Sheet - ussa

Show details

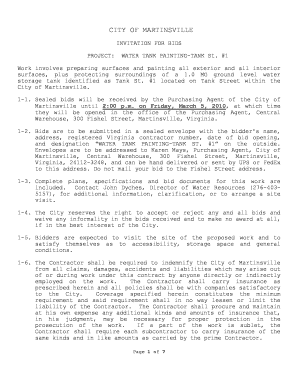

Freestyle Head Tax Accounting Sheet Division Event Date Event Name Event Site Was this event changed from its original date on the freestyle schedule agreement? YES NO Original date of event # Competitors

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign style head tax accounting

Edit your style head tax accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your style head tax accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing style head tax accounting online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit style head tax accounting. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out style head tax accounting

01

To fill out style head tax accounting, you will need to gather all relevant financial information related to your business. This includes income statements, balance sheets, expense reports, and any other documents that provide a comprehensive overview of your company's financial activities.

02

Begin by carefully reviewing all the financial records to ensure their accuracy. This step is crucial as any errors or inconsistencies could lead to inaccurate tax calculations and potential penalties.

03

Next, identify the applicable tax laws and regulations that govern style head tax accounting. It is important to stay updated with any changes in tax legislation to ensure compliance and maximize tax deductions or credits.

04

Follow the specific guidelines provided by the tax authority or consult with a professional accountant who specializes in style head tax accounting. They can provide valuable insights and assist in navigating through complex tax regulations.

05

Enter the relevant financial information into the designated sections of the tax forms or accounting software. Pay attention to the specific categories and sections that pertain to style head tax accounting to ensure accurate reporting.

06

Double-check all the entered information to ensure accuracy and completeness. Reconcile any discrepancies or inconsistencies before submitting the tax forms or records.

07

Who needs style head tax accounting? Style head tax accounting is primarily necessary for businesses engaged in the fashion and style industry. This includes clothing manufacturers, retailers, fashion designers, stylists, modeling agencies, and any other businesses related to the style and fashion sector.

08

Keeping accurate and up-to-date style head tax accounting records is crucial for businesses in this industry. It allows them to track and manage their financial activities efficiently, comply with tax regulations, and make informed business decisions.

09

Additionally, style head tax accounting provides businesses with valuable insights into their profit margins, inventory management, expenses, and overall financial health. This information can be utilized to identify areas for improvement, optimize operations, and facilitate strategic planning.

10

Overall, style head tax accounting is essential for businesses in the fashion and style industry to maintain financial transparency, comply with tax laws, and make well-informed business decisions that contribute to their long-term success.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit style head tax accounting from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your style head tax accounting into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send style head tax accounting for eSignature?

style head tax accounting is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I fill out style head tax accounting on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your style head tax accounting, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is style head tax accounting?

Style head tax accounting is a method of accounting where tax is calculated based on the number of employees or headcount in a business.

Who is required to file style head tax accounting?

Businesses with employees are required to file style head tax accounting.

How to fill out style head tax accounting?

Style head tax accounting can be filled out by entering the total number of employees and calculating the tax based on that number.

What is the purpose of style head tax accounting?

The purpose of style head tax accounting is to accurately calculate the tax owed by a business based on the number of employees.

What information must be reported on style head tax accounting?

The information that must be reported on style head tax accounting includes the total number of employees and the calculated tax amount.

Fill out your style head tax accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Style Head Tax Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.