Get the free SME LOAN APPLICATION FORM - Philippine Bank of ...

Show details

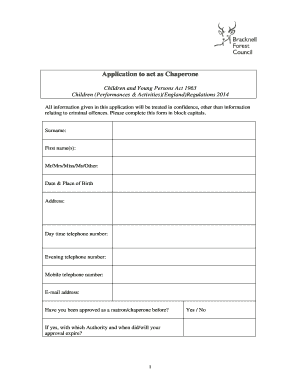

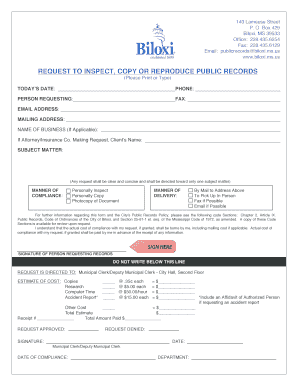

SME LOAN APPLICATION FORM Kind of SME Loan: I. CLIENT INFORMATION Name of Borrower/Company: Year started the Business: Control Code Number: Age of Business Owner: Date: Tax Identification Number:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sme loan application form

Edit your sme loan application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sme loan application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sme loan application form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sme loan application form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sme loan application form

How to fill out an SME loan application form:

01

Gather all necessary documents: Before starting to fill out the SME loan application form, make sure you have all the required documents ready. This may include financial statements, business plans, identification proof, bank statements, and any other relevant documents specified by the lender.

02

Provide accurate personal and business information: The application form will require you to provide personal and business details such as name, address, contact information, industry type, date of establishment, and legal structure of your business. Make sure to double-check and provide accurate information to avoid any discrepancies.

03

Fill in financial information: Lenders need to evaluate the financial health and viability of your business before granting a loan. You will be required to provide financial information such as annual revenue, expenses, profit/loss statements, and any outstanding debts. Be prepared with accurate and up-to-date financial figures.

04

State the loan amount and purpose: Clearly state the loan amount you are requesting and outline the purpose of the loan. Whether it's for expansion, working capital, equipment purchase, or any other specific need, provide a detailed explanation to help the lender understand your requirements.

05

Provide collateral and personal guarantee details: If the lender requires collateral or a personal guarantee to secure the loan, make sure to provide the necessary details. This may include property documents, asset information, or personal guarantee agreements. Consult with legal or financial professionals if needed.

06

Fill out any additional sections or disclosure forms: Depending on the lender and loan type, there may be additional sections or disclosure forms to fill out. Carefully read and complete these sections as required.

Who needs an SME loan application form?

01

Small and Medium-sized Enterprises (SMEs): Any SME looking to secure financing for their business may need to fill out an SME loan application form. This could include startups, growing firms, or established businesses seeking capital for various purposes such as expansion, equipment purchase, working capital, or debt consolidation.

02

Entrepreneurs or business owners: Individuals who own and operate their own businesses, regardless of the size, may need to fill out an SME loan application form to access funding. This includes sole proprietors, partners in a partnership, and directors of limited companies.

03

Businesses facing financial challenges: SME loan application forms may be necessary for businesses that are facing financial difficulties or need additional funds to overcome temporary setbacks. This could involve businesses that have encountered cash flow issues, unexpected expenses, or other financial challenges that require external support.

Remember, it's important to carefully review and understand the specific requirements of each lender before filling out an SME loan application form, as they may vary to some extent. Seek professional advice if needed to ensure accuracy and increase the chances of loan approval.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sme loan application form?

SME loan application form is a document used to apply for a loan specifically designed for small and medium enterprises.

Who is required to file sme loan application form?

Any small or medium enterprise looking to secure a loan is required to file the SME loan application form.

How to fill out sme loan application form?

To fill out the SME loan application form, you must provide information about your business, financials, loan purpose, and contact details.

What is the purpose of sme loan application form?

The purpose of SME loan application form is to assess the creditworthiness and suitability of small and medium enterprises for loan approval.

What information must be reported on sme loan application form?

Information such as business details, financial statements, loan amount, loan purpose, and contact information must be reported on the SME loan application form.

How do I edit sme loan application form online?

With pdfFiller, the editing process is straightforward. Open your sme loan application form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the sme loan application form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your sme loan application form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I fill out sme loan application form on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your sme loan application form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your sme loan application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sme Loan Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.