Get the free Bare Trust Deed

Show details

39 Stirling Highway Ned lands WA 6009 Telephone: 08 6389 0100 Mobile: 0477796959 legal consolidated. Combat Trust DeedLegal Consolidated Reference: BKD:5042:9 Your Reference: MC:123 19882016Legal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bare trust deed

Edit your bare trust deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bare trust deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bare trust deed online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bare trust deed. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

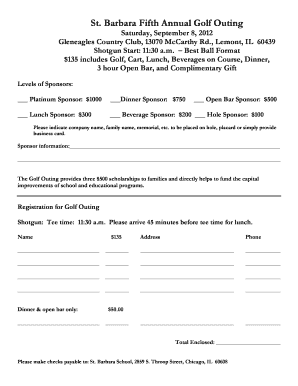

How to fill out bare trust deed

How to fill out bare trust deed

01

To fill out a bare trust deed, follow these steps:

02

Start by documenting the details of the settlor, who is creating the bare trust. Include their name, address, and any other necessary identification information.

03

Next, include the details of the trustee, who will hold the assets in trust. Include their name, address, and any other necessary identification information.

04

Specify the beneficiaries of the trust. This could be individuals or organizations who will ultimately benefit from the trust assets.

05

Describe the assets that will be held in trust. Include detailed information about each asset, such as its type, quantity, value, and any relevant identifying details.

06

Clearly outline the terms and conditions of the trust. This may include information about how the assets will be managed, distributed, or transferred in the future.

07

Add any additional clauses or provisions that are necessary or desired for the specific trust arrangement.

08

Review the completed bare trust deed carefully to ensure accuracy and clarity. Make any necessary revisions or amendments.

09

Once satisfied with the document, have all relevant parties sign and date the bare trust deed to make it legally binding.

10

Keep copies of the fully executed trust deed for future reference and record-keeping purposes.

Who needs bare trust deed?

01

Bare trust deeds are primarily used in legal and financial contexts. Some common examples of individuals or entities who may need a bare trust deed include:

02

- High-net-worth individuals who want to protect their assets and ensure a smooth transfer of wealth to beneficiaries.

03

- Parents or guardians who want to hold assets in trust for their children until they come of age.

04

- Financial institutions or investment companies who want to manage and distribute assets on behalf of clients.

05

- Executors or administrators of an estate who need to safeguard and distribute assets according to the deceased person's wishes.

06

- Business partners who want to establish a trust to manage shared assets or investments.

07

- Property developers who want to hold land or property in trust until certain conditions are met.

08

- Charitable organizations who receive assets or donations and need to handle them responsibly and transparently.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my bare trust deed directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your bare trust deed and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make changes in bare trust deed?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your bare trust deed and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I fill out bare trust deed on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your bare trust deed, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is bare trust deed?

A bare trust deed is a legal document that establishes a trust where the beneficiary has an absolute right to the trust property and the trustee has no discretion in how the assets are managed or distributed.

Who is required to file bare trust deed?

The trustee of the bare trust is required to file the bare trust deed.

How to fill out bare trust deed?

To fill out a bare trust deed, the trustee must include details of the trust property, the beneficiaries, and any specific instructions for the distribution of assets.

What is the purpose of bare trust deed?

The purpose of a bare trust deed is to hold assets on behalf of a beneficiary until they are ready to take control of the property.

What information must be reported on bare trust deed?

The bare trust deed must include details of the trust property, names of the beneficiaries, and any relevant instructions for the trustee.

Fill out your bare trust deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bare Trust Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.