TX Comptroller 01-117 2018 free printable template

Show details

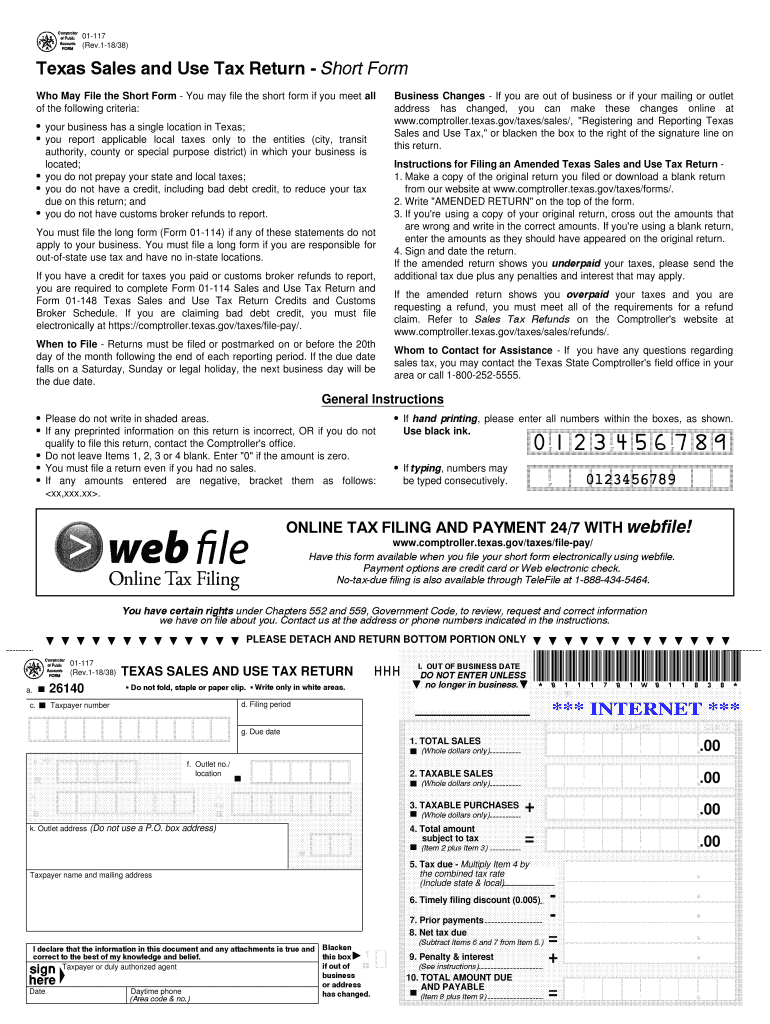

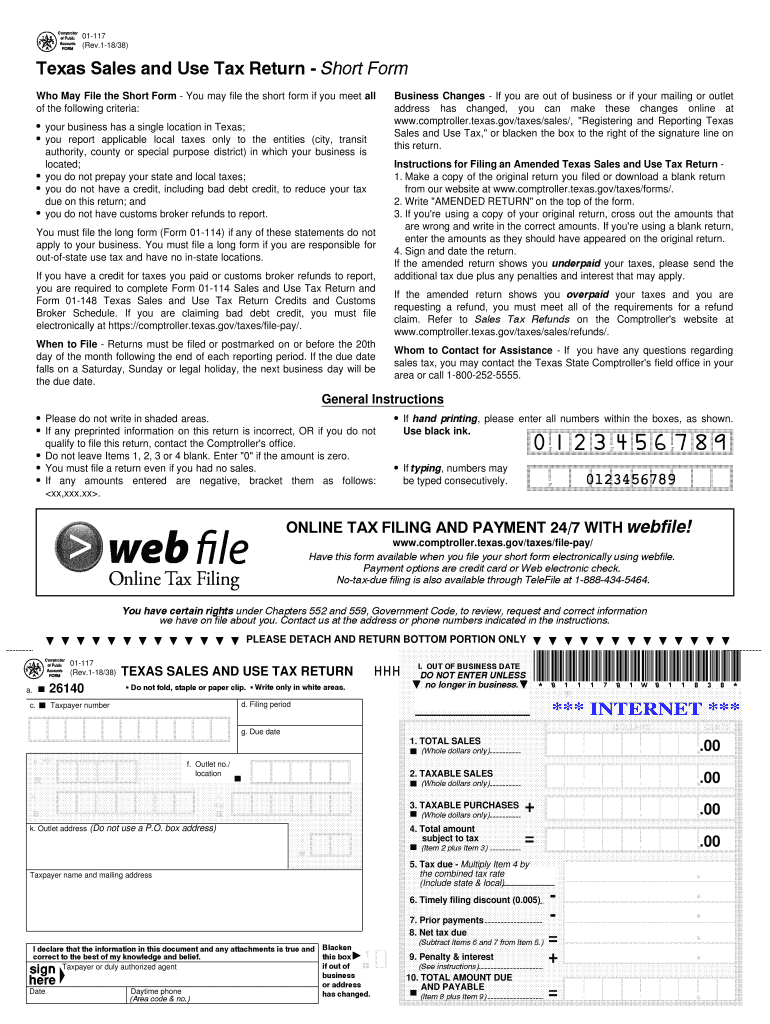

TOTAL AMOUNT DUE AND PAYABLE Form 01-117 Back Rev.1-18/38 continued Item l. If the location indicated in Item f is no longer in business enter the out-of-business date. AB CD PRINT FORM 01-117 Rev.1-18/38 Texas Sales and Use Tax Return - CLEAR FORM Short Form Who May File the Short Form - You may file the short form if you meet all of the following criteria I your business has a single location in Texas I you report applicable local taxes only to the entities city transit authority county or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 01-117

Edit your TX Comptroller 01-117 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 01-117 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Comptroller 01-117 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX Comptroller 01-117. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 01-117 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 01-117

How to fill out TX Comptroller 01-117

01

Obtain the TX Comptroller 01-117 form from the Texas Comptroller's website or your local tax office.

02

Fill in your legal name and business entity name if applicable at the top of the form.

03

Provide your Texas Taxpayer Identification Number (TIN) in the designated field.

04

Indicate the type of tax and the period for which you are filing.

05

Fill out the gross receipts or sales amounts in the appropriate sections, broken down by category if required.

06

Calculate any deductions and exemptions that apply to your situation.

07

Total your taxable amount, and ensure all calculations are accurate.

08

Sign and date the form to certify that the information provided is correct.

09

Submit the completed form to the Texas Comptroller's office by the deadline.

Who needs TX Comptroller 01-117?

01

Businesses operating in Texas that are required to report sales and use tax.

02

Individuals or entities that have collected sales tax and need to remit it to the state.

03

Organizations looking to claim exemptions on certain purchases or transactions.

Fill

form

: Try Risk Free

People Also Ask about

What is Texas special district sales tax?

The special purpose district sales and use tax will be increased to 1 1/2 percent as permitted under Chapter 775 of the Texas Health and Safety Code, effective October 1, 2022 in the special purpose district listed below.

What is TX ST sales tax?

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.

Is Texas sales tax based on destination or origin?

Marketplace providers that are engaged in business in Texas must collect and remit tax on all third-party sales. The tax is based on the shipping destination.

What is DFW sales tax?

What is the sales tax rate in Dallas, Texas? The minimum combined 2023 sales tax rate for Dallas, Texas is 8.25%. This is the total of state, county and city sales tax rates.

How to fill out a Texas sales and use tax exemption certification?

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

How to fill Texas resale certificate?

Common details listed on the Texas resale certificate include the name (company or individual) and address of the buyer, a descriptive detail of the goods being purchased, a reference that this merchandise is intended to be resold and the accurate Texas sales tax number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the TX Comptroller 01-117 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your TX Comptroller 01-117 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit TX Comptroller 01-117 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing TX Comptroller 01-117 right away.

How do I fill out the TX Comptroller 01-117 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign TX Comptroller 01-117. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is TX Comptroller 01-117?

TX Comptroller 01-117 is a Texas state form used for reporting certain business tax information, particularly for franchise tax purposes.

Who is required to file TX Comptroller 01-117?

Entities that are subject to Texas franchise tax, including most corporations and limited liability companies (LLCs) doing business in Texas, must file TX Comptroller 01-117.

How to fill out TX Comptroller 01-117?

To fill out TX Comptroller 01-117, provide accurate business identification details, revenue information, exemptions if applicable, and any other required financial data as outlined in the form instructions.

What is the purpose of TX Comptroller 01-117?

The purpose of TX Comptroller 01-117 is to report gross receipts and determine the franchise tax liability of a business in Texas.

What information must be reported on TX Comptroller 01-117?

Information required on TX Comptroller 01-117 includes business name, federal employer identification number (EIN), revenue figures, deductions, credits, and a summary of the business's financial activities in the reporting period.

Fill out your TX Comptroller 01-117 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 01-117 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.