Get the free Form IL-4644, Gains from Sales of Employer's Securities Received from a Qualified E...

Show details

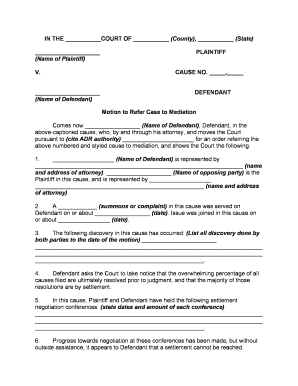

Step 3: Calculate net unrealized appreciation. Column E. Column F. Column G. Column H. Market value of stock. Federal tax basis of stock. Column E minus ...

We are not affiliated with any brand or entity on this form

Instructions and Help about form il-4644 gains from

How to edit form il-4644 gains from

How to fill out form il-4644 gains from

Instructions and Help about form il-4644 gains from

How to edit form il-4644 gains from

To edit form il-4644 gains from, you need to access a digital platform that allows PDF modifications. Tools like pdfFiller are ideal for this, as they support document editing directly in your browser. Simply upload the form, make the necessary changes, and save it once complete. Ensure you verify each entry to maintain compliance with IRS requirements.

How to fill out form il-4644 gains from

Filling out form il-4644 gains from involves providing accurate information regarding gains and sales. Start by entering your personal details, such as your name and taxpayer identification number. Next, report relevant transactions that resulted in capital gains. It's essential to reference detailed documentation for each transaction to support your entries. Once completed, review the form thoroughly to ensure all information is correct before submission.

Latest updates to form il-4644 gains from

Latest updates to form il-4644 gains from

Recent updates to form il-4644 gains from include changes in reporting thresholds for capital gains and updates to the instructions for ease of understanding. Taxpayers should review these updates carefully each tax season to ensure compliance. The IRS may also provide additional guidance on any significant shifts in tax legislation that affect this form.

All You Need to Know About form il-4644 gains from

What is form il-4644 gains from?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About form il-4644 gains from

What is form il-4644 gains from?

Form il-4644 gains from is used to report capital gains from the sale of assets such as real estate or stocks. It is important for taxpayers to accurately report their gains to ensure proper tax calculation and avoid penalties. The form facilitates the IRS's requirement for transparent reporting of asset sales.

What is the purpose of this form?

The purpose of form il-4644 gains from is to provide a detailed account of any profits made through the sale of investments or property. This includes determining the taxpayer's capital gains tax liability. Accurate completion of this form is crucial for both compliance and tax calculation purposes.

Who needs the form?

Taxpayers who have realized capital gains from selling assets must complete form il-4644 gains from. This generally includes individuals and businesses that have sold stocks, bonds, real estate, and other capital assets. Those who did not have any capital gains in the tax year may not need to file this form.

When am I exempt from filling out this form?

You may be exempt from filling out form il-4644 gains from if your capital gains fall below the threshold set by the IRS for the tax year, or if you're eligible for a specific exclusion, such as the sale of a primary residence under certain conditions. Always check current IRS guidelines to confirm your eligibility for exemptions.

Components of the form

The key components of form il-4644 gains from include personal information, details about the assets sold, the sale price, the basis of the assets, and the resulting gain or loss. Each section must be filled out accurately to ensure the IRS can effectively process your tax return and assess your liability.

What are the penalties for not issuing the form?

Failure to issue form il-4644 gains from when required can result in penalties from the IRS. These penalties may include fines and interest on any unpaid taxes resulting from underreporting of capital gains. Timely and accurate filing is crucial to avoid such penalties.

What information do you need when you file the form?

When filing form il-4644 gains from, you will need your taxpayer identification number, details of the asset sold, the purchase price, the sale price, and any pertinent transaction documents that support your reported figures. Ensure all required information is gathered before starting the filing process to prevent errors.

Is the form accompanied by other forms?

Form il-4644 gains from is typically filed along with other tax forms such as form 1040, where your overall income is reported. If you're reporting specific types of gains or losses, additional schedules may be necessary, like Schedule D for capital gains and losses. Always check the latest IRS requirements for the specific tax year.

Where do I send the form?

The destination for form il-4644 gains from varies based on your location and whether you are filing electronically or by mail. If filing by mail, refer to the instructions included with the form for the appropriate address. If submitting electronically, follow the steps outlined in your chosen tax preparation software.

See what our users say