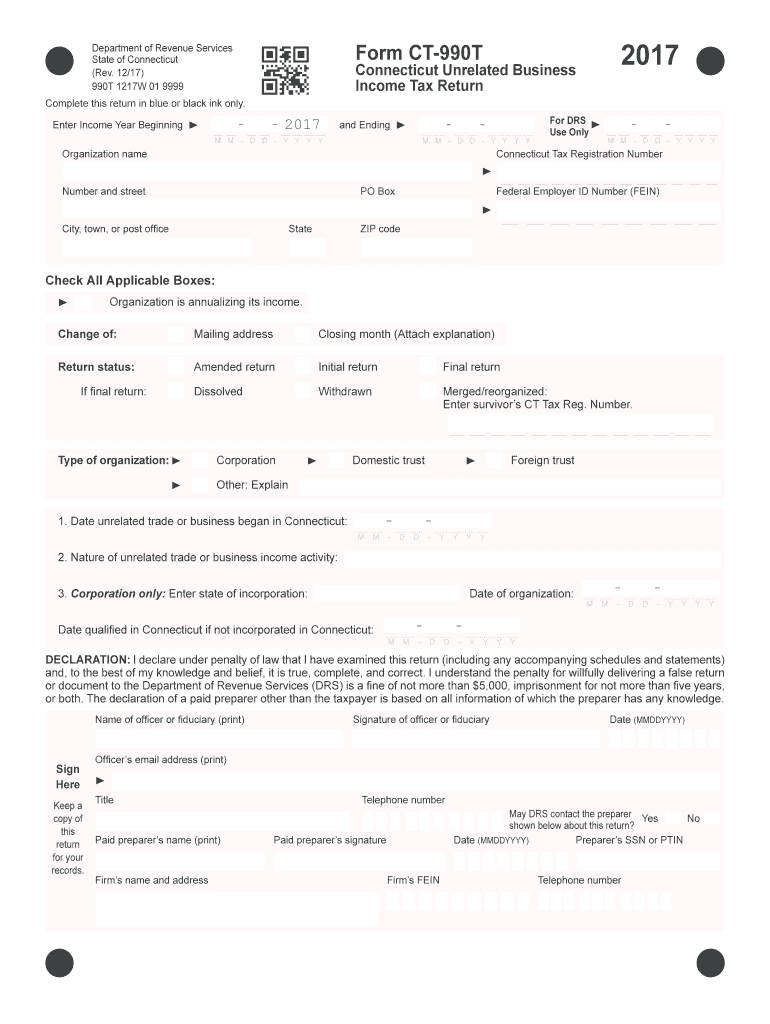

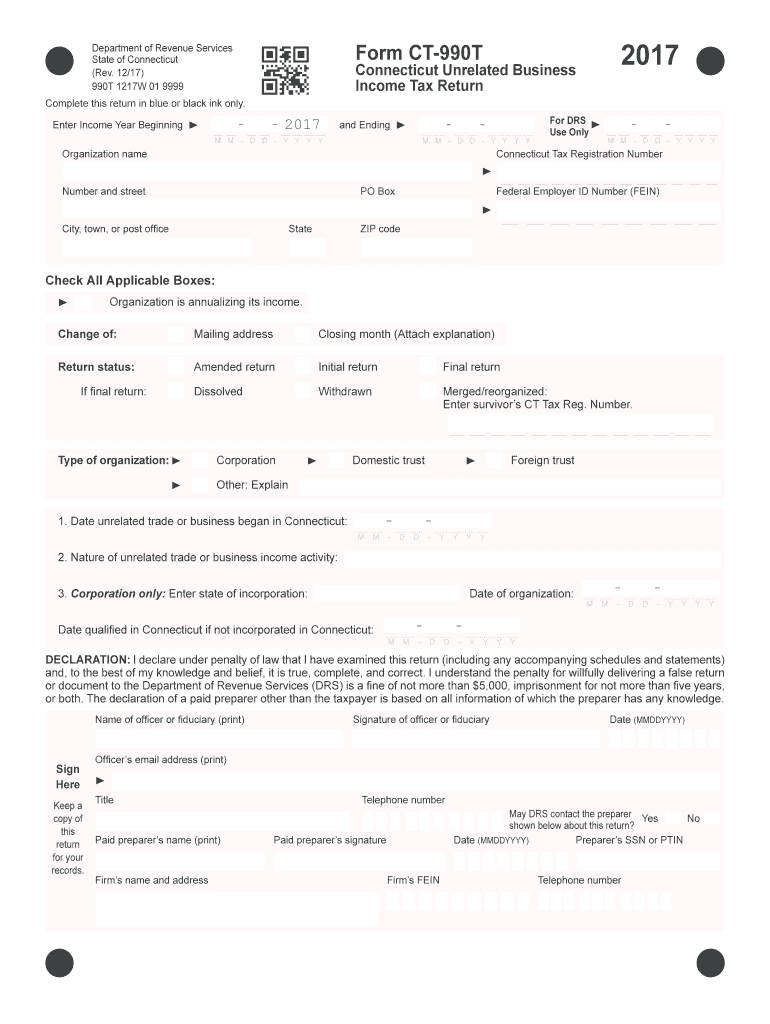

CT DRS CT-990T 2017 free printable template

Get, Create, Make and Sign form ct-990t - ctgov

How to edit form ct-990t - ctgov online

Uncompromising security for your PDF editing and eSignature needs

CT DRS CT-990T Form Versions

How to fill out form ct-990t - ctgov

How to fill out CT DRS CT-990T

Who needs CT DRS CT-990T?

Instructions and Help about form ct-990t - ctgov

How does a non-profit maintain tax-exempt status annual financial reports must be submitted to the IRS and the California Franchise Tax Board the Board of Directors should review the Corporations annual IRS and state filings before often submitted the nonprofit will retain an independent accountant to conduct a review of the organization's financial statements and to issue a report to the Board of Directors which is a less expensive alternative to obtaining a complete audit the nonprofit should hire a professional accountant to help implement a fiscal management system addressing issues such as dual signature requirement on bank accounts regular review of monthly statements by the board and an annual audit the local chapter of the American Institute of Certified Public Accountants or this California Board of Accountancy x' clearinghouse for volunteer accounting services may be contacted for information on accountants who may provide free services or reduced cost services to nonprofits pursuant to California Government Code section one two five eight six referred to as the nonprofit integrity Act of 2004 a charitable organization with gross revenue of two million dollars or more must obtain independent audits and appoint in audit committee the audited financial statements must be made available for inspection at any time during the existence of the nonprofit organization the IRS or the California Franchise Tax Board may audit the organization to determine tax liability penalties or revocation of tax-exempt status informational returns IRS Form 990 and California FT Form 199 or 199 n public charities must submit annual filings to the IRS including IRS Form 990 or 990-ez until the return of organization exempt from income tax and an accompanying schedule a within four and a half months following the close of the organization's tax year this is the organization's informational return stating its finances and activities certain organizations are exempt from this violent requirement such as churches and organizations with annual gross receipts of $50,000 or less except for private foundations rather such organizations must file form 990-n which is an annual electronic notice form private foundations must file the more rigorous form 990-pf regardless of their gross receipts the California equivalent for the annual exempt organization return is FT Form 199 and 199 n unrelated business income tax returns IRS Form 990 and California FT Form 109 an organization that has annual gross incomes of $1000 or more from unrelated trade or business activities must file IRS Form 990 exempt organization business income tax return in addition to that annual informational return the unrelated business income will be taxed at the same rate as the standard corporation federal income tax moreover if the organization has a significant amount of unrelated business income the IRS may determine that the organization is spending a substantial amount of time on non-exempt...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form ct-990t - ctgov?

How do I fill out form ct-990t - ctgov using my mobile device?

How do I edit form ct-990t - ctgov on an Android device?

What is CT DRS CT-990T?

Who is required to file CT DRS CT-990T?

How to fill out CT DRS CT-990T?

What is the purpose of CT DRS CT-990T?

What information must be reported on CT DRS CT-990T?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.