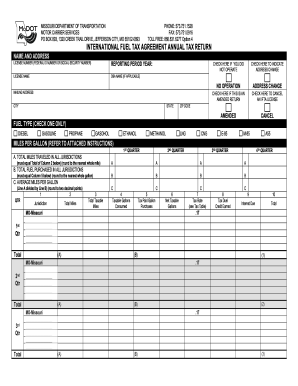

MO International Fuel Tax Agreement Quarterly Tax Return 2017-2025 free printable template

Show details

Email: contacts×moot.mo.gov Missouri Department of Transportation

Motor Carrier Services

PO Box 270, 830 Moot Drive, Jefferson City, MO 651020270Phone:866.831.6277Fax:573.751.0916INTERNATIONAL FUEL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO International Fuel Tax Agreement Quarterly

Edit your MO International Fuel Tax Agreement Quarterly form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO International Fuel Tax Agreement Quarterly form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO International Fuel Tax Agreement Quarterly online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MO International Fuel Tax Agreement Quarterly. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO International Fuel Tax Agreement Quarterly Tax Return Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO International Fuel Tax Agreement Quarterly

How to fill out MO International Fuel Tax Agreement Quarterly Tax

01

Gather relevant information: Obtain your vehicle mileage records, fuel purchase receipts, and jurisdictions traveled.

02

Identify the reporting period: Determine the quarter for which you are filing the tax agreement.

03

Fill in your business information: Include your name, address, and telephone number on the form.

04

Report total miles: Record the total miles traveled in each jurisdiction during the reporting period.

05

Report fuel purchased: Include the total gallons of fuel purchased in each jurisdiction.

06

Calculate tax owed: Use the applicable tax rates to calculate the fuel tax owed for each jurisdiction.

07

Prepare any necessary documentation: Attach any required fuel receipts and mileage logs.

08

Submit your form: Ensure you file the form by the due date, either by mail or electronically.

Who needs MO International Fuel Tax Agreement Quarterly Tax?

01

Trucking companies that operate across multiple states or jurisdictions.

02

Independent truck drivers who travel through different states while transporting goods.

03

Businesses that use commercial vehicles and need to report fuel taxes for interstate travel.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MO International Fuel Tax Agreement Quarterly in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your MO International Fuel Tax Agreement Quarterly and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I get MO International Fuel Tax Agreement Quarterly?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific MO International Fuel Tax Agreement Quarterly and other forms. Find the template you need and change it using powerful tools.

How do I complete MO International Fuel Tax Agreement Quarterly on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your MO International Fuel Tax Agreement Quarterly from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is MO International Fuel Tax Agreement Quarterly Tax?

The MO International Fuel Tax Agreement Quarterly Tax is a tax levied on motor carriers operating in multiple jurisdictions. It ensures that fuel use taxes are collected fairly across states and provinces involved in the IFTA program.

Who is required to file MO International Fuel Tax Agreement Quarterly Tax?

Motor carriers who operate qualified vehicles that travel in multiple jurisdictions and use fuel are required to file the MO International Fuel Tax Agreement Quarterly Tax.

How to fill out MO International Fuel Tax Agreement Quarterly Tax?

To fill out the MO International Fuel Tax Agreement Quarterly Tax, filers should gather their fuel purchase and mileage records, complete the required forms provided by the state, and report the relevant fuel consumption and miles traveled in each jurisdiction during the quarter.

What is the purpose of MO International Fuel Tax Agreement Quarterly Tax?

The purpose of the MO International Fuel Tax Agreement Quarterly Tax is to streamline the collection of fuel taxes from motor carriers operating in multiple jurisdictions, ensuring that they pay their fair share of taxes based on fuel use.

What information must be reported on MO International Fuel Tax Agreement Quarterly Tax?

The information that must be reported includes total miles traveled in each jurisdiction, total gallons of fuel purchased for each jurisdiction, and any tax paid to other jurisdictions.

Fill out your MO International Fuel Tax Agreement Quarterly online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO International Fuel Tax Agreement Quarterly is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.