Get the free LONG TERM CARE INSURANCE - BUSINESS PROFILE

Show details

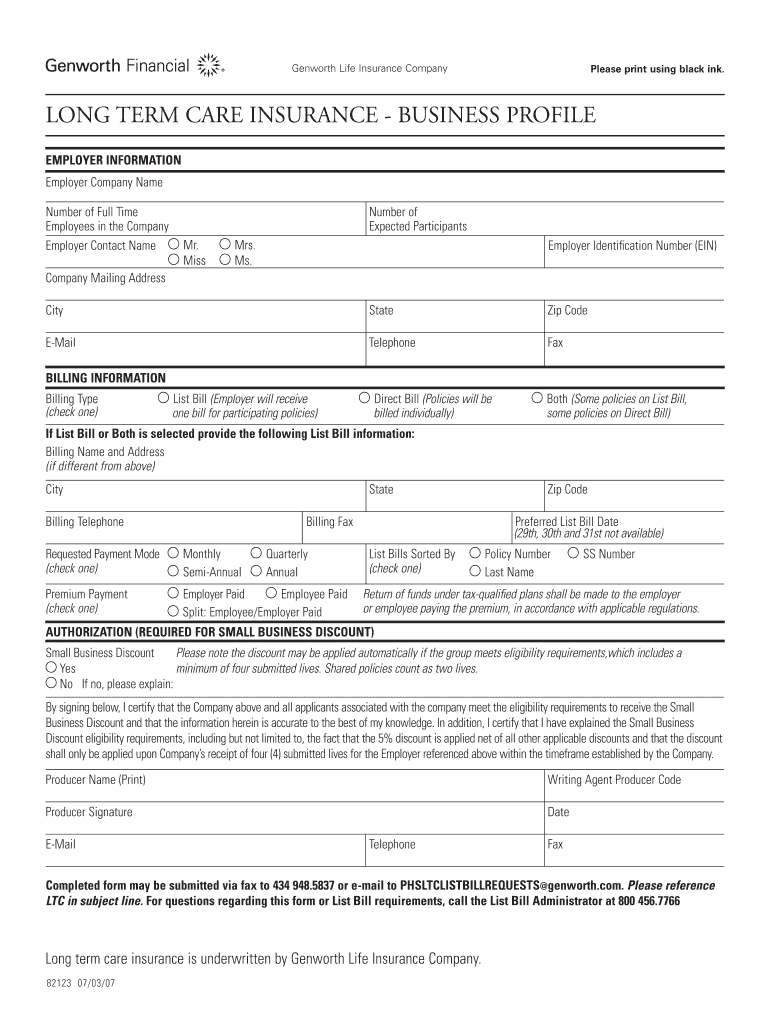

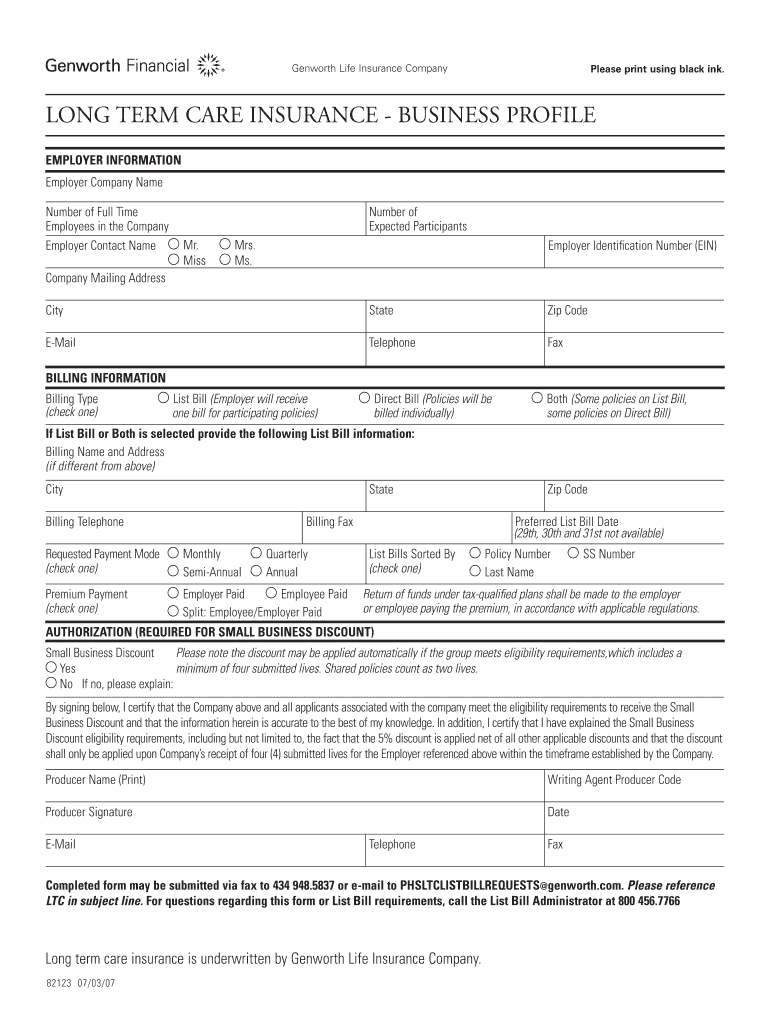

Gen worth Life Insurance Company Please print using black ink. LONG TERM CARE INSURANCE BUSINESS PROFILE EMPLOYER INFORMATION Employer Company Name Number of Full Time Employees in the Company Employer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long term care insurance

Edit your long term care insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long term care insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long term care insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit long term care insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long term care insurance

How to fill out long term care insurance:

01

Start by gathering all the necessary documents and information. This may include your personal identification, health history, current medications, and financial information.

02

Research and compare different long term care insurance providers and policies. Consider factors such as coverage options, premiums, deductibles, and any additional benefits or riders that may be offered.

03

Contact the chosen insurance provider and request an application form. Most insurance companies provide application forms online, which can be downloaded and printed.

04

Carefully read through the application form and instructions. Make sure you understand what information is required and how to fill it out accurately. You may also want to consult with an insurance agent or seek professional advice if you have any doubts.

05

Begin filling out the application form step by step. Provide accurate and truthful information about yourself, including your age, health status, and any pre-existing conditions. Some applications may require you to disclose your medical history or undergo a medical examination.

06

Pay attention to the sections related to coverage options, benefits, and deductibles. Select the appropriate choices based on your preferences and needs. Review the policy details to ensure it aligns with your expectations.

07

If you have any questions or need assistance while filling out the application form, don't hesitate to contact the insurance provider's customer service or reach out to an insurance agent.

Who needs long term care insurance:

01

Aging individuals: As individuals age, the risk of needing long term care increases. Long term care insurance can provide financial protection for those who may require nursing home care, in-home care, or other long term care services as they age.

02

Individuals with chronic health conditions: Certain chronic health conditions, such as Parkinson's disease, Alzheimer's disease, or multiple sclerosis, may lead to the need for long term care. Long term care insurance can help cover the costs associated with these conditions.

03

Individuals without a strong support system: Long term care insurance can be beneficial for individuals who do not have family members or friends available to provide care and support in the event of a long term illness or disability.

04

Individuals concerned about preserving their assets: Long term care expenses can quickly deplete savings and assets. Long term care insurance can help protect assets, allowing individuals to pass on their wealth to their loved ones.

05

Individuals who want more control over their care options: Long term care insurance can provide individuals with the ability to choose the type of care they receive and where they receive it, whether it's at home, in an assisted living facility, or a nursing home.

It's essential to assess individual circumstances, financial capabilities, and health status to determine if long term care insurance is the right choice for someone. Consulting with a financial advisor or insurance professional can help in understanding specific needs and options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my long term care insurance in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your long term care insurance along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an electronic signature for signing my long term care insurance in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your long term care insurance and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit long term care insurance on an Android device?

You can edit, sign, and distribute long term care insurance on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is long term care insurance?

Long term care insurance is a type of insurance that helps cover the cost of long-term care services, such as assistance with activities of daily living.

Who is required to file long term care insurance?

Individuals who want to protect themselves against the high cost of long-term care services may choose to purchase long term care insurance.

How to fill out long term care insurance?

To fill out long term care insurance, you will need to provide personal information, medical history, and choose a policy that meets your needs.

What is the purpose of long term care insurance?

The purpose of long term care insurance is to financially protect individuals who may require assistance with activities of daily living in the future.

What information must be reported on long term care insurance?

Information such as personal details, medical history, and coverage options must be reported on long term care insurance.

Fill out your long term care insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long Term Care Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.