ST-120.1 2012-2025 free printable template

Show details

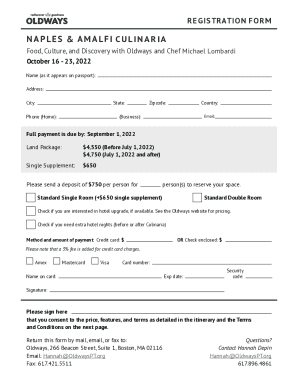

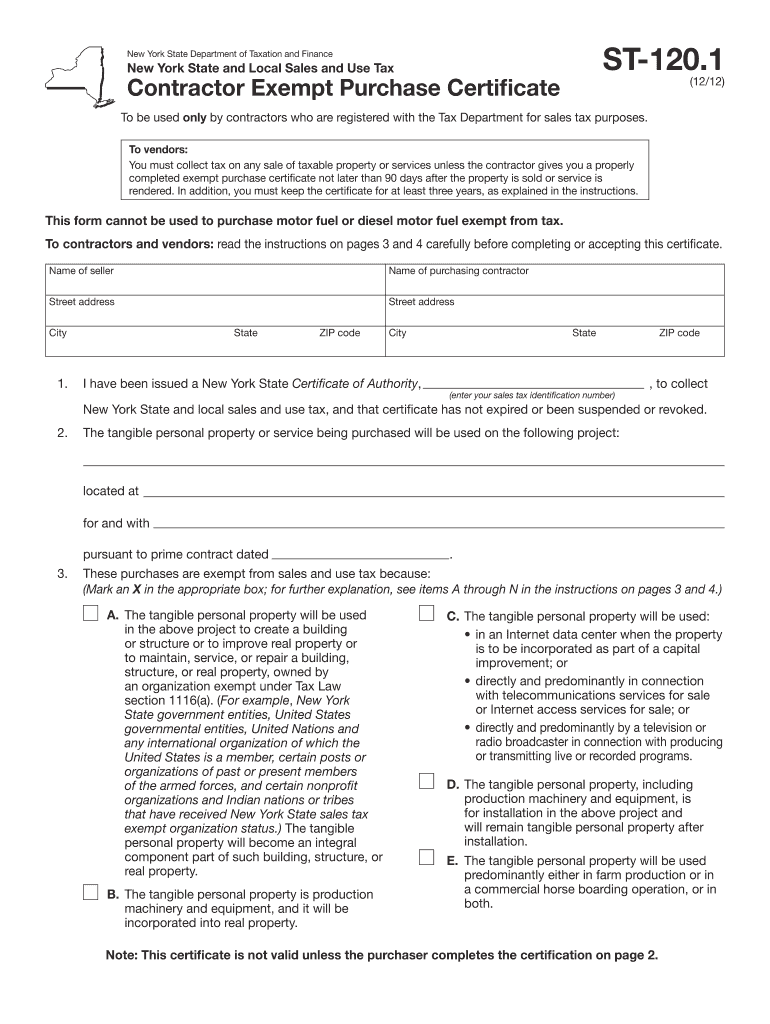

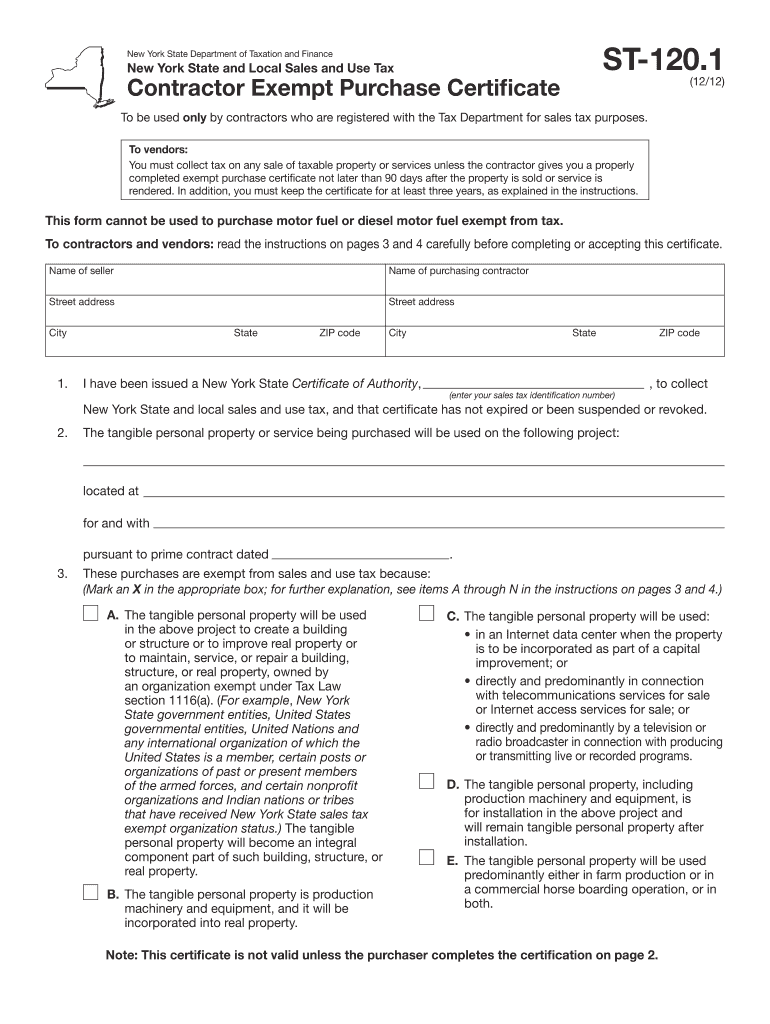

ST-120.1 New York State Department of Taxation and Finance New York State and Local Sales and Use Tax Contractor Exempt Purchase Cert?came (12/12) To be used only by contractors who are registered

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign religious exemption form immunization 157 blank

Edit your 43618192 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your religious exemption form nc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ST-1201 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ST-1201. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ST-1201

How to fill out ST-120.1

01

Start by obtaining the ST-120.1 form from the official website or your local tax office.

02

Fill in your name and address at the top of the form.

03

Provide your tax identification number (TIN) or Social Security number (SSN).

04

Indicate the type of exemption you are claiming by checking the appropriate box.

05

Fill in details regarding the items or services for which you are claiming the exemption.

06

Include the name and address of the seller from whom you are purchasing the goods or services.

07

Specify the date of purchase and any additional relevant details as required.

08

Sign and date the form at the bottom.

Who needs ST-120.1?

01

Individuals or businesses making tax-exempt purchases in New York State.

02

Organizations such as non-profits that qualify for sales tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

Is it better to claim 0 or exempt?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What does filing exempt mean?

If you claim exempt, no federal income tax is withheld from your paycheck; you may owe taxes and penalties when you file your 2020 tax return.

How do you fill out exempt?

To claim exempt, you must submit a W-4 Form. Do not complete lines 5 and 6. Enter “Exempt” on line 7. Note: You must submit a new W-4 Form by February 15 each year to continue your exemption.

How do I get tax exemption?

Tax exemptions can be availed by investing in the following tools: Senior Citizen Savings Scheme (SCSS) Sukanya Samriddhi Yojana (SSY) National Pension Scheme (NPS) Public Provident Fund (PPF) National Pension Scheme (NPS)

What does it mean to fill exempt?

If you claim exempt, no federal income tax is withheld from your paycheck; you may owe taxes and penalties when you file your 2020 tax return.

Is filing exempt a good thing?

There is no downside to a tax exemption. Federal, state, and local governments create them to provide a benefit to specific people, businesses, or other entities in special situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ST-1201 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your ST-1201 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get ST-1201?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific ST-1201 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an eSignature for the ST-1201 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your ST-1201 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is ST-120.1?

ST-120.1 is a New York State tax form used by certain businesses to report sales tax exemptions.

Who is required to file ST-120.1?

Businesses making tax-exempt purchases in New York State are required to file ST-120.1.

How to fill out ST-120.1?

To fill out ST-120.1, provide your business information, purchase details, and the applicable exemption reason clearly and accurately on the form.

What is the purpose of ST-120.1?

The purpose of ST-120.1 is to document and certify exempt purchases for sales tax purposes in New York State.

What information must be reported on ST-120.1?

Information that must be reported on ST-120.1 includes the buyer's name and address, seller's name and address, description of the property or service purchased, and the reason for exemption.

Fill out your ST-1201 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ST-1201 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.