Get the free BCOMMERCIAL INVOICEb - Customs Clearance Solutions Inc - home

Show details

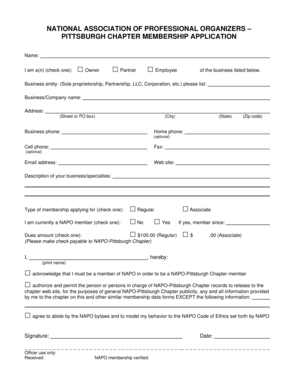

COMMERCIAL INVOICE SHIPPER Invoice No: Page of Invoice Date: Ship Date: File Number: CONSIGNEE RELATED BILL TO NOT RELATED SOLD NOT SOLD SHIPMENT INFORMATION Customer PO No: Letter of Credit No: Mode

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bcommercial invoiceb - customs

Edit your bcommercial invoiceb - customs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bcommercial invoiceb - customs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bcommercial invoiceb - customs online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bcommercial invoiceb - customs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bcommercial invoiceb - customs

How to Fill Out Commercial Invoice - Customs:

01

Start by identifying the exporter and importer: Clearly state the business name and address of both the exporter and importer. Include contact information, such as phone numbers and emails.

02

Document the shipment details: Provide information about the shipment, including the country of origin, the destination country, the mode of transport, and the date of export. Specify the delivery terms, such as FOB (Free on Board) or CIF (Cost, Insurance, and Freight).

03

Describe the goods being shipped: Provide a detailed description of each item being shipped, including its quantity, unit of measure, and value. Use specific terms that accurately describe the goods, such as brand name, model number, and any applicable certifications or specifications.

04

Specify the harmonized system (HS) code: Each item must be assigned an HS code, which is a standardized code used for international trade classification. These codes classify goods based on their nature, function, or purpose. Make sure to accurately classify the goods to avoid any customs issues.

05

Declare the item value: Indicate the total amount being charged for the goods being exported. This should include the unit price, quantity, and total value for each item. Clearly state the currency used.

06

Include the terms of payment: Specify the agreed-upon terms of payment between the exporter and importer. This could be terms like "payment in advance," "letter of credit," or "open account." Be sure to provide any necessary payment details.

07

Provide the shipment details: Include information such as the weight, dimensions, and packaging of the shipment. This helps customs officers determine the appropriate handling and customs duties.

Who Needs Commercial Invoice - Customs:

01

Exporters: Any business or individual involved in exporting goods internationally needs a commercial invoice for customs purposes. This ensures that the necessary information is provided to customs authorities to smooth the export process.

02

Importers: Importers require commercial invoices to accurately track and account for the goods they are bringing into their country. Commercial invoices help in calculating import duties, assessing customs fees, and arranging transportation.

03

Customs Authorities: Customs officers rely on commercial invoices to assess the value of a shipment, determine the appropriate customs duties and taxes, and ensure compliance with import regulations. Commercial invoices aid in efficient customs clearance processes.

In conclusion, filling out a commercial invoice correctly is crucial for both exporters and importers to facilitate smooth customs processing. Customs authorities rely on these invoices to assess and regulate international trade transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is commercial invoice - customs?

A commercial invoice is a document that provides details about the goods being shipped, including a description of the items, their value, and the terms of sale.

Who is required to file commercial invoice - customs?

The exporter or the freight forwarder is typically responsible for preparing and filing the commercial invoice for customs purposes.

How to fill out commercial invoice - customs?

The commercial invoice should include information such as the seller and buyer details, a description of the goods, quantity, value, and any other relevant information required by customs.

What is the purpose of commercial invoice - customs?

The purpose of a commercial invoice for customs is to provide necessary information for customs officials to assess duties and taxes, verify the value of the goods, and ensure compliance with import/export regulations.

What information must be reported on commercial invoice - customs?

The commercial invoice must include details such as the sender and receiver's information, a detailed description of the goods, quantity, value, and any applicable terms of sale.

How do I modify my bcommercial invoiceb - customs in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your bcommercial invoiceb - customs along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I edit bcommercial invoiceb - customs on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign bcommercial invoiceb - customs right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Can I edit bcommercial invoiceb - customs on an Android device?

You can edit, sign, and distribute bcommercial invoiceb - customs on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your bcommercial invoiceb - customs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bcommercial Invoiceb - Customs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.