Get the free FICO Scores vs. Credit Scores: What's the Difference?Credit ...

Show details

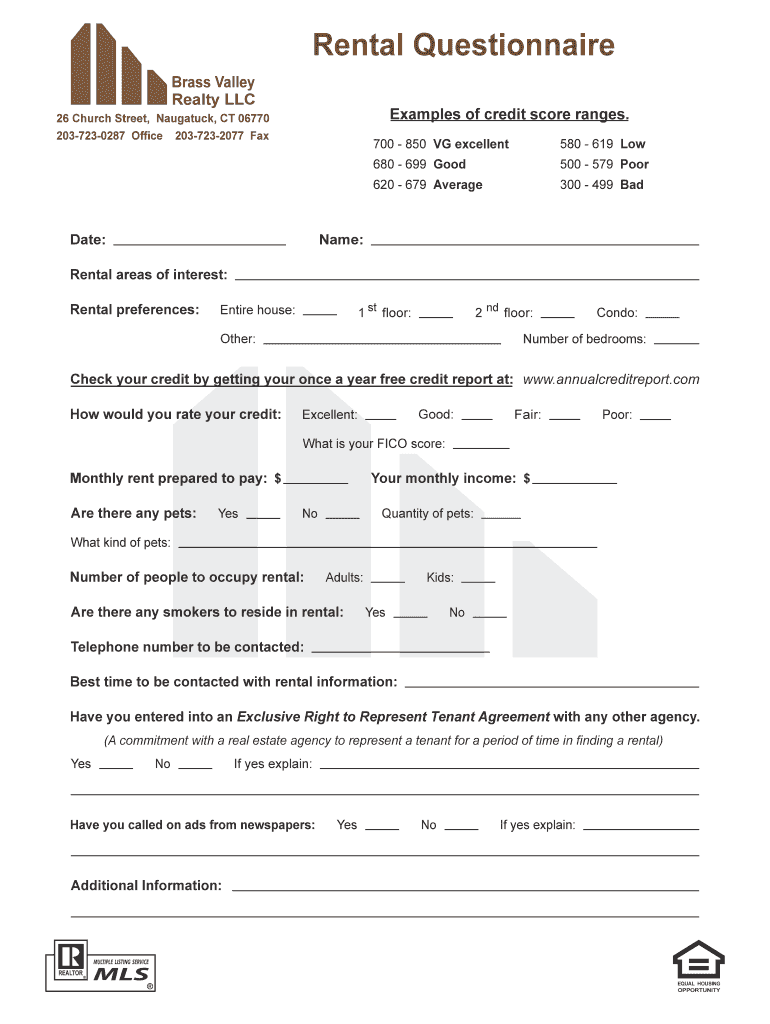

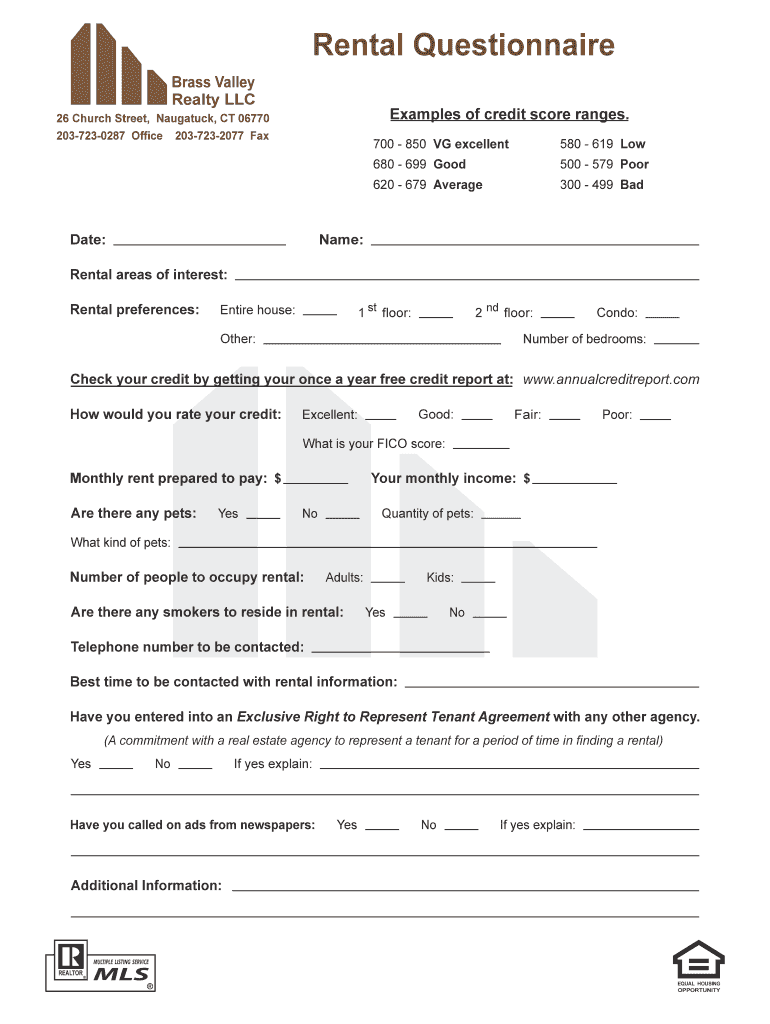

Rental Questionnaire Brass Valley Realty Examples of credit score ranges.26 Church Street, Naugatuck, CT 06770 2037230287 Office 2037232077 Fax700 850 VG excellent580 619 Low680 699 Good500 579 Poor620

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fico scores vs credit

Edit your fico scores vs credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fico scores vs credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fico scores vs credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fico scores vs credit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fico scores vs credit

How to fill out fico scores vs credit:

01

Understand the difference between FICO scores and credit. FICO scores are specific credit scores developed by the Fair Isaac Corporation, while credit refers to a person's overall credit history and financial behavior.

02

Obtain a copy of your credit report. You can request a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year at AnnualCreditReport.com.

03

Review your credit report for accuracy. Check for any errors, such as incorrect personal information or accounts that don't belong to you. Dispute any inaccuracies with the credit bureau to have them corrected.

04

Pay your bills on time. This is one of the most important factors that affects your credit score, including your FICO score. Late payments can have a negative impact on your creditworthiness.

05

Keep your credit utilization low. This refers to the amount of credit you use compared to your overall credit limit. Aim to use no more than 30% of your available credit to maintain a good credit score.

06

Diversify your credit mix. Having a mix of different types of credit, such as credit cards, loans, and mortgages, can positively impact your credit score and FICO score.

07

Avoid opening too many new accounts. Opening multiple new credit accounts within a short period of time can lower your average account age and potentially harm your credit.

08

Monitor your credit regularly. Keep an eye on your credit report and credit scores to stay informed about any changes or potential issues.

Who needs fico scores vs credit:

01

Individuals who are interested in understanding their creditworthiness and financial standing will find both FICO scores and credit reports useful.

02

Lenders and financial institutions rely on both FICO scores and credit reports to assess the creditworthiness of potential borrowers when considering loan applications.

03

Landlords often use credit reports and FICO scores to determine whether to approve a rental application, as they provide insights into an applicant's financial responsibility.

04

Insurance companies may also consider credit information, including FICO scores, when determining insurance premiums or eligibility for certain policies.

05

Individuals who are working towards improving their credit or FICO scores can benefit from monitoring their progress over time and making necessary adjustments to achieve their desired financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fico scores vs credit directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your fico scores vs credit along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I execute fico scores vs credit online?

pdfFiller has made filling out and eSigning fico scores vs credit easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in fico scores vs credit?

With pdfFiller, it's easy to make changes. Open your fico scores vs credit in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is fico scores vs credit?

FICO scores are specific credit scores created by the Fair Isaac Corporation, which use various factors to assess an individual's creditworthiness. Credit, in a broader sense, encompasses all aspects of an individual's borrowing history, including loan types, amounts, payment history, and more.

Who is required to file fico scores vs credit?

Lenders and financial institutions typically use FICO scores to evaluate an individual's credit risk when they apply for loans or credit. Individuals themselves do not file FICO scores; rather, they are generated by credit reporting agencies based on the individual's credit history.

How to fill out fico scores vs credit?

You do not fill out FICO scores; they are calculated based on your credit report information. To improve your credit score, focus on making timely payments, reducing outstanding debt, and maintaining low credit utilization.

What is the purpose of fico scores vs credit?

The purpose of FICO scores is to provide lenders with a standardized method to assess the likelihood that a borrower will default on a loan. Credit, in general, helps individuals access financing by quantifying their creditworthiness.

What information must be reported on fico scores vs credit?

FICO scores are calculated using information from credit reports, which must report data such as payment history, credit utilization, length of credit history, types of credit accounts, and new credit inquiries.

Fill out your fico scores vs credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fico Scores Vs Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.