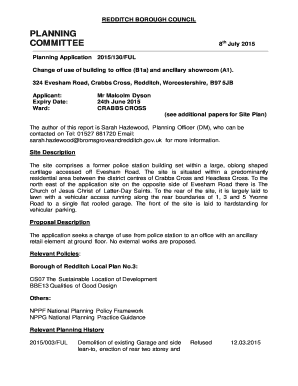

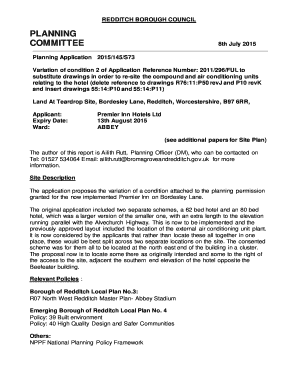

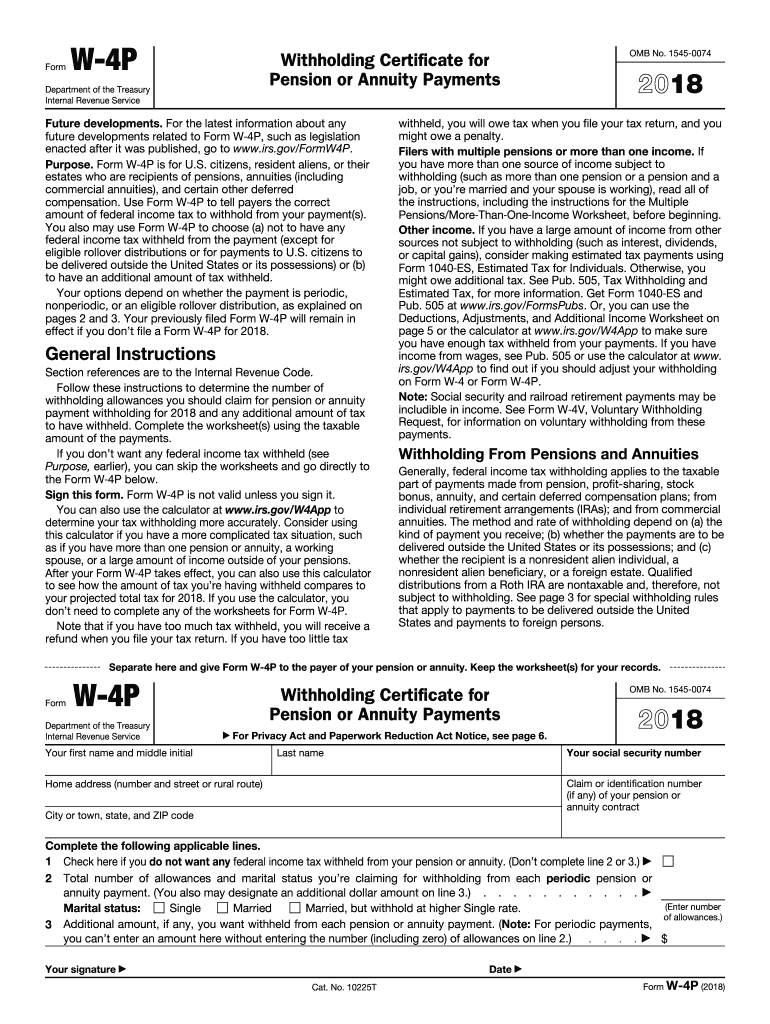

IRS W-4P 2018 free printable template

Instructions and Help about IRS W-4P

How to edit IRS W-4P

How to fill out IRS W-4P

About IRS W-4P 2018 previous version

What is IRS W-4P?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-4P

What should I do if I realize I made a mistake on my w4p change after submission?

If you notice an error on your w4p change after it has been submitted, promptly file an amended form to correct the mistake. Ensure that you highlight the changes made to avoid potential confusion during processing.

How can I check the status of my submitted w4p change?

To verify the status of your w4p change, you can use the online tracking tools provided by the IRS. Input your details as required, and check for any notifications regarding processing or acceptance.

Are there common errors associated with the w4p change that I should watch out for?

Yes, common errors on the w4p change include incorrect taxpayer identification numbers and missed signatures. Double-check all information for accuracy before submission to prevent rejection or processing delays.

What if I need to file a w4p change on behalf of someone else?

If you're filing a w4p change on behalf of someone else, ensure you have the proper authorization in place, such as a power of attorney. This provides legitimacy to your submission and can help in any subsequent communications with tax authorities.

What should I know about the e-signature requirements for submitting a w4p change?

When submitting a w4p change electronically, ensure your e-signature meets IRS standards. This involves ensuring your identification and authentication methods comply with current regulations to maintain the integrity of your submission.

See what our users say