Paychex RS0079 2012 free printable template

Get, Create, Make and Sign Paychex RS0079

Editing Paychex RS0079 online

Uncompromising security for your PDF editing and eSignature needs

Paychex RS0079 Form Versions

How to fill out Paychex RS0079

How to fill out Paychex RS0079

Who needs Paychex RS0079?

Instructions and Help about Paychex RS0079

Okay everybody I'm back let me just make sure that we've only got managers still on the call up Mary Ann I see that you're still on the call can you drop off please yes I'm here King we're all done with the employee piece, so you can drop off now okay thanks take camp thank you — okay um thank you gu, soso now we're going to just go — basically what we're going to start with I'm going to come back up here and come over to company which you don't know if you guys look the same on your end as I do but essentially in your dashboard will look different this is my home screen because I run the payroll but here I have this menu on the side, and I'm going to go back to time and attendance which is the section we were just in, but we were in the employee side which all of you will need to be in but the piece that you actually need to know about to get into your section Ruth is this what you're seeing yes it is okay so where you need to go to actually like to go to your own section there your employee section in the right over here you click on this little arrow this drop-down, and you see you have a few different things here, and I don't know that you guys will have all of these menu options, but you should see employee dashboard and manage your dashboard what you're you're always going to default and come into your manager dashboard but when you need to go do your own timesheet you got to come over here to employee dashboard okay, so that's how you're going to toggle between is you're going to just click on this little arrow and then switch between manager and employees so do that change that for you okay, so that's that's what everybody will need to do when they come in here when they need to go do their own time you just have to switch between and that's so that's the way to do it that little magic arrow all right thank you I just tried it and yep you're right to work okay great so, so now we are here, and we are in the I'm sorry's have to move the webinar thing out of the way here, so I can see everything on my side um, so basically this is your home screen and you know because I'm an administrator I see everybody but you guys will just see whoever your employees are so and then like you have any different tabs across the top and this is really going to be, and again you might not have all of these tabs, but you should have the majority of them, so you can click through you know and these are the things just telling you about your different employees you know who's the manager you know things like that, and you know this is really just information almost not much that you would need to do here and the employees tab other than like if you are their labor level was wrong something like that you know, but ultimately you know just let me know, and I can fix that so like if you want to see a specific employees or curl something like that you know how their balances work I mean that's kind of this is just informational essentially so if you ever are...

People Also Ask about

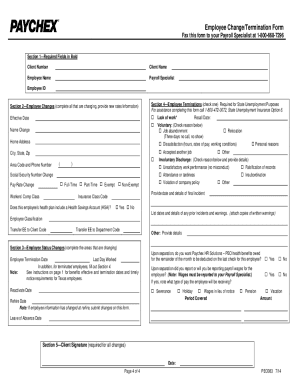

How do I transfer my 401k to Paychex Flex?

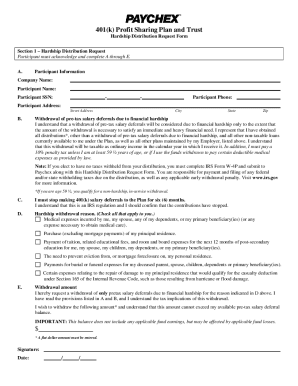

How do I request a 401k distribution from Paychex?

How do I contact Paychex Flex 401k?

How do I move my 401k from one company to another?

How do I contact Paychex?

How do I get my money from Paychex?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Paychex RS0079 for eSignature?

Can I sign the Paychex RS0079 electronically in Chrome?

How do I fill out the Paychex RS0079 form on my smartphone?

What is Paychex RS0079?

Who is required to file Paychex RS0079?

How to fill out Paychex RS0079?

What is the purpose of Paychex RS0079?

What information must be reported on Paychex RS0079?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.