ZA Old Mutual Corporate Death Claim Annexure B 2013 free printable template

Show details

N.B. Any misrepresentations either provided or omitted will be viewed in a serious light and will prejudice your prospects of receiving any allocation of the death benefits or part thereof under the policy/policies. I declare under oath that the information in this annexure and in the supporting documents that I have signed is true and correct and indemnify the SuperFund and Old Mutual against any claim that may arise from any incorrect or false information provided on this form. Signed at...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ZA Old Mutual Corporate Death Claim

Edit your ZA Old Mutual Corporate Death Claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ZA Old Mutual Corporate Death Claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ZA Old Mutual Corporate Death Claim online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ZA Old Mutual Corporate Death Claim. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ZA Old Mutual Corporate Death Claim Annexure B Form Versions

Version

Form Popularity

Fillable & printabley

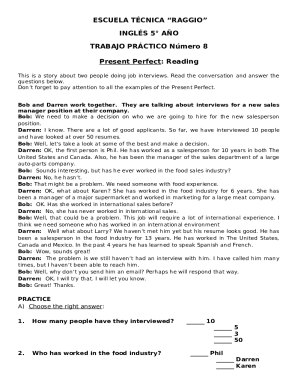

How to fill out ZA Old Mutual Corporate Death Claim

Point by point instructions on how to fill out Old Mutual Superfund death:

01

Start by gathering all the required documents such as the death certificate, proof of relationship to the deceased, and any other relevant paperwork.

02

Visit the official Old Mutual website and navigate to the Superfund death claims section. You may need to create an account or log in to access the necessary forms.

03

Download and carefully read through the Superfund death claim form. Make sure you understand all the sections and requirements.

04

Begin by filling out the personal details section, providing accurate information about yourself as the claimant.

05

Proceed to the deceased's details section, where you will need to provide their personal information, including full name, date of birth, and ID number.

06

Complete the beneficiary details section, filling in the necessary information about the individual(s) who will receive the death benefit.

07

Attach all the required supporting documents, such as the death certificate and proof of relationship. Ensure that all copies are clear and legible.

08

Review the completed form and supporting documents to verify their accuracy and completeness. Make any necessary revisions or additions.

09

Once you are satisfied with the form, submit it to Old Mutual as per their instructions. This may involve mailing the physical copies or submitting them electronically through the website.

10

Wait for the confirmation of receipt from Old Mutual. They may contact you if any additional information or documentation is required.

11

Old Mutual will then process the claim and, upon approval, proceed with the payment of the death benefit to the designated beneficiaries.

Who needs Old Mutual Superfund death?

01

Individuals who have invested in the Old Mutual Superfund and would like to ensure that their nominated beneficiaries receive the death benefit in the event of their passing.

02

Any investor in the Old Mutual Superfund who wishes to protect their loved ones financially and provide for them in the unfortunate circumstance of their death.

03

Those who have reached a stage in life where they consider financial planning for their future, including provisions for their beneficiaries after death.

04

People who have dependents or loved ones who rely on their financial support and want to guarantee their well-being in the face of unexpected events.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to withdraw from Old Mutual investment?

The withdrawal will be processed and paid into your bank account within a maximum of 7 days of you accepting these terms, provided all required documents are received. You will not have any claim against Old Mutual if the money is deposited into an incorrect bank account where you supplied the incorrect bank details.

How does the Old Mutual super fund work?

Old Mutual SuperFund allows retired members to continue their membership even though they have retired from their employer. This means that you are no longer forced to retire from the Fund when you still have other sources of income and don't need your retirement benefit yet.

How do I get a death claim?

Duly accomplished Application Form for Funeral Benefit. Death Certificate of member issued by LCR OR PSA. If claimant is not a GSIS member, Birth Certificate issued by LCR or PSA or two valid government issued IDs with date of birth and signature. Death Certificate of legal spouse issued by LCR OR PSA if married.

How long does it take to claim provident fund?

Provided your tax affairs are in order, and you have submitted all the required documents (such as a copy of your ID, a completed instruction form stating where the money should go, and proof of banking details), it normally takes 14 to 21 business days to receive your provident fund pay-out.

How do I withdraw money from Old Mutual SuperFund?

Give all these to your payroll administrator within 60 days of leaving your employer, or call the Old Mutual SuperFund service centre at 0860 20 30 40. 1 Subject to legislation and the rules of the receiving fund, at the time of transfer. Your final option is to take some, or all, of your retirement savings in cash.

How do I claim a death claim online?

Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Send sss death claim application form via email, link, or fax.You can also download it, export it or print it out. Edit your death claim application sss online. Sign it in a few clicks. Share your form with others.

How do I report a death to Old Mutual?

How to claim with Old Mutual Web. Submit a Funeral and Life insurance claim online. WhatsApp. Save 0860 933 333 as a contact on your phone. USSD. Dial *120*6672” for free to begin the process of submitting a funeral claim. Email.

How long does Old Mutual take to payout a SuperFund claim?

2) How long does the process take? This process can take as little as 15 working days (after your last contribution is processed and the claim has been submitted by your Employer) provided that the administrator receives all necessary documentation, including your tax clearance and banking approval.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ZA Old Mutual Corporate Death Claim online?

Filling out and eSigning ZA Old Mutual Corporate Death Claim is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in ZA Old Mutual Corporate Death Claim without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit ZA Old Mutual Corporate Death Claim and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit ZA Old Mutual Corporate Death Claim on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign ZA Old Mutual Corporate Death Claim. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is old mutual superfund death?

Old Mutual SuperFund Death is a form that needs to be completed in the event of the death of a member in the Old Mutual SuperFund.

Who is required to file old mutual superfund death?

The next of kin or legal representative of the deceased member is required to file the Old Mutual SuperFund Death form.

How to fill out old mutual superfund death?

The Old Mutual SuperFund Death form can be filled out online or by contacting the Old Mutual SuperFund customer service for assistance.

What is the purpose of old mutual superfund death?

The purpose of the Old Mutual SuperFund Death form is to notify Old Mutual of the death of a member and to initiate the process of distributing the deceased member's funds.

What information must be reported on old mutual superfund death?

The Old Mutual SuperFund Death form requires information such as the deceased member's name, date of death, contact information of the next of kin, and any other relevant details.

Fill out your ZA Old Mutual Corporate Death Claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ZA Old Mutual Corporate Death Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.