Get the free questionaire on retirement planning pdf

Show details

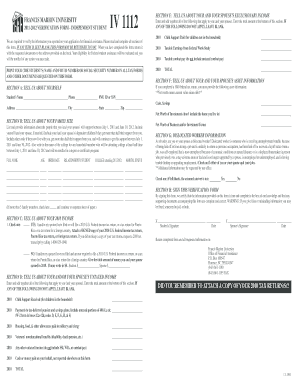

Sr101111V7Retirement Financial Planning Questionnaire We can offer advice on a FULL range of needs and products. These include Retirement Planning, Savings & Investments, Mortgages and Life & Health

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign questionaire on retirement planning

Edit your questionaire on retirement planning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your questionaire on retirement planning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing questionaire on retirement planning online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit questionaire on retirement planning. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out questionaire on retirement planning

How to fill out questionaire on retirement planning

01

Start by gathering all the necessary financial information, such as your current income, expenses, savings, investments, and any existing retirement accounts.

02

Determine your retirement goals and objectives. Consider factors such as the age at which you plan to retire, the lifestyle you want to maintain during retirement, and any specific financial targets you want to achieve.

03

Evaluate your risk tolerance and investment preferences. This will help you determine the appropriate asset allocation and investment strategies for your retirement plan.

04

Assess your current financial situation and identify any gaps or areas that need improvement. Analyze your debt levels, insurance coverage, and other financial obligations that may impact your retirement planning.

05

Use a retirement planning calculator or software to estimate your future financial needs and the amount of savings required to achieve your retirement goals.

06

Consider consulting a financial advisor or retirement specialist for personalized guidance and advice.

07

Once you have gathered all the necessary information and assessed your financial situation, start filling out the questionnaire by providing accurate and detailed answers to each question.

08

Review and double-check your answers before submitting the questionnaire. Make sure all the information provided is correct and complete.

09

If you have any doubts or questions while filling out the questionnaire, don't hesitate to seek clarification from the organization or individual providing the questionnaire.

10

After completing the questionnaire, make sure to keep a copy for your records and refer to it when monitoring your retirement plan progress or making future adjustments.

Who needs questionaire on retirement planning?

01

Anyone who wants to plan for their retirement and ensure a financially secure future can benefit from filling out a questionnaire on retirement planning.

02

This includes individuals of all ages, from young adults who are just starting their careers to those nearing retirement age.

03

Even if you already have a retirement plan in place, periodically reviewing and updating it through a questionnaire can help you stay on track and make necessary adjustments.

04

Additionally, employers or organizations may require employees to fill out retirement planning questionnaires as part of their benefits and retirement planning programs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send questionaire on retirement planning for eSignature?

When you're ready to share your questionaire on retirement planning, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in questionaire on retirement planning without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing questionaire on retirement planning and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit questionaire on retirement planning on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign questionaire on retirement planning. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is questionaire on retirement planning?

A questionnaire on retirement planning is a survey or form designed to gather information about an individual's financial preparation for retirement.

Who is required to file questionaire on retirement planning?

Individuals who are nearing retirement age or are already retired may be required to fill out a questionnaire on retirement planning.

How to fill out questionaire on retirement planning?

To fill out a questionnaire on retirement planning, individuals typically need to provide information about their current financial situation, retirement savings, investment portfolios, and future financial goals.

What is the purpose of questionaire on retirement planning?

The purpose of a questionnaire on retirement planning is to help individuals assess their current financial situation, identify potential gaps in their retirement savings, and develop a plan to achieve their retirement goals.

What information must be reported on questionaire on retirement planning?

Information that may need to be reported on a questionnaire on retirement planning includes current income, retirement savings account balances, investment holdings, anticipated retirement age, and estimated future expenses.

Fill out your questionaire on retirement planning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Questionaire On Retirement Planning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.