Get the free Pension and Tax Sheltering

Show details

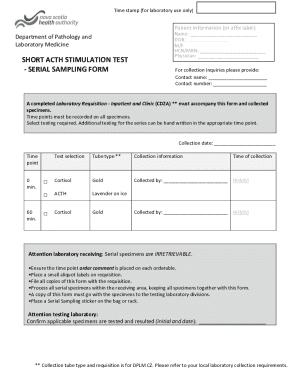

Pension and Tax Sheltering with a 403B Plan from S.D. Clifford Advisors, LLC 4150 Been Village St NW Suite 601, Canton Ohio 44718 8004561803 3304931814 www.sharetheharvest.com Payments by an employer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pension and tax sheltering

Edit your pension and tax sheltering form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pension and tax sheltering form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pension and tax sheltering online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pension and tax sheltering. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pension and tax sheltering

How to fill out pension and tax sheltering:

01

Start by gathering all relevant financial information, including your income, expenses, and investment holdings.

02

Determine your eligibility for different types of pension plans and tax shelters. This may vary depending on your employment status and jurisdiction.

03

Research different pension plans and tax shelters available to you. This includes options such as individual retirement accounts (IRAs), 401(k) plans, and government-sponsored plans like the Canada Pension Plan or Social Security.

04

Consult with a financial advisor or tax professional to determine the best pension and tax sheltering strategy for your specific needs and goals.

05

Complete the necessary paperwork to enroll in your chosen pension plan or tax shelter. This may involve providing personal information, banking details, and beneficiary designations.

06

Contribute funds to your pension plan or tax shelter on a regular basis, ensuring that you stay within any contribution limits or deadlines.

07

Monitor your investment performance and make adjustments as needed. This may involve rebalancing your portfolio, exploring different investment options, or seeking professional advice.

08

Keep track of any tax deductions, credits, or benefits associated with your pension and tax sheltering strategy. Consult with a tax professional to ensure you maximize your tax savings.

09

Review and update your pension and tax sheltering plan regularly, especially when there are changes in your financial situation, goals, or tax laws.

10

Stay informed about any updates or changes to pension and tax sheltering regulations, as this may impact your strategy.

Who needs pension and tax sheltering:

01

Individuals who want to save for retirement and ensure financial security in later years.

02

Self-employed individuals or entrepreneurs who do not have access to employer-sponsored pension plans.

03

High-income earners who want to reduce their taxable income and take advantage of tax benefits offered through pension and tax sheltering options.

04

Individuals who anticipate a significant increase in income in the future and want to defer paying taxes on that income until retirement when they may be in a lower tax bracket.

05

Those who want to take advantage of employer matching contributions offered through pension plans.

06

Individuals who want to diversify their investment portfolio by investing in tax-efficient options within a pension or tax shelter.

07

Anyone who wants to take control of their financial future and have a plan in place to achieve their retirement goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pension and tax sheltering without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including pension and tax sheltering. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send pension and tax sheltering for eSignature?

When your pension and tax sheltering is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make edits in pension and tax sheltering without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing pension and tax sheltering and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is pension and tax sheltering?

Pension and tax sheltering refers to the act of setting aside money into retirement accounts or investments that provide tax advantages, allowing individuals to save for retirement while minimizing their tax liabilities.

Who is required to file pension and tax sheltering?

Individuals who have income from employment or self-employment are typically required to file for pension and tax sheltering, as well as those who contribute to retirement accounts or investment plans with tax benefits.

How to fill out pension and tax sheltering?

To fill out pension and tax sheltering, individuals must accurately report their income, contributions to retirement accounts, and any other relevant financial information on their tax return or designated forms provided by the IRS or relevant tax authority.

What is the purpose of pension and tax sheltering?

The purpose of pension and tax sheltering is to encourage individuals to save for retirement by providing tax incentives and benefits for contributing to retirement accounts or investments that offer tax advantages.

What information must be reported on pension and tax sheltering?

Information such as income from employment or self-employment, contributions to retirement accounts, details of investment plans with tax benefits, and any other relevant financial information must be reported on pension and tax sheltering forms.

Fill out your pension and tax sheltering online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pension And Tax Sheltering is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.