Get the free Central Provident Fund Board - CPF Board - Members Home - mycpf cpf gov

Show details

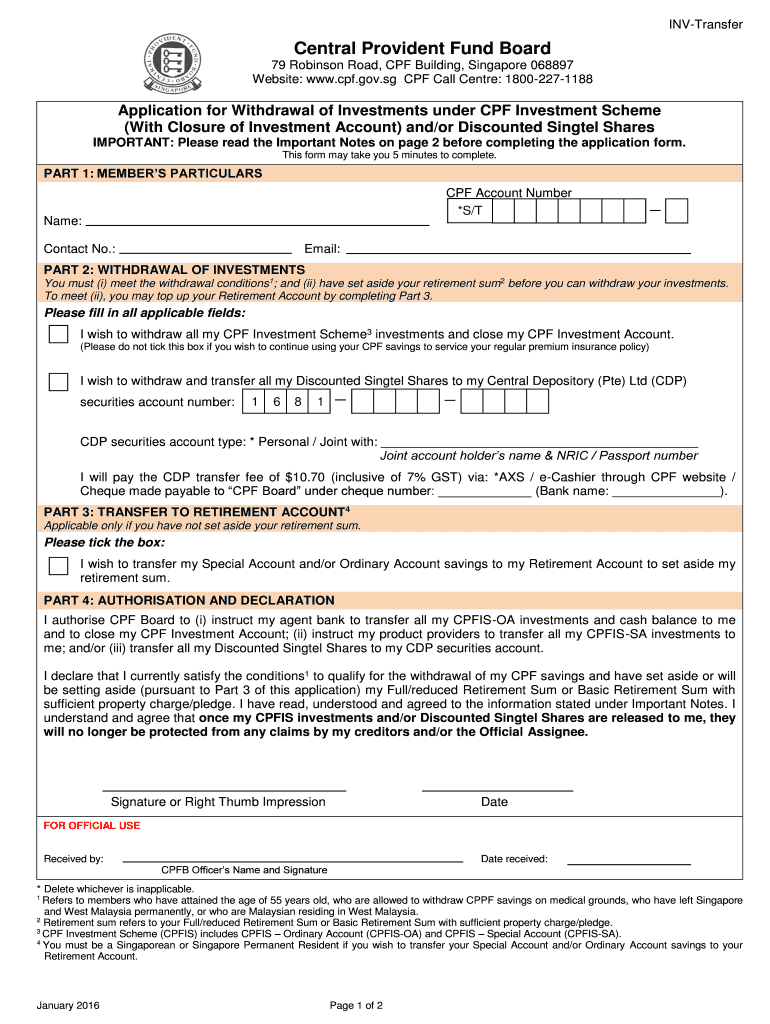

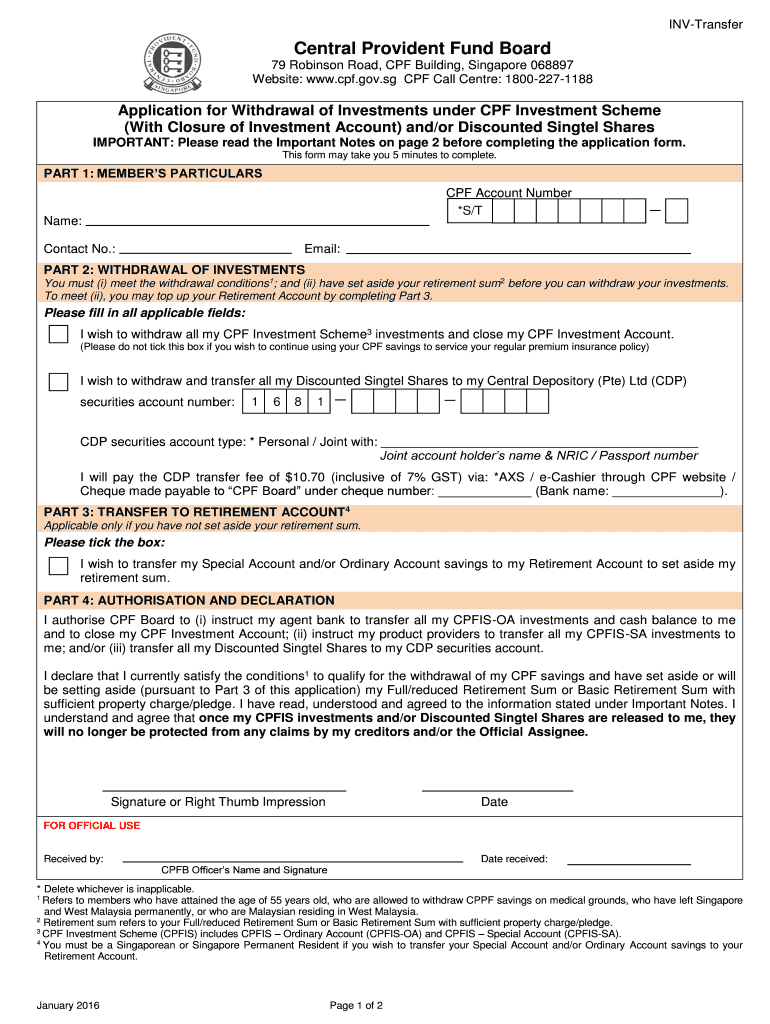

Transfer Central Provident Fund Board 79 Robinson Road, CPF Building, Singapore 068897 Website: www.cpf.gov.sg CPF Call Center: 18002271188 Application for Withdrawal of Investments under CPF Investment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign central provident fund board

Edit your central provident fund board form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your central provident fund board form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit central provident fund board online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit central provident fund board. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out central provident fund board

How to fill out central provident fund board:

01

Obtain the necessary forms: Start by acquiring the CPF Board's application forms, which are available on their official website. These forms can also be obtained from the CPF Service Centres or CPF Self-Service Machines.

02

Provide personal details: Fill in your personal information accurately in the application forms. This includes your full name, identification number, contact details, and residential address. Ensure that all the provided details match your official identification documents.

03

Declare your employment status: Specify your employment status, whether you are employed under a company or self-employed. If you are employed, you will need to provide details of your employer, such as the company name, address, and contact number.

04

Indicate your contribution preference: Determine the type of contributions you wish to make to your CPF account, such as mandatory contributions, voluntary contributions, or topping up of your CPF Special Account.

05

Choose your investment options: If you opt for the CPF Investment Scheme, select your desired investment options. You can choose from various investment instruments, including stocks, bonds, unit trusts, and more. Ensure that you understand the risks and rewards associated with each option.

06

Nominate beneficiaries: Consider nominating beneficiaries to your CPF funds in the event of your demise. This ensures that your loved ones are provided for financially. Provide their details accurately, including their full names, identification numbers, and contact details.

Who needs central provident fund board:

01

Singaporean citizens: All Singaporean citizens are required to contribute to their Central Provident Fund (CPF) accounts. The CPF scheme aims to provide individuals with a secure retirement income, healthcare financing, and home ownership support.

02

Permanent residents: Permanent residents (PRs) are also eligible to contribute to their CPF accounts. As PRs have a long-term stake in Singapore, the CPF scheme helps them save for their retirement and other financial needs.

03

Employees in Singapore: Regardless of citizenship or residency status, all employees working in Singapore, including foreigners, are required to contribute to their CPF accounts. The CPF contributions are deducted from their salaries and help build up their retirement funds.

04

Self-employed individuals: Self-employed individuals, such as freelancers, entrepreneurs, and gig economy workers, are also eligible to contribute to their CPF accounts. This allows them to save for their retirement and enjoy the CPF benefits available to all CPF members.

In summary, anyone residing or working in Singapore, whether a citizen, permanent resident, or foreign employee, needs to have a Central Provident Fund (CPF) account. This ensures long-term financial security, retirement income, and other CPF benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify central provident fund board without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including central provident fund board. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make changes in central provident fund board?

The editing procedure is simple with pdfFiller. Open your central provident fund board in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in central provident fund board without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing central provident fund board and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is central provident fund board?

Central Provident Fund (CPF) is a mandatory savings scheme for working Singapore citizens and permanent residents to fund their retirement, healthcare, and housing needs.

Who is required to file central provident fund board?

Employers in Singapore are required to file Central Provident Fund (CPF) contributions for their employees.

How to fill out central provident fund board?

Employers can fill out Central Provident Fund (CPF) contributions online through the CPF e-Submission system.

What is the purpose of central provident fund board?

The purpose of the Central Provident Fund (CPF) Board is to help Singaporeans save for retirement, healthcare, and housing needs.

What information must be reported on central provident fund board?

Employers need to report the wages, CPF contribution amounts, and other relevant employee details on the Central Provident Fund (CPF) submissions.

Fill out your central provident fund board online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Central Provident Fund Board is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.