Get the free Rental amp Royalty Income bSchedule Eb

Show details

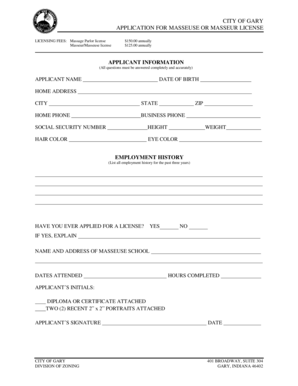

Rental & Royalty Income (Schedule E) General Information Kind of property (Residential or Commercial?)...... ............................. Location of property .............................. Percentage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental amp royalty income

Edit your rental amp royalty income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental amp royalty income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rental amp royalty income online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rental amp royalty income. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental amp royalty income

Step 1: Gather necessary documents and information

01

Collect all relevant documents such as rental agreements, lease agreements, royalty contracts, and any other relevant documents related to your rental and royalty income.

02

Make sure to have detailed financial records, including income and expenses related to your rental and royalty activities.

Step 2: Report rental income

01

In the appropriate section of your tax return form (such as Schedule E for individual tax returns in the US), report your rental income.

02

Include income earned from renting out properties, such as houses, apartments, commercial buildings, or any other real estate properties.

03

Be sure to report the total rental income for the tax year, excluding any expenses or deductions at this stage.

Step 3: Report royalty income

01

On the same tax return form, report any royalty income you have earned during the tax year.

02

This includes income received from the use or sale of intellectual property, such as patents, copyrights, trademarks, or franchise rights.

03

Note that royalty income may also be reported separately on Schedule C if you are engaged in a trade or business as a self-employed individual.

Step 4: Deduct allowable expenses

01

Identify any expenses directly related to your rental and royalty income and deduct them from your total income.

02

Common rental expenses may include property maintenance, repairs, advertising, property management fees, insurance, and mortgage interest.

03

For royalty income, deduct any related expenses such as legal fees, licensing fees, or any costs directly incurred in generating royalty income.

Step 5: Allocate expenses between rental and royalty activities (if applicable)

01

If you have both rental income and royalty income, you may need to allocate some expenses between these activities.

02

Determine the percentage of each activity's use or time in relation to the total and allocate the expenses accordingly.

Step 6: Keep accurate records

01

Maintaining detailed and accurate records of your rental and royalty activities throughout the year is crucial.

02

Keep track of all income and expense transactions, invoices, receipts, and documentation related to your rental and royalty income.

03

These records will not only help you accurately fill out your tax forms but also assist in case of any potential audits or inquiries.

Who needs rental and royalty income?

01

Individuals who own rental properties and receive income from renting them out need to report rental income.

02

Individuals or businesses that earn income from licensing or selling intellectual property, such as patents, copyrights, or trademarks, need to report royalty income.

03

Even if you are uncertain whether your income qualifies as rental or royalty income, it is important to consult with a tax professional or refer to the tax laws of your jurisdiction to ensure compliance with reporting requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rental amp royalty income?

Rental and royalty income is the money received by an individual or organization for allowing someone else to use their property or assets. This can include rental payments for real estate, equipment, or intellectual property, as well as royalties from the use of patents, trademarks, or copyrights.

Who is required to file rental amp royalty income?

Individuals or businesses who receive rental and royalty income are required to report it on their tax return to the IRS.

How to fill out rental amp royalty income?

Rental and royalty income should be reported on Schedule E of the IRS Form 1040. You will need to provide details of the income received, expenses incurred, and other related information.

What is the purpose of rental amp royalty income?

The purpose of reporting rental and royalty income is to accurately report all sources of income to the IRS and ensure compliance with tax laws.

What information must be reported on rental amp royalty income?

You must report the amount of rental and royalty income received, any related expenses incurred, and details of the property or assets generating the income.

How can I send rental amp royalty income for eSignature?

To distribute your rental amp royalty income, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete rental amp royalty income online?

pdfFiller makes it easy to finish and sign rental amp royalty income online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out rental amp royalty income on an Android device?

Complete your rental amp royalty income and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your rental amp royalty income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Amp Royalty Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.