NH DP-2848 2018 free printable template

Show details

DO NOT STAPLE

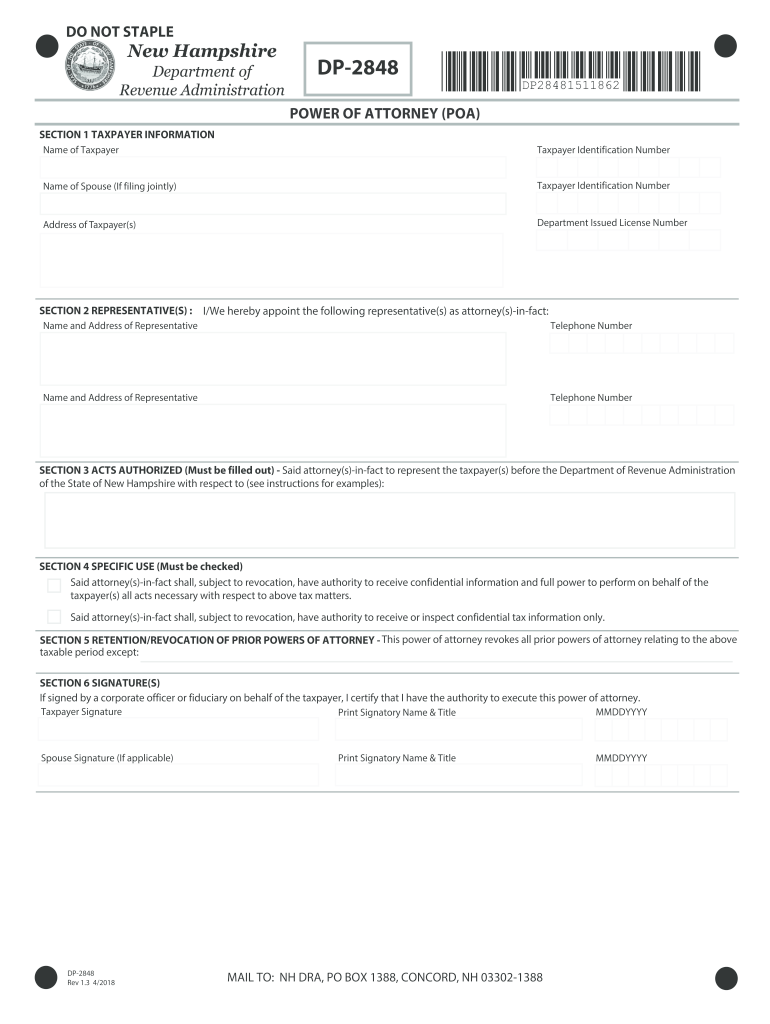

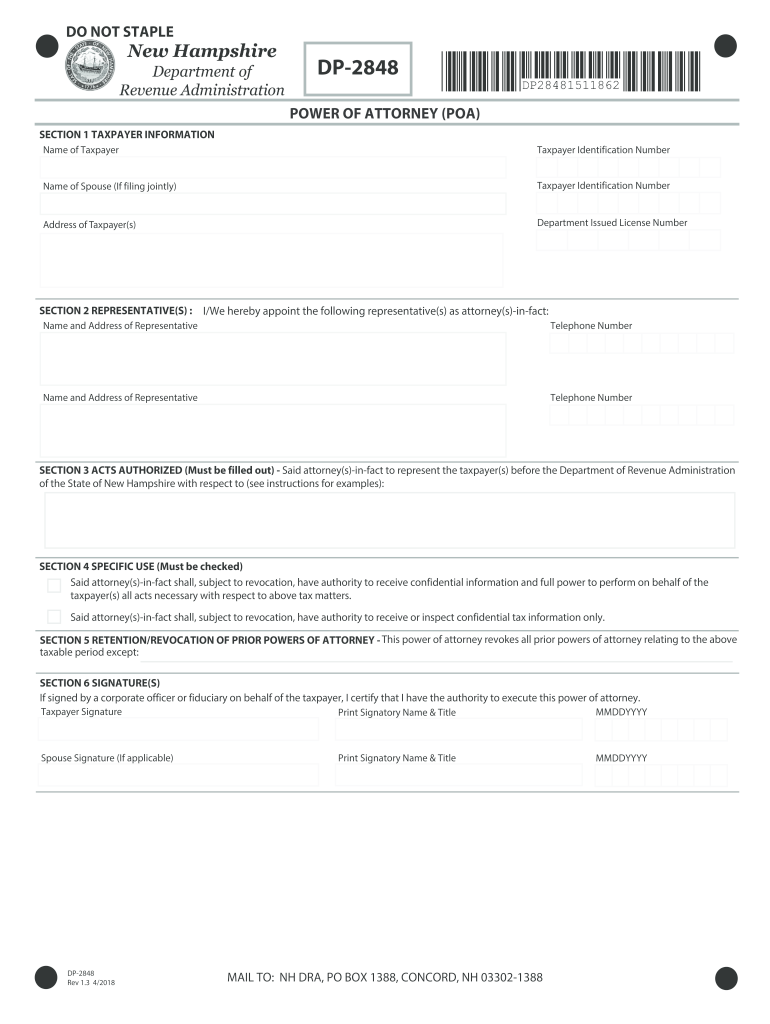

DP2848POWER OF ATTORNEY (POA)

SECTION 1 TAXPAYER INFORMATION

Name of TaxpayerTaxpayer Identification Cumbersome of Spouse (If filing jointly)Taxpayer Identification NumberAddress of

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NH DP-2848

Edit your NH DP-2848 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NH DP-2848 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NH DP-2848 online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NH DP-2848. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NH DP-2848 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NH DP-2848

How to fill out NH DP-2848

01

Obtain the NH DP-2848 form from the New Hampshire Department of Revenue Administration website or office.

02

Fill in your full name and contact information in the designated fields.

03

Enter the name and contact information of the person you are appointing as your representative.

04

Specify the type of tax matters for which the representative is authorized to act.

05

Include any specific limitations or instructions regarding the authority granted to the representative.

06

Sign and date the form to validate it.

07

Submit the completed form to the New Hampshire Department of Revenue Administration as instructed.

Who needs NH DP-2848?

01

Individuals who wish to appoint a representative to handle their tax matters with the New Hampshire Department of Revenue.

02

Taxpayers needing assistance with tax filings, disputes, or communication with the tax authority.

Fill

form

: Try Risk Free

People Also Ask about

Does IRS form 2848 need to be notarized?

Does Form 2848 Need to be Notarized? Form 2848 does not need to be notarized. However, the person submitting the form is required to authenticate their client's identity if they do not have a personal or business relationship with them.

Can I use form 2848 for a business?

The Form 2848 can be used by all taxpayers. This includes individuals and businesses. So if you are a business taxpayer, you can use the same Form 2848 as an individual would.

What is the best way to submit POA to IRS?

Fax or Mail Forms 2848 and 8821 If you can't use an online option, you can fax or mail authorization forms to us. Use for: Individual or business taxpayer. Any tax matter or period.

What is form 2848 used for?

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

Does the IRS accept power of attorney?

You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney.

How do I submit power of attorney to IRS?

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter(s) and tax year(s)/period(s) specified on the Form 2848.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NH DP-2848 directly from Gmail?

NH DP-2848 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I sign the NH DP-2848 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out NH DP-2848 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your NH DP-2848 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is NH DP-2848?

NH DP-2848 is the New Hampshire Department of Revenue Administration form used for the appointment of a tax representative or agent.

Who is required to file NH DP-2848?

Taxpayers who want to designate someone else to represent them before the New Hampshire Department of Revenue Administration are required to file NH DP-2848.

How to fill out NH DP-2848?

To fill out NH DP-2848, provide your name, address, and taxpayer identification number, and include the representative's details along with the specific tax matters for which they are authorized to act.

What is the purpose of NH DP-2848?

The purpose of NH DP-2848 is to formally authorize an individual or entity to act on behalf of a taxpayer regarding tax matters with the New Hampshire Department of Revenue Administration.

What information must be reported on NH DP-2848?

The information that must be reported on NH DP-2848 includes the taxpayer's name and contact information, the representative's name and contact information, and the specific tax matters for which the representation is granted.

Fill out your NH DP-2848 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NH DP-2848 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.