Get the free Income Tax Withhholding Guideline - North Dakota State Government

Show details

1988Railroads Supplemental Annual Report to the North Dakota Tax Commissioner (To be completed by Class II and Class III railroads) (For the year ended December 31, 20 Names of Railroad: Address:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income tax withhholding guideline

Edit your income tax withhholding guideline form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income tax withhholding guideline form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit income tax withhholding guideline online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit income tax withhholding guideline. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income tax withhholding guideline

How to fill out income tax withhholding guideline

01

To fill out income tax withholding guidelines, follow these steps:

02

Determine your filing status - whether you are single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

03

Calculate your total allowances. This involves considering your personal exemptions, dependents, and other factors.

04

Review the tax withholding tables provided by the Internal Revenue Service (IRS). These tables guide employers to withhold the correct amount of taxes from your paycheck based on your filing status and allowances.

05

Use the IRS Form W-4 to adjust your withholdings if necessary. This form allows you to specify any additional amount to be withheld from each paycheck or any extra withholding allowances you want to claim.

06

Consult with a tax professional or use online tax calculators to ensure accuracy and determine if any further adjustments are needed.

07

Submit your completed Form W-4 to your employer, who will use it to calculate and withhold the appropriate amount of federal income tax from your wages.

08

Periodically review and update your withholdings as needed, especially if your personal or financial circumstances change.

09

Remember, it is important to accurately fill out your income tax withholding guidelines to avoid over or underpayment of taxes.

Who needs income tax withhholding guideline?

01

Anyone who receives income subject to federal income tax needs income tax withholding guidelines.

02

This includes employees who receive wages or salaries, as well as individuals who receive other types of taxable income such as pensions, taxable grants, or certain types of government assistance.

03

Self-employed individuals who expect to owe $1,000 or more in taxes also need to follow income tax withholding guidelines to ensure they meet their tax obligations.

04

It is important for anyone who earns income to understand and comply with the income tax withholding guidelines to avoid penalties or unnecessary tax burdens.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get income tax withhholding guideline?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the income tax withhholding guideline in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make changes in income tax withhholding guideline?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your income tax withhholding guideline to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my income tax withhholding guideline in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your income tax withhholding guideline and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is income tax withholding guideline?

Income tax withholding guidelines are rules set by the government that require employers to withhold a certain amount of taxes from their employees' paychecks to cover the employees' tax liabilities.

Who is required to file income tax withholding guideline?

Employers are required to file income tax withholding guidelines for their employees.

How to fill out income tax withholding guideline?

Employers must accurately calculate the amount of taxes to withhold from each employee's paycheck based on the employee's W-4 form and the IRS withholding tables.

What is the purpose of income tax withholding guideline?

The purpose of income tax withholding guidelines is to ensure that employees pay their taxes throughout the year, rather than having to come up with a large sum at tax time.

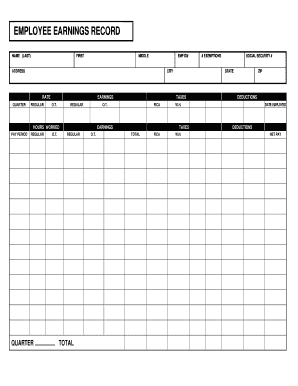

What information must be reported on income tax withholding guideline?

Income tax withholding guidelines must include the employee's name, Social Security number, wages earned, and the amount of taxes withheld.

Fill out your income tax withhholding guideline online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Tax Withhholding Guideline is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.