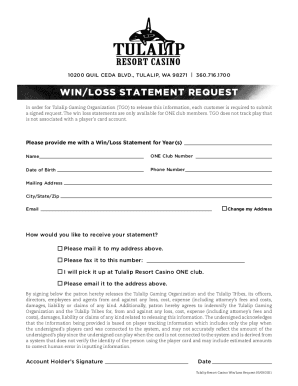

WA Tulalip Resort Casino Win/Loss Statement Request 2015 free printable template

Show details

10200 Quit Cedar Blvd., Tulip, WA 98271 1.888.272.1111Win/Loss Statement Request In order for Tulip Gaming Organization (TO) to release this information each customer is required to submit a signed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WA Tulalip Resort Casino WinLoss Statement

Edit your WA Tulalip Resort Casino WinLoss Statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WA Tulalip Resort Casino WinLoss Statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WA Tulalip Resort Casino WinLoss Statement online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit WA Tulalip Resort Casino WinLoss Statement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA Tulalip Resort Casino Win/Loss Statement Request Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WA Tulalip Resort Casino WinLoss Statement

How to fill out WA Tulalip Resort Casino Win/Loss Statement Request

01

Visit the official website of the Tulalip Resort Casino.

02

Locate the section for the Win/Loss Statement Request form.

03

Download the form or fill it out online if available.

04

Provide your full name, address, and contact information.

05

Enter your Player's Club membership number, if applicable.

06

Specify the time period for which you want the Win/Loss Statement.

07

Review the form for accuracy before submission.

08

Submit the completed form via email, mail, or in-person as instructed.

Who needs WA Tulalip Resort Casino Win/Loss Statement Request?

01

Players who want to report gambling winnings or losses for tax purposes.

02

Individuals requesting their gambling activity records for personal tracking.

03

Anyone who participated in gambling at the Tulalip Resort Casino during the specified timeframe and requires a formal statement.

Fill

form

: Try Risk Free

People Also Ask about

Can you get a win loss statement from a ?

You can request your Win Loss Statement by email on any kiosk by swiping your Player's Card, and entering your 24K Select Club password.

Are win loss statements proof of gambling losses?

Can a win loss statement be used for tax purposes. Yes, you can use it for your tax year if you have won and lost money through gambling venues such as lotteries, raffles, horse races, and s.

Is a W2G the same as a win loss statement?

A W2-G is an official tax document that is issued for individual jackpots and other gaming winnings over a certain amount; you should be given a copy of this form at the time the winnings are awarded. This is not the same as an annual win/loss statement.

What is the difference between a win loss statement and a W2G?

Win/Loss Statements have a net win or loss of a single players account during a specific year. W2G is the reportable tax amount given to the IRS. 1099 is the reportable promotional gifts and/or winnings reported to the IRS.

Is a win loss statement good enough for taxes?

The bottom line is that losing money at a or the race track does not by itself reduce your tax bill. You must first report all your winnings before a loss deduction is available as an itemized deduction. Therefore, at best, deducting your losses allows you to avoid paying tax on your winnings, but nothing more.

Does a win or loss statement help on your taxes?

The bottom line is that losing money at a or the race track does not by itself reduce your tax bill. You must first report all your winnings before a loss deduction is available as an itemized deduction. Therefore, at best, deducting your losses allows you to avoid paying tax on your winnings, but nothing more.

How do I get a win loss statement from online ?

You will directly request the WIN LOSS statement from the or gambling establishment. If you have received gambling winnings exceeding $600 during the tax year, the W-9 form will be sent to the gambling entity.

What is a win loss statement?

A Win/Loss statement is a report that provides an estimated play (amount of money that is won and loss) for the calendar year based on when a player's reward card is properly inserted into the gaming device during play.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the WA Tulalip Resort Casino WinLoss Statement electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your WA Tulalip Resort Casino WinLoss Statement and you'll be done in minutes.

How do I fill out WA Tulalip Resort Casino WinLoss Statement using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign WA Tulalip Resort Casino WinLoss Statement and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit WA Tulalip Resort Casino WinLoss Statement on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign WA Tulalip Resort Casino WinLoss Statement on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is tulalip win loss statement?

The Tulalip Win Loss Statement is a document that tracks an individual's gaming winnings and losses at the Tulalip Casino, typically used for tax purposes.

Who is required to file tulalip win loss statement?

Players who gamble at the Tulalip Casino and wish to report their winnings and losses for tax purposes are required to file a Tulalip Win Loss Statement.

How to fill out tulalip win loss statement?

To fill out the Tulalip Win Loss Statement, players need to accurately record their total gambling wins and losses, along with their identification information, such as name and player card number, if applicable.

What is the purpose of tulalip win loss statement?

The purpose of the Tulalip Win Loss Statement is to provide a formal record of a player's gambling activities to assist with federal tax reporting and to demonstrate losses against winnings.

What information must be reported on tulalip win loss statement?

The information that must be reported on a Tulalip Win Loss Statement includes the player's name, account number, total amounts won and lost, and specifics on the gaming activities conducted.

Fill out your WA Tulalip Resort Casino WinLoss Statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WA Tulalip Resort Casino WinLoss Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.