Get the free Refund Petition - Joint - The City of Huntsville

Show details

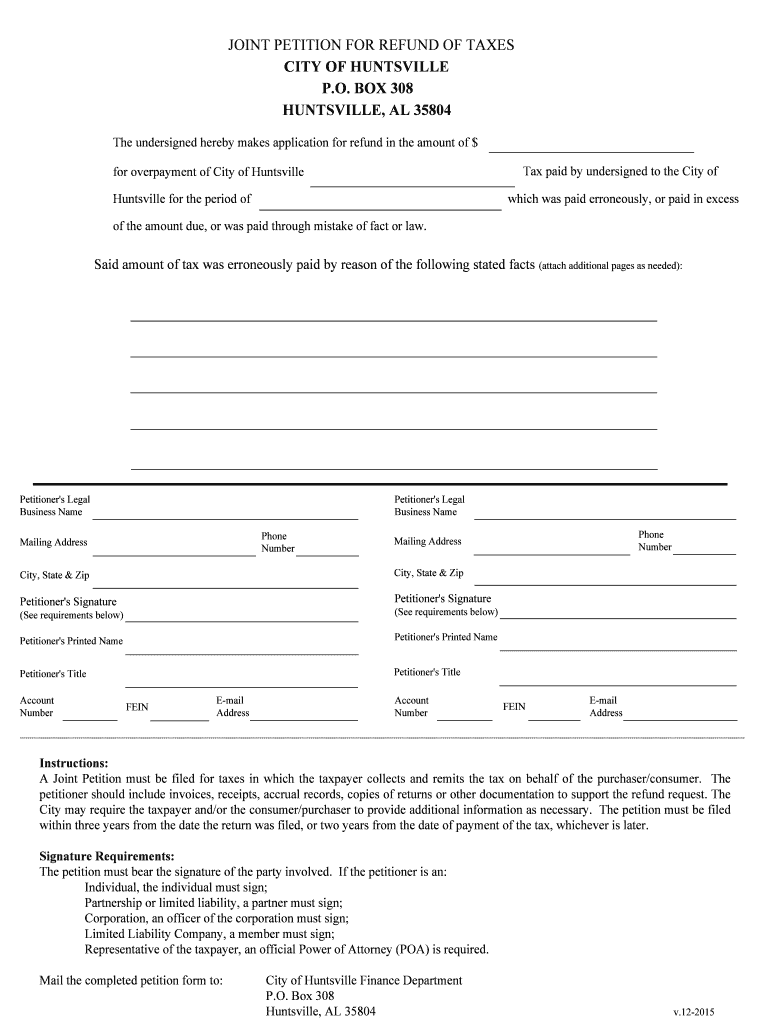

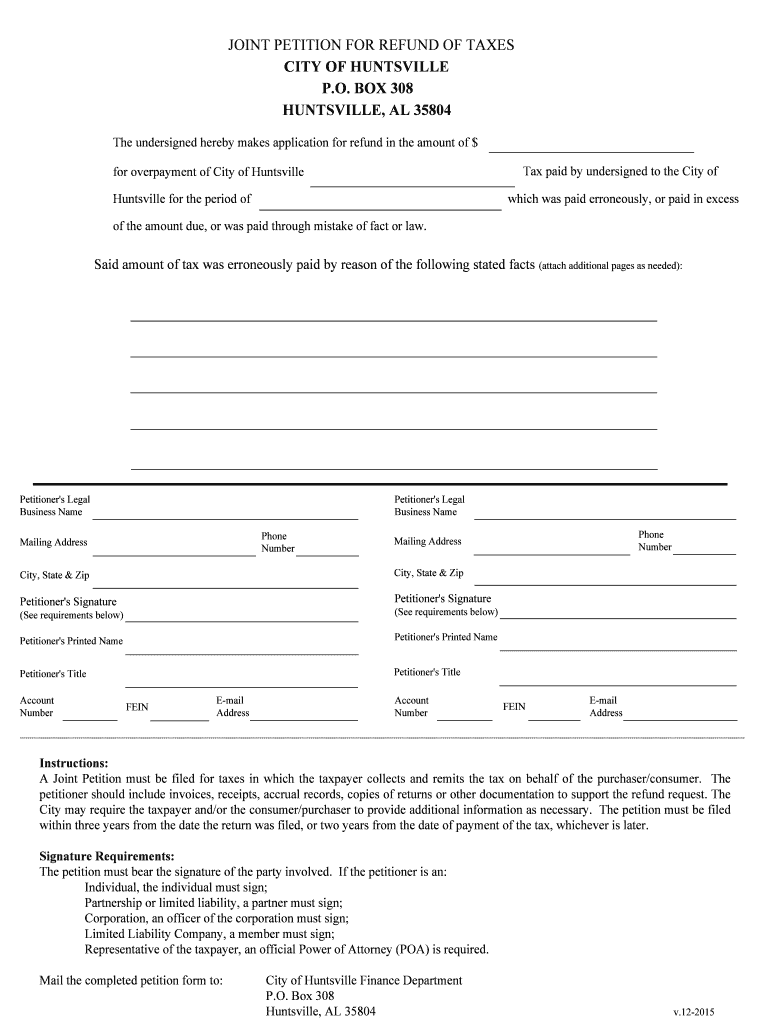

JOINT PETITION FOR REFUND OF TAXES CITY OF HUNTSVILLE P.O. BOX 308 HUNTSVILLE, AL 35804 The undersigned hereby makes application for refund in the amount of $ Tax paid by undersigned to the City of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign refund petition - joint

Edit your refund petition - joint form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your refund petition - joint form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing refund petition - joint online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit refund petition - joint. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out refund petition - joint

How to fill out refund petition - joint?

01

Begin by gathering all relevant documents, such as receipts, invoices, and any other proof of payment or purchase related to the item for which you are seeking a refund.

02

Open a blank document or download a refund petition form from the appropriate website or organization. Make sure it is specifically for joint refunds.

03

Fill out the personal information section, which may include names, addresses, and contact details for both parties involved in the joint refund.

04

Clearly state the reason for the refund request. Be concise and specific, providing all necessary details about the item or service, the date of purchase, and any relevant warranty or guarantee information.

05

Attach copies of all supporting documents, ensuring they are legible and clearly labeled. This may include receipts, invoices, warranty documentation, or any other proof of purchase.

06

Provide any additional information or explanations that may support your refund claim, such as correspondence with the seller, attempts to resolve the issue, or any specific terms and conditions that may apply.

07

Double-check all the information provided and ensure that it is accurate and complete. Any errors or missing information may delay the refund process.

08

Sign and date the petition, ensuring that both parties involved in the joint refund have affixed their signatures.

Who needs a refund petition - joint?

01

Couples or partners who made a joint purchase and are seeking a refund for the same item or service.

02

Business partners who are jointly responsible for purchasing items or services and want to request a refund together.

03

Family members or friends who made a joint purchase and wish to pursue a refund collectively.

Note: A joint refund petition is typically used when two or more individuals are seeking a refund for the same item or service. It allows multiple parties to address the issue together and increase the chances of a favorable outcome.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find refund petition - joint?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific refund petition - joint and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit refund petition - joint on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign refund petition - joint. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete refund petition - joint on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your refund petition - joint by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is refund petition - joint?

Refund petition - joint is a request to claim a refund of overpaid taxes by two or more individuals who filed a joint tax return.

Who is required to file refund petition - joint?

Two or more individuals who filed a joint tax return and are seeking to claim a refund of overpaid taxes.

How to fill out refund petition - joint?

To fill out a refund petition - joint, the individuals must provide their personal information, details of the overpaid taxes, and any additional supporting documentation.

What is the purpose of refund petition - joint?

The purpose of refund petition - joint is to request a refund of overpaid taxes that were submitted as part of a joint tax return.

What information must be reported on refund petition - joint?

The refund petition - joint must include personal information of the individuals, details of the overpaid taxes, and any supporting documentation to validate the claim.

Fill out your refund petition - joint online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Refund Petition - Joint is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.