IRS 6765 2018 free printable template

Show details

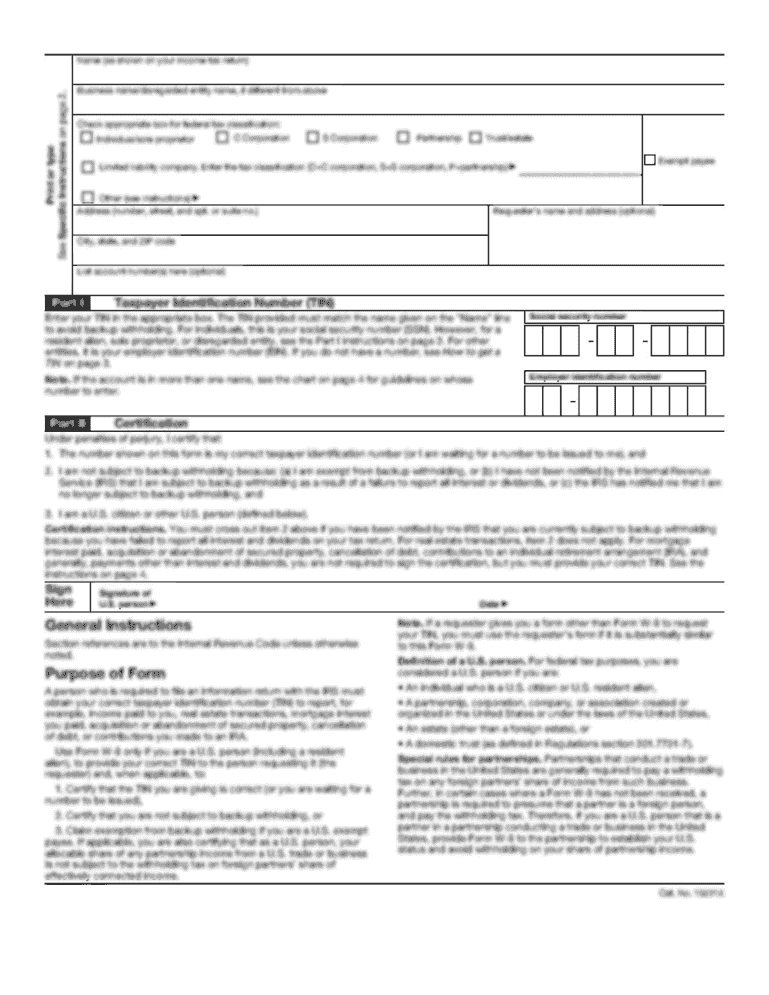

Divide line 29 by 6. 0For Paperwork Reduction Act Notice see separate instructions. Cat. No. 13700H Form 6765 Rev. 3-2018 Page 2 Add lines 23 and 32. Form Rev. March 2018 Department of the Treasury Internal Revenue Service Name s shown on return Credit for Increasing Research Activities OMB No. 1545-0619 Attach to your tax return. Go to www.irs.gov/Form6765 for instructions and the latest information. Attachment Sequence No. 81 Identifying number Section A Regular Credit. Skip this section and...go to Section B if you are electing or previously elected and are not revoking the alternative simplified credit. Certain amounts paid or incurred to energy consortia see instructions. Basic research payments to qualified organizations see instructions. Qualified organization base period amount. Subtract line 3 from line 2. If zero or less enter -0-. Wages for qualified services do not include wages used in figuring the work opportunity credit. Cost of supplies. Rental or lease costs of...computers see instructions. Enter the applicable percentage of contract research expenses. See instructions. Total qualified research expenses. Add lines 5 through 8. Enter fixed-base percentage but not more than 16 0. 16 see instructions Enter average annual gross receipts. See instructions. Multiply line 11 by the percentage on line 10. Enter the smaller of line 13 or line 14 Add lines 1 4 and 15. No Are you electing the reduced credit under section 280C Yes If Yes multiply line 16 by 13 0....13. If No multiply line 16 by 20 0. 20 and see the instructions for the statement that must be attached* Fiscal year filers see instructions. Members of controlled groups or businesses under common control see instructions for the statement that must be attached. Section B Alternative Simplified Credit. Skip this section if you are completing Section A. line 8 instructions. Enter your total qualified research expenses for the prior 3 tax years. If you had no qualified research expenses in any...one of those years skip lines 30 and 31. Yes Section C Current Year Credit Enter the portion of the credit from Form 8932 line 2 that is attributable to wages that were also used to figure the credit on line 17 or line 34 whichever applies. Estates and trusts go to line 39. Partnerships and S corporations not electing the payroll tax credit stop here and report this amount on Schedule K. Schedule K the amount on this line reduced by the amount on line 44. Eligible small businesses stop here and...report the credit on Form 3800 Part III line 4i. See Filers other than eligible small businesses stop here and report the credit on Form 3800 Part III line 1c* Note Qualified small business filers other than partnerships and S corporations electing the payroll tax credit must complete Form 3800 before completing Section D. Amount allocated to beneficiaries of the estate or trust see instructions. Form 3800 Part III line 4i. See instructions. For filers other than eligible small businesses...report the credit on Form 3800 Part III line 1c.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 6765

How to edit IRS 6765

How to fill out IRS 6765

Instructions and Help about IRS 6765

How to edit IRS 6765

To edit IRS 6765, obtain a copy of the form either physically or digitally. You can fill it out by hand or using PDF editing software. If you choose to use pdfFiller, you can easily upload the form and utilize its editing tools to input your information accurately.

How to fill out IRS 6765

To fill out IRS 6765, follow these steps:

01

Download the form from the IRS website or access it through pdfFiller.

02

Identify the appropriate sections relevant to your claim.

03

Provide accurate and current information as required by the form.

04

Review the completed form for errors or omissions before submission.

About IRS 6 previous version

What is IRS 6765?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 6 previous version

What is IRS 6765?

IRS 6765, also known as the "Credit for Increasing Research Activities," is a form used by businesses to claim a tax credit for qualified research expenses. This credit aims to incentivize companies to invest in research and development (R&D) within the United States.

What is the purpose of this form?

The purpose of IRS 6765 is to allow taxpayers to report and claim the Research and Development tax credit. This credit is designed to encourage innovation, as firms can reduce their tax liability based on eligible R&D expenditures.

Who needs the form?

IRS 6765 must be filed by businesses conducting qualified research activities in the United States. This includes corporations, partnerships, and sole proprietorships engaged in activities that meet the IRS requirements for the research credit.

When am I exempt from filling out this form?

You are exempt from filling out IRS 6765 if your business does not engage in qualified research activities. Additionally, if your research expenditures do not qualify under IRS guidelines, you do not need to submit this form.

Components of the form

IRS 6765 contains several components, including the credit calculation worksheet, details about the taxpayer, and the certification of expenses eligible for the credit. Each section requires accurate data to ensure correct credit calculations.

What are the penalties for not issuing the form?

Failing to issue IRS 6765 can result in penalties, including disallowance of the claimed credit and additional taxes owed. The IRS may also impose fines for inaccuracies or omissions in your submission, stressing the importance of compliance.

What information do you need when you file the form?

When filing IRS 6765, you need to provide detailed information about the research activities and associated expenses. This includes descriptions of projects, the methods used, and documentation to support your claim. Supporting payroll documentation is also necessary.

Is the form accompanied by other forms?

IRS 6765 may be accompanied by other forms depending on the specifics of your tax situation. For example, you might need to include Schedule C or form 8884 if you are claiming additional credits related to your research activities.

Where do I send the form?

Send IRS 6765 along with your tax return to the appropriate address provided by the IRS instructions. This varies based on the state in which you are filing and whether you are submitting electronically or by mail.

See what our users say