IRS 1120-W 2018 free printable template

Show details

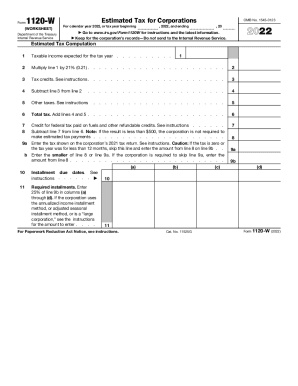

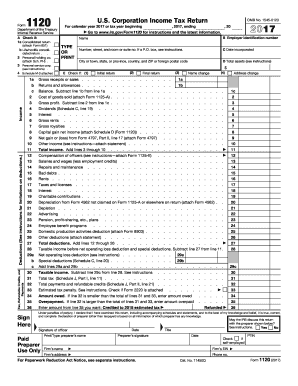

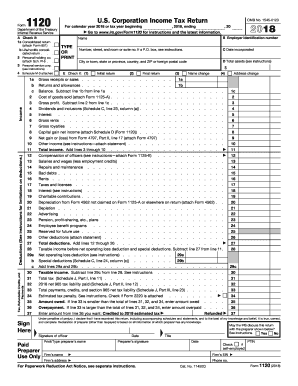

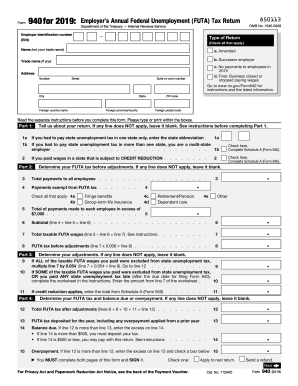

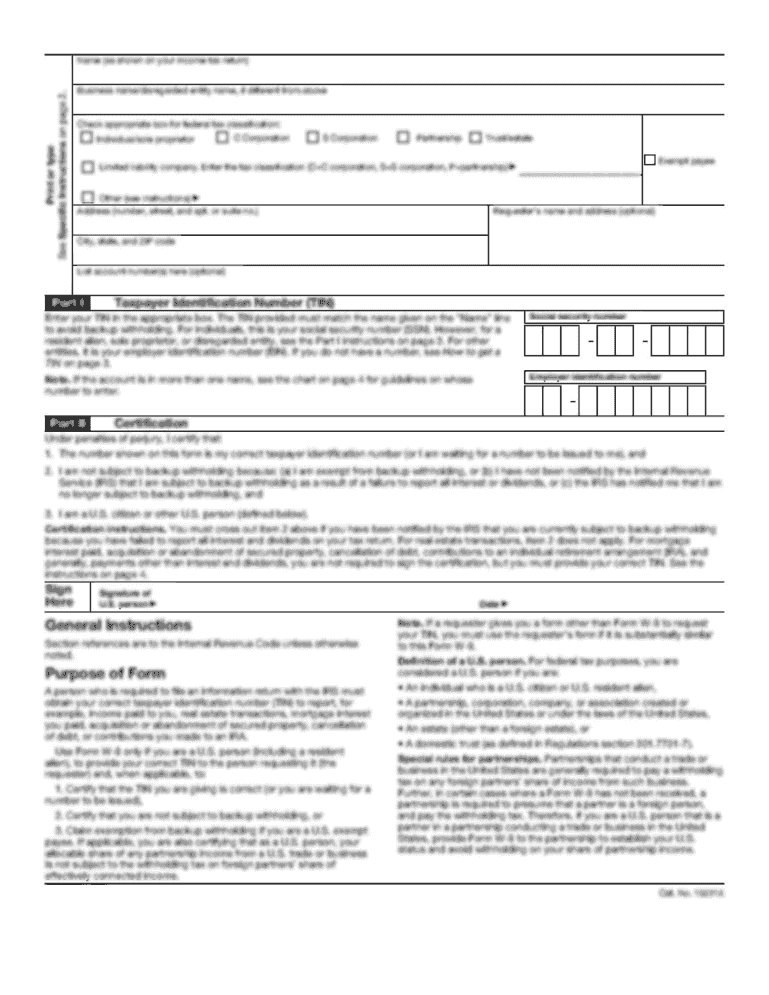

Form 1120-W WORKSHEET Department of the Treasury Internal Revenue Service Estimated Tax for Corporations For calendar year 2018 or tax year beginning OMB No. 1545-0123 2018 and ending Go to www.irs.gov/Form1120W for instructions and the latest information. Keep for the corporation s records Do not send to the Internal Revenue Service. Taxable income expected for the tax year. Multiply line 1 by 21 0. 21. Tax credits. See instructions. Subtract line 3 from line 2. Other taxes. See instructions...Total tax. Add lines 4 and 5. Credit for federal tax paid on fuels and other refundable credits. See instructions. make estimated tax payments. 9a Enter the tax shown on the corporation s 2017 tax return* See instructions. Caution If the tax is zero or the tax year was for less than 12 months skip this line and enter the amount from line 8 on line 9b. b Enter the smaller of line 8 or line 9a* If the corporation is required to skip line 9a enter the amount from line 8. a Installment due dates....See instructions. Required installments. Enter 25 of line 9b in columns a through d. If the corporation uses the annualized income installment method or adjusted seasonal installment method or is a large corporation see the instructions for the amount to enter. For Paperwork Reduction Act Notice see instructions. b Cat* No* 11525G 9a 9b c d Form 1120-W WORKSHEET 2018 Page Schedule A Adjusted Seasonal Installment Method and Annualized Income Installment Method see instructions Part I Use this...method only if the base period percentage for any 6 consecutive months is at least 70. Enter taxable income for the following periods Tax year beginning in 2015. 1b 1c 2018. See instructions for the treatment of extraordinary items. Divide the amount in each column on line 1a by the amount in column d on line 3a* 3c Add lines 4 through 6. Divide line 7 by 3. 0Divide line 2 by line 8. Extraordinary items see instructions. Add lines 9a and 9b. Figure the tax on the amount on line 9c by following...the same steps used to figure the tax on page 1 line 2. 11a Divide the amount in columns a through c on line 3a by the amount in column d on line 3a* First 4 months Entire year 9c 11a 11b 11c Add lines 11a through 11c* Multiply the amount in columns a through c of line 10 by the amount in the corresponding column of line 13. In column d enter the amount from line 10 column d. Reserved* Enter any other taxes for each payment period. See instructions. Add lines 14 and 16. For each period enter the...same type of credits as allowed on page 1 lines 3 and 7. See instructions. 3a 3b 1a Annualized Income Installment Method First Annualization periods see instructions. 23a Annualized taxable income. Multiply line 21 by line 22. 23b Add lines 23a and 23b. following the same steps used to figure the tax on page 1 line 2. 23c For each annualization period enter the same type of credits as allowed on page 1 lines 3 and 7. See instructions. Total tax after credits. Subtract line 28 from line 27. If...zero or less enter -0-.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-W

How to edit IRS 1120-W

How to fill out IRS 1120-W

Instructions and Help about IRS 1120-W

How to edit IRS 1120-W

To edit IRS 1120-W, you may use pdfFiller, which provides editing tools that allow you to modify the form easily. You can input corrections, add missing information, or update figures using the interactive fields available in the tool. After editing, ensure that your entries are legible and compliant with IRS standards before saving or printing the document for submission.

How to fill out IRS 1120-W

Filling out IRS 1120-W involves several steps to ensure accuracy. First, gather all necessary financial documents related to your corporation. This includes revenue, expenses, and deductions. Next, navigate through the form line by line, entering the required information. Ensure that you check your calculations for both current and previous quarters to prevent errors. Once completed, review the form thoroughly before filing it with the IRS.

About IRS 1120-W 2018 previous version

What is IRS 1120-W?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-W 2018 previous version

What is IRS 1120-W?

IRS 1120-W is the estimated tax for corporations. It is used by corporations to calculate their estimated tax liability for the upcoming tax year. Corporations use this form to ensure that they pay the correct estimated taxes quarterly, which helps avoid underpayment penalties.

What is the purpose of this form?

The purpose of IRS 1120-W is to provide a structured format for corporations to report their estimated income tax obligations. By using this form, corporations can estimate their tax payments based on expected income, ensuring timely and accurate payments to the IRS. This helps maintain compliance with U.S. tax laws.

Who needs the form?

Corporations that expect to owe tax of $500 or more when they file their tax return must file IRS 1120-W. This includes both large corporations and smaller businesses that anticipate taxable income. Understanding your corporate structure and tax obligations is important to determine if you need to file this form.

When am I exempt from filling out this form?

Exemptions from filing IRS 1120-W typically apply to corporations that do not expect to owe any tax for the tax year or have had a loss during the preceding years. Additionally, newly formed corporations may not have the necessary information to estimate their taxes accurately, thus exempting them from filing until they have clearer projections.

Components of the form

IRS 1120-W consists of several key components, including estimated tax computation sections, data about previous payments, and sections to report adjustments. Each section serves to capture the corporation's financial activity accurately and project the tax obligations accordingly. Proper completion of each component is critical for compliance and avoiding potential penalties.

What are the penalties for not issuing the form?

Failure to file IRS 1120-W on time can lead to penalties, including a late payment penalty. If a corporation does not pay at least 90% of its required estimated tax by the due date, it may also incur additional interest charges. These penalties can add up, negatively impacting a corporation's financial standing with the IRS.

What information do you need when you file the form?

When filing IRS 1120-W, you need specific information, including the corporation's income, deductions, credits, and any other financial data that impacts the estimated tax liability. Having accurate and up-to-date financial records facilitates the completion process and ensures the accuracy of the estimated tax calculations.

Is the form accompanied by other forms?

IRS 1120-W is generally filed independently; however, corporations may need to submit additional forms, such as IRS Form 1120, when filing their annual tax return. If you have other forms related to income, deductions, or credits, ensure they are completed and submitted as necessary to comply with IRS regulations.

Where do I send the form?

IRS 1120-W should be sent to the appropriate IRS address, which depends on the corporation's location and whether payment is enclosed. Refer to the IRS guidelines for updated addresses or submission methods, including electronic filing options that may be available for your corporation.

See what our users say