Get the free MARYLAND FORM 502AE SUBTRACTION FOR INCOME DERIVED WITHIN ARTS AND ENTERTAINMENT DIS...

Show details

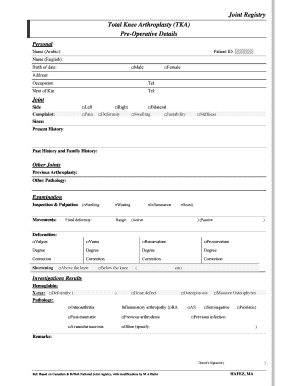

MARYLAND FORM502AE2015SUBTRACTION FOR INCOME DERIVED WITHIN ARTS AND ENTERTAINMENT DISTRICT(S)Print using blue or black ink only. ATTACH TO FORM 502 OR FORM 505. First nameInitialLast antisocial Security

We are not affiliated with any brand or entity on this form

Instructions and Help about maryland form 502ae subtraction

How to edit maryland form 502ae subtraction

How to fill out maryland form 502ae subtraction

Instructions and Help about maryland form 502ae subtraction

How to edit maryland form 502ae subtraction

To edit maryland form 502ae subtraction, access the form through a reliable source, such as your state’s tax website or a tax preparation service. If using pdfFiller, you can upload the form and utilize its editing tools to make necessary changes. Ensure all information is accurate and complete before saving the edited version for submission.

How to fill out maryland form 502ae subtraction

Filling out maryland form 502ae subtraction involves placing accurate financial data in specified fields. Follow these general steps:

01

Gather necessary documents, including income statements and details on deductions.

02

Input your personal information, including name, address, and Social Security number.

03

List specific subtraction amounts eligible under Maryland tax guidelines.

04

Review all entries for accuracy, ensuring compliance with Maryland tax regulations.

05

Save or print the completed form for your records before submission.

Latest updates to maryland form 502ae subtraction

Latest updates to maryland form 502ae subtraction

The maryland form 502ae subtraction has undergone recent revisions to streamline the filing process and clarify deduction eligibility. It is essential to review the latest version of the form to ensure you are using the correct guidelines and instructions. Check the Maryland State Comptroller's website for the most current updates and amendments related to this form.

All You Need to Know About maryland form 502ae subtraction

What is maryland form 502ae subtraction?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About maryland form 502ae subtraction

What is maryland form 502ae subtraction?

Maryland form 502ae subtraction is a tax form used by Maryland residents to claim specific subtractions from their federal adjusted gross income. This form is crucial for individuals seeking to reduce their taxable income by accounting for allowable deductions as defined by Maryland tax law.

What is the purpose of this form?

The purpose of maryland form 502ae subtraction is to provide a standardized way for taxpayers to report various subtractions that lower their state taxable income. By filing this form, individuals can potentially reduce their overall tax liability, making it an important aspect of tax planning in Maryland.

Who needs the form?

Anyone who resides in Maryland and wishes to claim a subtraction from their federal adjusted gross income must complete maryland form 502ae subtraction. This includes individuals who may qualify for specific deductions related to retirement contributions, student loan interest, or certain Maryland-specific expenses.

When am I exempt from filling out this form?

You are exempt from filling out maryland form 502ae subtraction if you do not have any qualifying subtractions to report. Additionally, if your tax situation does not require you to file a Maryland tax return, you may not need to submit this form. Always verify your eligibility based on current state tax laws.

Components of the form

Maryland form 502ae subtraction consists of multiple sections which include taxpayer identification information, applicable subtractions, and totals. Key components include:

01

Personal identification details: name, address, Social Security number

02

Subtraction categories: various allowable deductions

03

Total subtraction amount: the sum of all eligible deductions

Due date

Maryland form 502ae subtraction must be submitted along with your state tax return by the Maryland tax filing deadline, typically April 15th for most filers. Filing timely is critical to avoid penalties and ensure proper processing of your tax return.

What are the penalties for not issuing the form?

Failure to file maryland form 502ae subtraction when required may result in penalties from the Maryland Comptroller’s office. Penalties can include fines, interest on unpaid taxes, and potential audits. It is crucial to submit all necessary tax documentation accurately and on time to avoid these consequences.

What information do you need when you file the form?

When filing maryland form 502ae subtraction, you need to gather the following information:

01

Your federal adjusted gross income.

02

Details of any received subtractions eligible under Maryland law.

03

Your Social Security number and personal identification information.

Is the form accompanied by other forms?

Maryland form 502ae subtraction is typically submitted alongside your Maryland state income tax return. It may also require additional supporting documentation depending on the specific subtractions claimed. Always check for any changes in requirement for accompanying forms during the current filing season.

Where do I send the form?

After completing maryland form 502ae subtraction, you must send it to the Maryland Comptroller's office. The submission can usually be done by mail or electronically, depending on your filing choice. Verify the correct mailing address and submission method on the Maryland State Comptroller's website for the most accurate and current information.

See what our users say