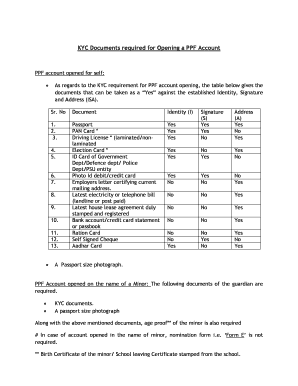

Gun Lake Casino WinLoss Statement Request free printable template

Show details

Gun Lake Casino

Win/Loss Statement Request

Name:

Passport Card Number:

Date of Birth:

Email Address:

Is this a change of address? YES NO (please circle)

Mailing Address:

City/State/Zip:

Telephone:

Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gaming statement loss form

Edit your gaming loss win form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your win loss gaming form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lake win loss statement online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit optional gaming loss form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loss statement gaming form

How to fill out an activity statement:

01

Gather all relevant information: Before starting to fill out the activity statement, make sure you have all the necessary information. This may include details about your income, expenses, deductions, and any other relevant financial transactions.

02

Understand the sections: Familiarize yourself with the different sections of the activity statement. This typically includes sections for reporting GST, PAYG withholding, PAYG installment, and other tax obligations. Review each section carefully to ensure you understand what needs to be reported in each.

03

Report your income: Begin by reporting your income in the appropriate section of the activity statement. This may include income from wages, investments, business activities, or any other sources. Make sure to enter the income accurately and include all necessary details.

04

Report your expenses: Next, report any relevant expenses that are deductible for tax purposes. This may include expenses related to your business, investments, or other activities. Ensure that you have the necessary supporting documentation for these expenses.

05

Include GST information: If you are registered for Goods and Services Tax (GST), you will need to report the relevant information in the designated section of the activity statement. This typically includes reporting the total GST collected from sales and the total GST paid on purchases.

06

Account for other tax obligations: Depending on your circumstances, there may be additional tax obligations that need to be reported in the activity statement. For example, this could include reporting and paying the PAYG withholding or PAYG installment amounts.

Who needs an activity statement:

01

Individuals with business activities: If you are self-employed or operating a business, you will likely need to complete an activity statement. This is to report your business income, expenses, and any associated tax obligations.

02

Companies and organizations: Companies, partnerships, trusts, and other similar entities are also required to prepare and lodge activity statements. This allows them to report their financial transactions, income, and tax obligations to the relevant tax authorities.

03

Individuals with certain investments or income sources: Some individuals who have specific investments, such as rental properties or shares, may also need to complete an activity statement. This is to report income and deductible expenses associated with these investments.

In summary, anyone with business activities, entities, or individuals with certain investments or income sources may need to fill out an activity statement. It is important to carefully follow the instructions and accurately report all relevant information to fulfill your tax obligations.

Fill

loss statement activity

: Try Risk Free

People Also Ask about gaming loss

What is the business activity statement?

A BAS is a form that reports the amount you need to pay the ATO. The formula is GST collected on sales, less GST paid on purchases, plus tax withheld on wages (pay as you go withholding) to employees and plus an income tax instalment (pay as you go instalment).

How do you make an activity statement?

Once you're signed in to myGov, access the ATO from linked services, then: Select Tax and then Activity statements from the menu. To lodge a new activity statement, select Lodge activity statement. To view or revise an already lodged activity statement, select View or revise activity statements.

What is business activity statement form?

Business Activity Statement (BAS) is a government form that all businesses must lodge to the Australian Tax Office (ATO). It's a summary of all the business taxes you have paid or will pay to the government during a specific period. Most Australian businesses will lodge their BAS monthly, quarterly or annually.

What is an activity statement used for?

These statements are used to report on and pay several different types of taxes including the Goods and Services Tax (GST) you've collected, Pay as You Go (PAYG) instalments or withholding, Fuel Tax Credits (FTC) and Fringe Benefits Tax (FBT).

What is the purpose of activity statements?

Your business may need to complete business activity statements (BAS) to report on taxes and make payments. Your BAS helps you to report on taxes like: goods and services tax (GST) pay as you go (PAYG) withholding.

Where do I get a BAS form?

If you've lost or haven't received your paper BAS, you can get a copy by phoning us on 13 28 66. Note: Mail isn't an option if you are lodging your BAS using an online channel.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in gun win loss form without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your gun win loss form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for the gun win loss form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your gun win loss form.

How can I fill out gun win loss form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your gun win loss form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is Gun Lake Casino WinLoss Statement Request?

It is a formal request form that allows players to obtain a record of their gambling activity, including wins and losses, at Gun Lake Casino.

Who is required to file Gun Lake Casino WinLoss Statement Request?

Players who wish to get a detailed report of their gambling activity, especially for tax purposes, are required to file this request.

How to fill out Gun Lake Casino WinLoss Statement Request?

Players need to provide their personal details such as name, address, and account information, along with the specific time frame for which they are requesting the win/loss statement.

What is the purpose of Gun Lake Casino WinLoss Statement Request?

The purpose is to furnish players with an official document that summarizes their gambling activity for record-keeping and tax filing purposes.

What information must be reported on Gun Lake Casino WinLoss Statement Request?

The request must report the player's total wins, total losses, and the time period for which the gambling activity is being reported.

Fill out your gun win loss form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gun Win Loss Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.