Get the free ABORIGINAL TAXATION CONFERENCE SEPTEMBER 4 ... - CDEPNQL

Show details

TRAINING ON ACCOUNTABILITY MARCH 21 AND 22, 2017 FOUR POINTS BY SHERATON HOTEL, QUEBEC REGISTRATION FORM CLOSING DATE FOR REGISTRATIONS MARCH 10, 2017, GENERAL INFORMATION Name: Organization: Job

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aboriginal taxation conference september

Edit your aboriginal taxation conference september form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aboriginal taxation conference september form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aboriginal taxation conference september online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit aboriginal taxation conference september. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aboriginal taxation conference september

How to fill out aboriginal taxation conference september

01

To fill out the aboriginal taxation conference september registration form, follow these steps:

1. Visit the official website of the conference.

02

Look for the registration page or link.

03

Click on the registration link to access the registration form.

04

Provide the required personal information such as name, contact details, and organization.

05

Select the appropriate registration category (e.g., individual, group, student, etc.)

06

Choose the desired conference package or ticket type (e.g., full conference, single day pass).

07

Indicate any special dietary requirements or accessibility needs, if applicable.

08

Review the provided information for accuracy.

09

Proceed to the payment section and choose the preferred payment method.

10

Complete the payment process as per the instructions.

11

Once the payment is confirmed, you will receive a confirmation email with your registration details.

12

Keep the confirmation email or registration ID handy for future reference.

13

Attend the aboriginal taxation conference in September and enjoy the insightful sessions and networking opportunities!

Who needs aboriginal taxation conference september?

01

The aboriginal taxation conference in September is primarily targeted towards individuals and organizations involved in taxation matters related to aboriginal communities.

02

This conference is beneficial for:

03

- Tax professionals specializing in aboriginal taxation.

04

- Lawyers and legal professionals dealing with indigenous tax laws.

05

- Government representatives responsible for formulating tax policies for indigenous communities.

06

- Community leaders and elders from aboriginal communities interested in understanding taxation issues.

07

- Researchers and academics studying indigenous tax systems.

08

- Students pursuing studies in indigenous law or taxation.

09

By attending this conference, participants can gain valuable knowledge, insights, and networking opportunities in the field of aboriginal taxation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit aboriginal taxation conference september online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your aboriginal taxation conference september to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I fill out aboriginal taxation conference september on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your aboriginal taxation conference september. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out aboriginal taxation conference september on an Android device?

Use the pdfFiller mobile app and complete your aboriginal taxation conference september and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

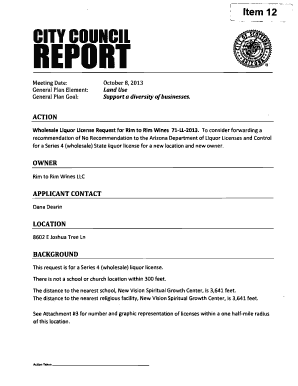

What is aboriginal taxation conference september?

The aboriginal taxation conference september is a conference focused on taxation issues relevant to indigenous communities.

Who is required to file aboriginal taxation conference september?

Tax professionals, government officials, and individuals involved in indigenous taxation matters are required to attend and file the aboriginal taxation conference september.

How to fill out aboriginal taxation conference september?

To fill out the aboriginal taxation conference september, attendees must provide information on various tax-related topics affecting indigenous communities.

What is the purpose of aboriginal taxation conference september?

The purpose of the aboriginal taxation conference september is to discuss and address tax challenges faced by indigenous peoples and communities.

What information must be reported on aboriginal taxation conference september?

Information regarding tax laws, policies, practices, and case studies relevant to indigenous taxation must be reported on the aboriginal taxation conference september.

Fill out your aboriginal taxation conference september online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aboriginal Taxation Conference September is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.