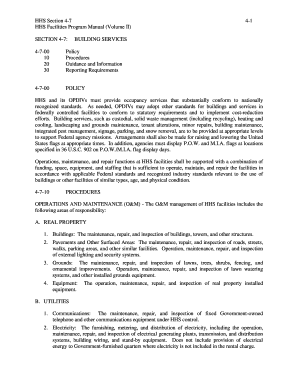

Get the free REV UP YOUR SAVINGS! 700 - Rebate Processing

Show details

REV UP YOUR SAVINGS!$7 00Get $7.00* cash back by mail when you purchase 5 quarts or more of Chevron Supreme conventional motor oil between September 11 November 5, 2016.REBATEREBATE CLAIM FORM FILE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rev up your savings

Edit your rev up your savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev up your savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rev up your savings online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rev up your savings. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rev up your savings

How to fill out rev up your savings

01

Start by assessing your current financial situation. Take a look at your income, expenses, and debts to get a clear picture of where you stand.

02

Set specific savings goals. Determine how much you want to save and by when. This will help you stay motivated and focused.

03

Create a budget. Allocate a portion of your income towards savings and make sure to stick to it.

04

Track your expenses. Keep a record of your spending to identify areas where you can cut back and save more.

05

Automate your savings. Set up automatic transfers from your checking account to a savings account to make saving easier and more consistent.

06

Reduce unnecessary expenses. Look for ways to trim your spending, such as cutting cable TV subscriptions or dining out less frequently.

07

Increase your income. Consider taking on a side gig or exploring opportunities for advancement in your career to boost your earning potential.

08

Save on recurring expenses. Review your bills and subscriptions regularly to ensure you're getting the best deals and cancel any unnecessary services.

09

Prioritize debt repayment. Pay off high-interest debts first to free up more funds for saving.

10

Stay disciplined and motivated. Stick to your savings plan and celebrate milestones along the way to stay motivated and on track.

11

Review and adjust your savings strategy periodically. As your financial situation changes, reassess your goals and make necessary adjustments.

Who needs rev up your savings?

01

Rev up your savings is beneficial for anyone who wants to improve their financial situation and grow their savings. It is particularly helpful for individuals who struggle with saving money and need guidance on how to get started and stay on track.

02

Whether you're just starting to save or looking to accelerate your savings growth, rev up your savings provides valuable tips and strategies to help you achieve your goals.

03

It is also useful for individuals who want to build an emergency fund, save for a specific purchase, plan for retirement, or take control of their financial future.

04

Regardless of your income level or financial knowledge, rev up your savings can be a valuable resource to help you make progress towards your savings goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit rev up your savings from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including rev up your savings, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in rev up your savings?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your rev up your savings to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out rev up your savings on an Android device?

On an Android device, use the pdfFiller mobile app to finish your rev up your savings. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is rev up your savings?

Rev up your savings is a program designed to help individuals increase their savings and achieve their financial goals.

Who is required to file rev up your savings?

All individuals who are interested in increasing their savings and improving their financial health can participate in the rev up your savings program.

How to fill out rev up your savings?

To fill out rev up your savings, individuals can attend workshops, read educational materials, create a savings plan, and track their progress.

What is the purpose of rev up your savings?

The purpose of rev up your savings is to help individuals save more money, develop good saving habits, and reach their financial objectives.

What information must be reported on rev up your savings?

Information such as income, expenses, savings goals, progress tracking, and financial habits must be reported on rev up your savings.

Fill out your rev up your savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rev Up Your Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.