ED RIE 2020-2025 free printable template

Show details

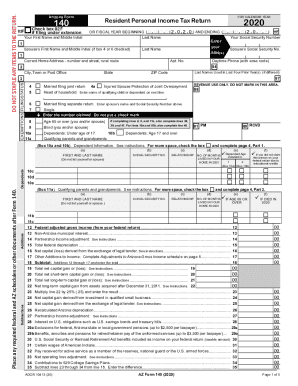

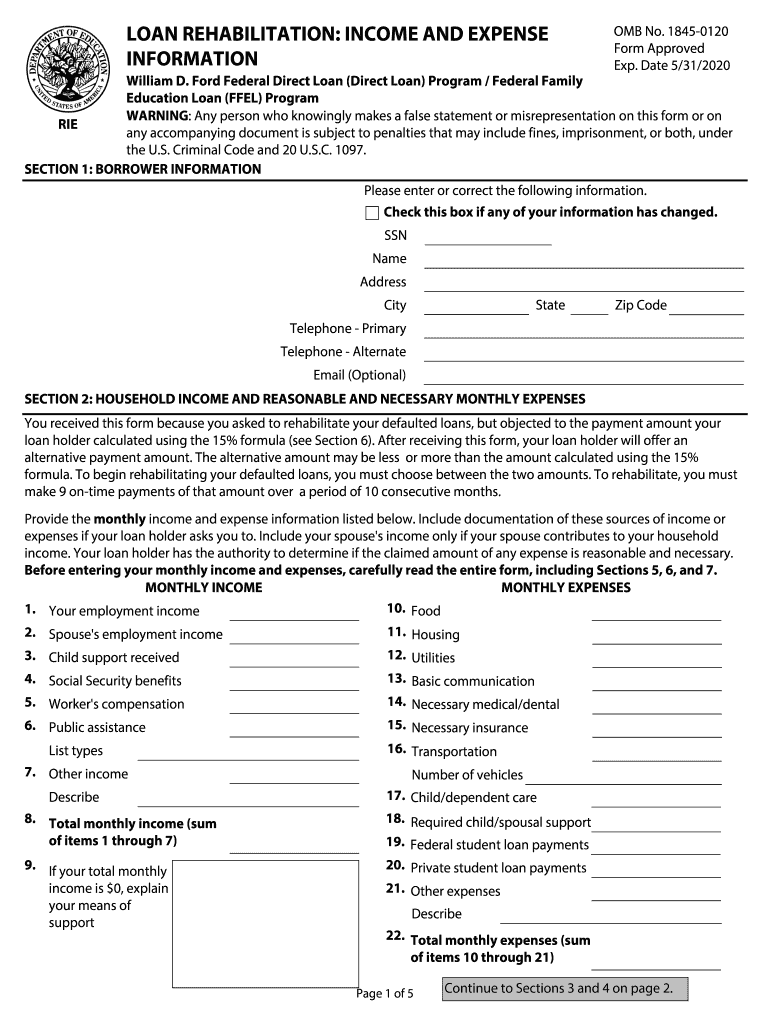

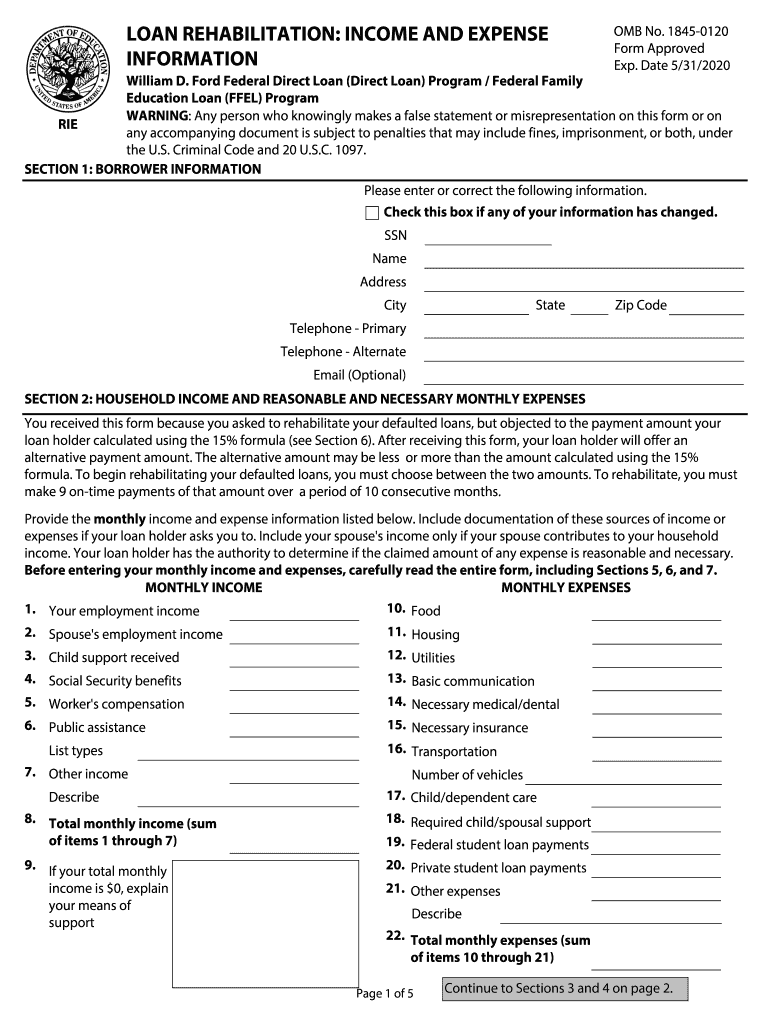

LOAN REHABILITATION: INCOME AND EXPENSE

INFORMATION OMB No. 18450120

Form Approved

Exp. Date 5/31/2020William D. Ford Federal Direct Loan (Direct Loan) Program / Federal Family

Education Loan (FEEL)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ed income expense form

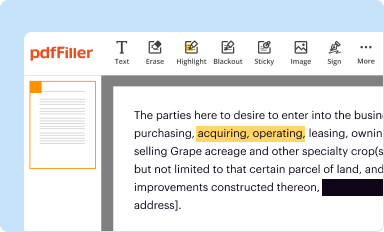

Edit your rehabilitation form template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

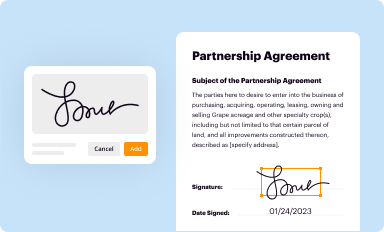

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

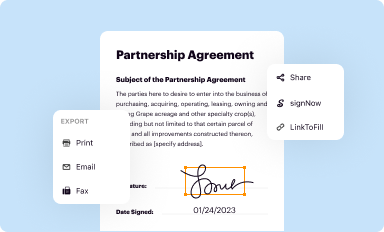

Share your form instantly

Email, fax, or share your rehabilitation form download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

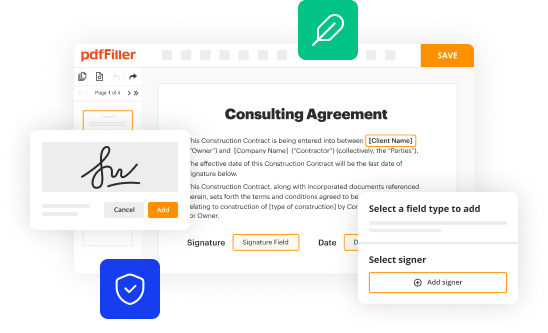

Editing expense information template online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ed rie expense create form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income information form pdf

How to fill out ED RIE

01

Gather necessary information about the project.

02

Identify the key sections of the ED RIE form.

03

Start filling in the project details, including the title and description.

04

Provide specific objectives and outcomes for the project.

05

Include details about the target audience and stakeholders.

06

Outline the budget and funding sources.

07

Review all entries for accuracy and completeness.

08

Submit the completed ED RIE form as required.

Who needs ED RIE?

01

Project managers overseeing educational initiatives.

02

Educational organizations seeking funding.

03

Stakeholders involved in program assessment and development.

04

Policy makers requiring project evaluations.

Fill

income expense information template

: Try Risk Free

People Also Ask about

How do I claim student loans on my taxes?

When filing taxes, don't report your student loans as income. Student loans aren't taxable because you'll eventually repay them. Free money used for school is treated differently. You don't pay taxes on scholarship or fellowship money used toward tuition, fees and equipment or books required for coursework.

Do you get a 1098-E for private student loans?

Each lender will issue its own form, so you'll receive a 1098-E from your servicer if you have federal loans. If you have private loans, you'll receive a separate 1098-E.

Do student loans need to be claimed on taxes?

Student loans are not considered taxable income because you're obligated to pay them back. Whether you're still in school or have graduated, your loans may reduce the amount you owe to the IRS through the student loan interest deduction, the American opportunity tax credit and the lifetime earning credit.

How do I deduct student loans from my taxes?

The student loan interest deduction is not an itemized deduction — it's taken above the line. That means it's subtracted from your taxable income to save you money. For example, if you fall into the 22% tax bracket, the maximum student loan interest deduction would put $550 back in your pocket.

Where can I deduct student loan interest?

The student loan interest deduction is not an itemized deduction — it's taken above the line. That means it's subtracted from your taxable income to save you money. For example, if you fall into the 22% tax bracket, the maximum student loan interest deduction would put $550 back in your pocket.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ED RIE to be eSigned by others?

When you're ready to share your ED RIE, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit ED RIE in Chrome?

ED RIE can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out ED RIE on an Android device?

Use the pdfFiller Android app to finish your ED RIE and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is ED RIE?

ED RIE stands for Education Data Reporting and Information Exchange, which is a system used to collect, report, and share educational data.

Who is required to file ED RIE?

Educational institutions including schools, districts, and educational agencies that receive federal funding are generally required to file ED RIE.

How to fill out ED RIE?

To fill out ED RIE, institutions need to gather required data, follow the specific guidelines provided by the Department of Education, and submit the information through the designated reporting platform.

What is the purpose of ED RIE?

The purpose of ED RIE is to standardize the collection and reporting of educational data to improve transparency, accountability, and the effective allocation of resources.

What information must be reported on ED RIE?

The information reported on ED RIE typically includes student demographics, educational outcomes, financial data, and other metrics necessary for compliance and assessment.

Fill out your ED RIE online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ED RIE is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.